Harmonic Patterns

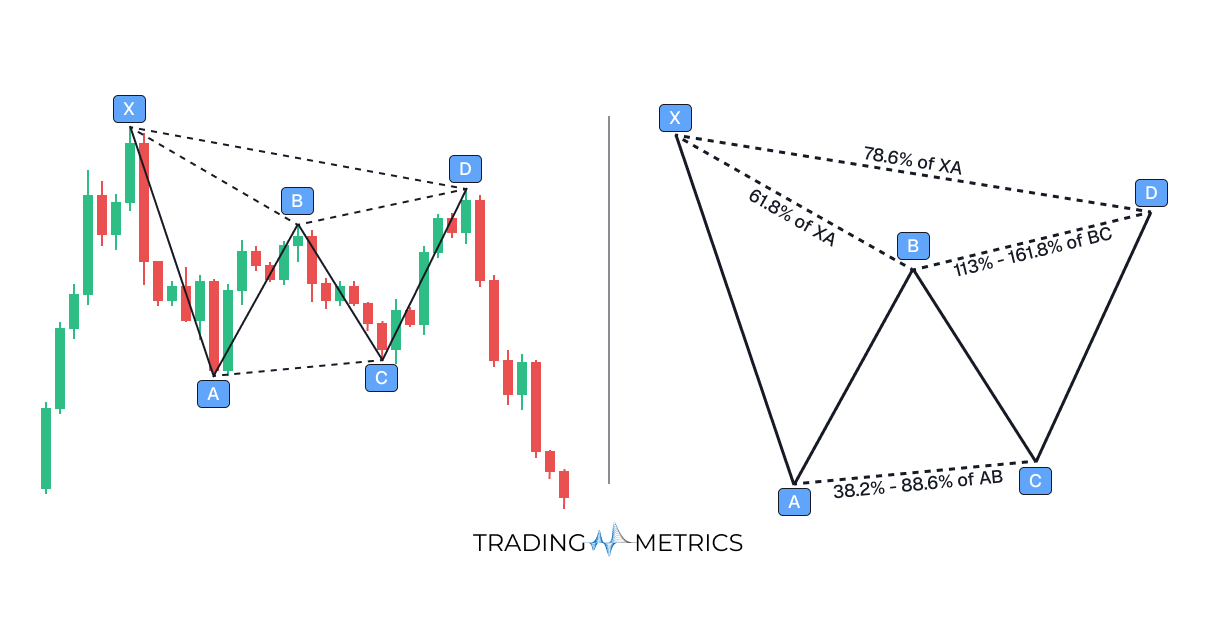

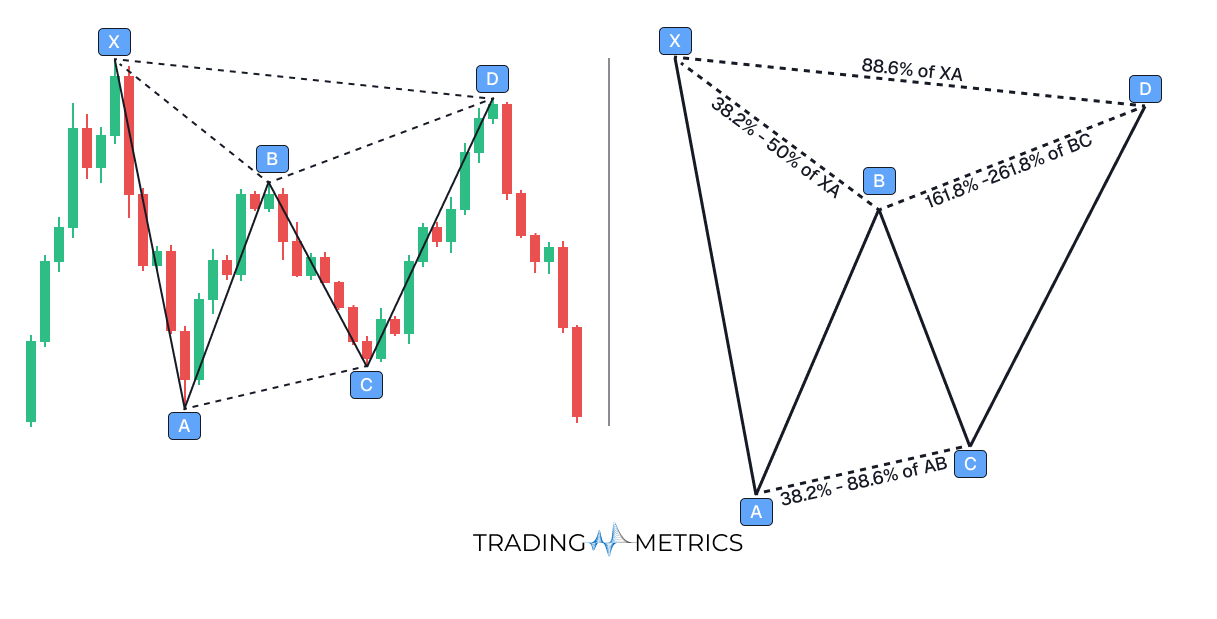

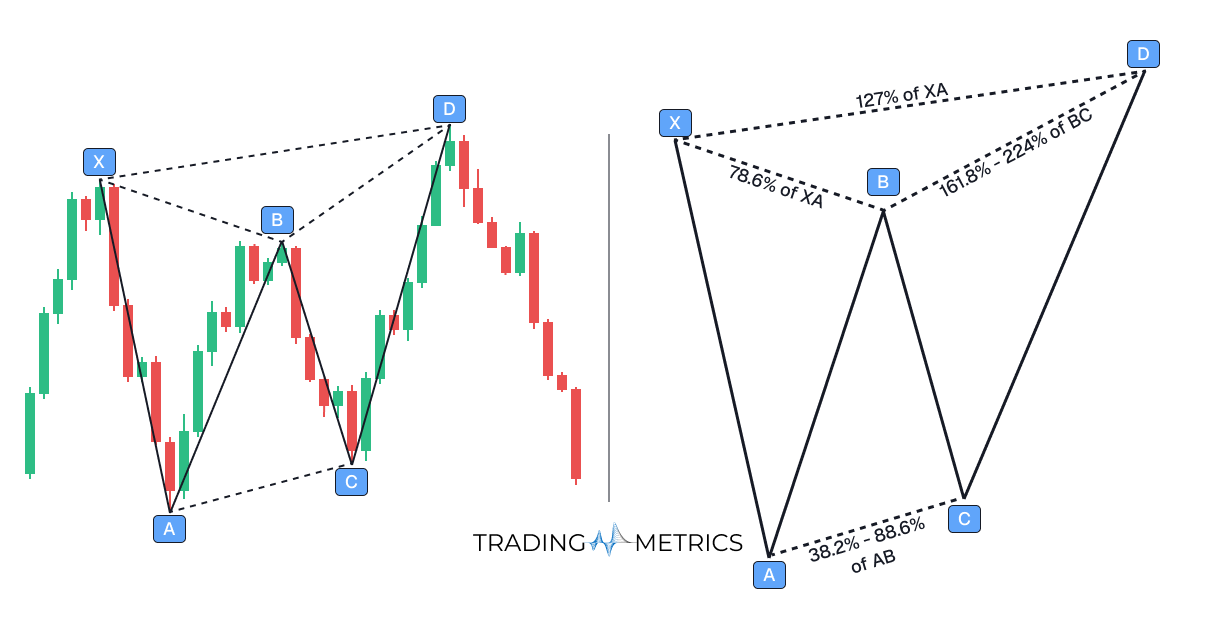

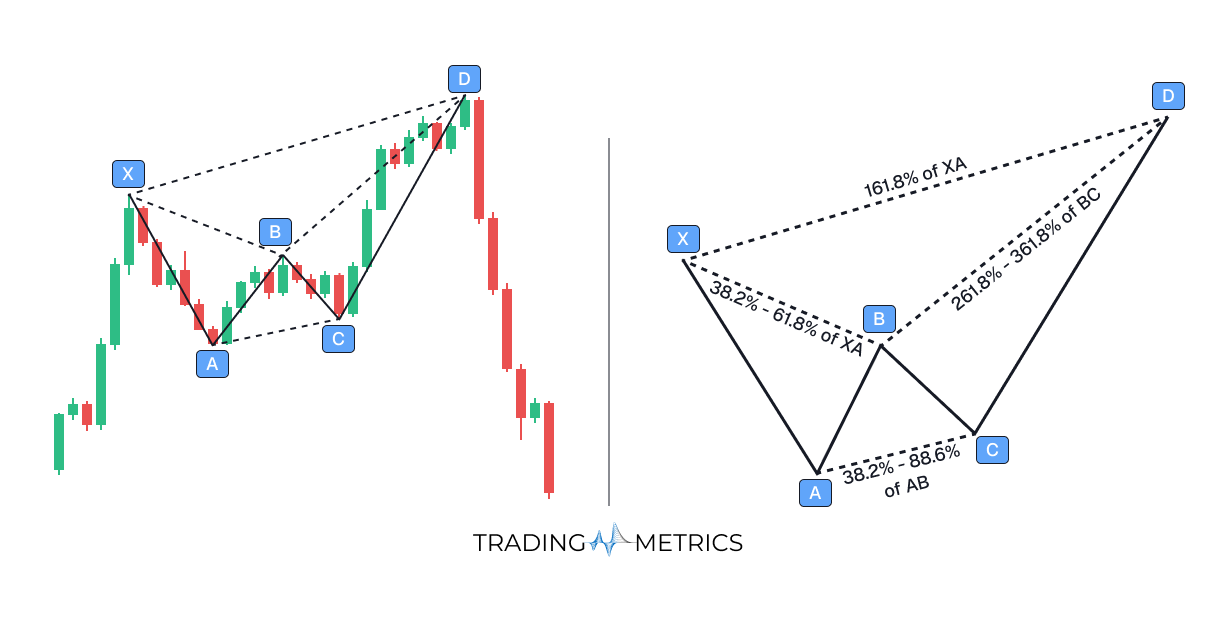

The Bullish Gartley hints at a strong bounce after a measured pullback, while the Bearish Gartley warns of a sharp drop after an extended rise, both shaped by precise Fibonacci ratios.

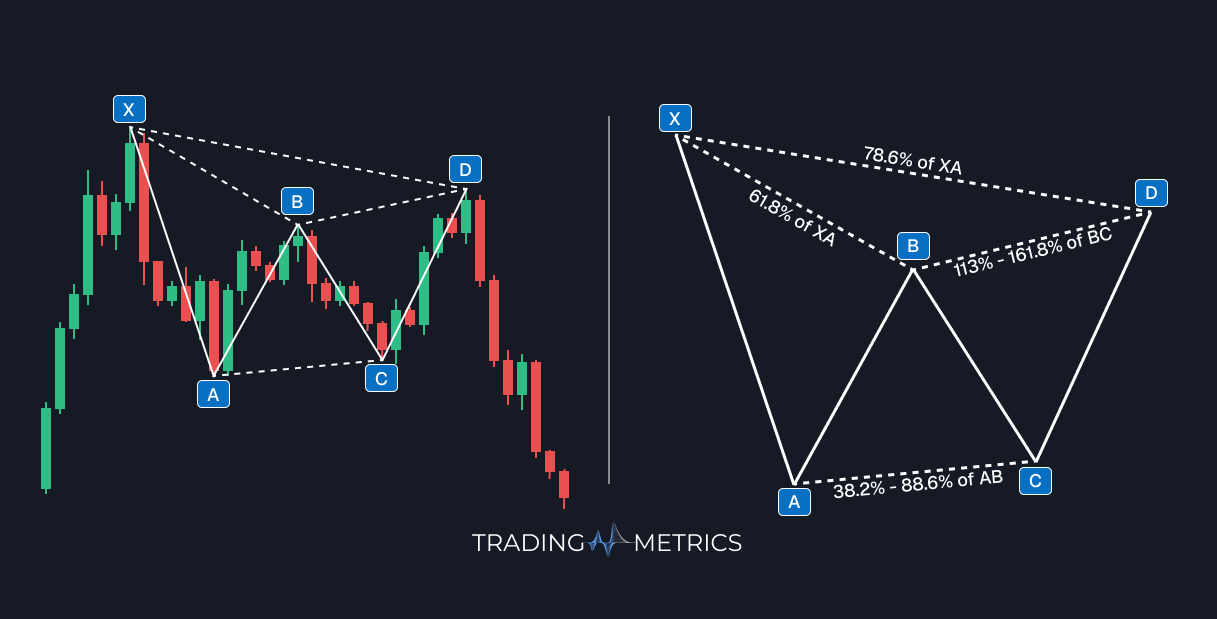

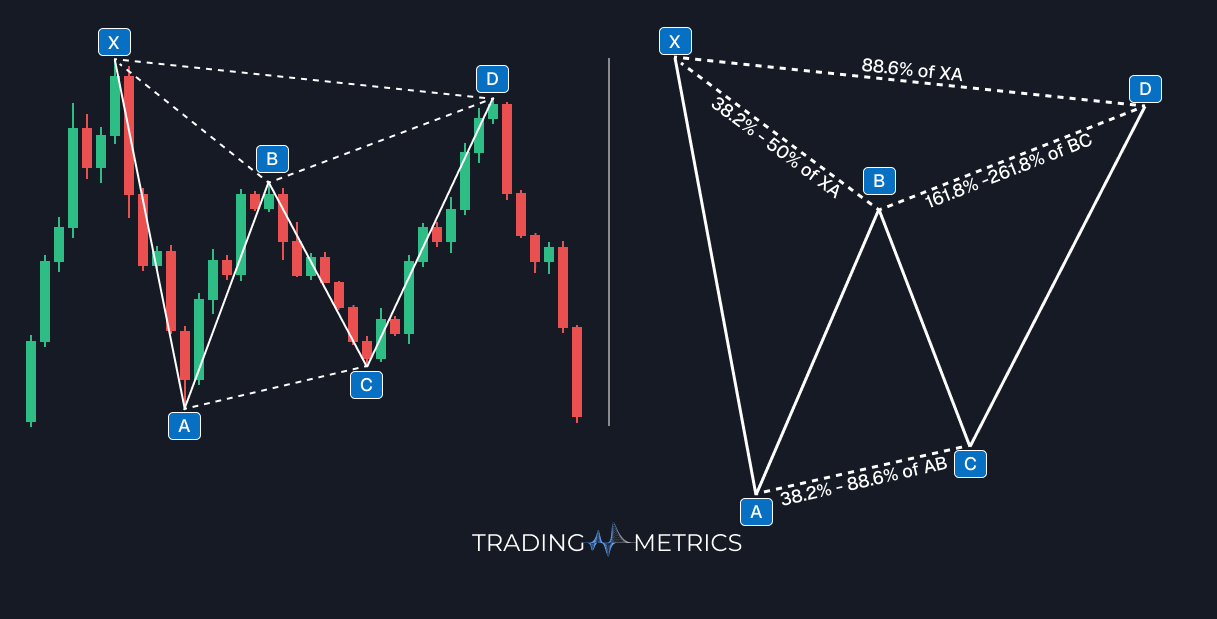

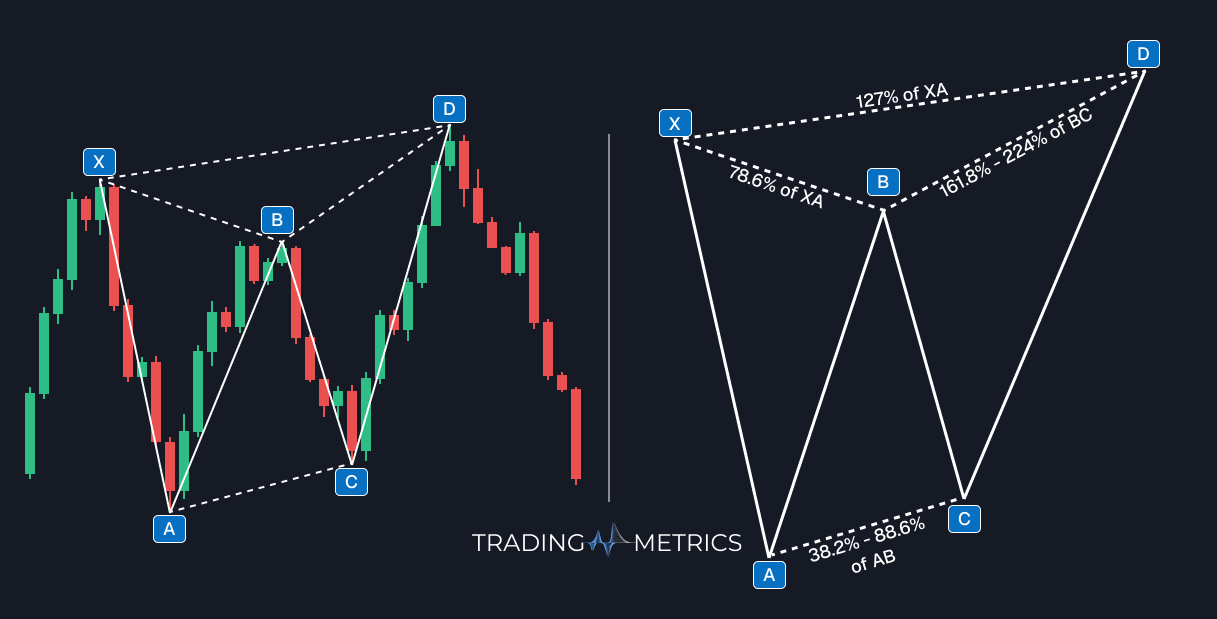

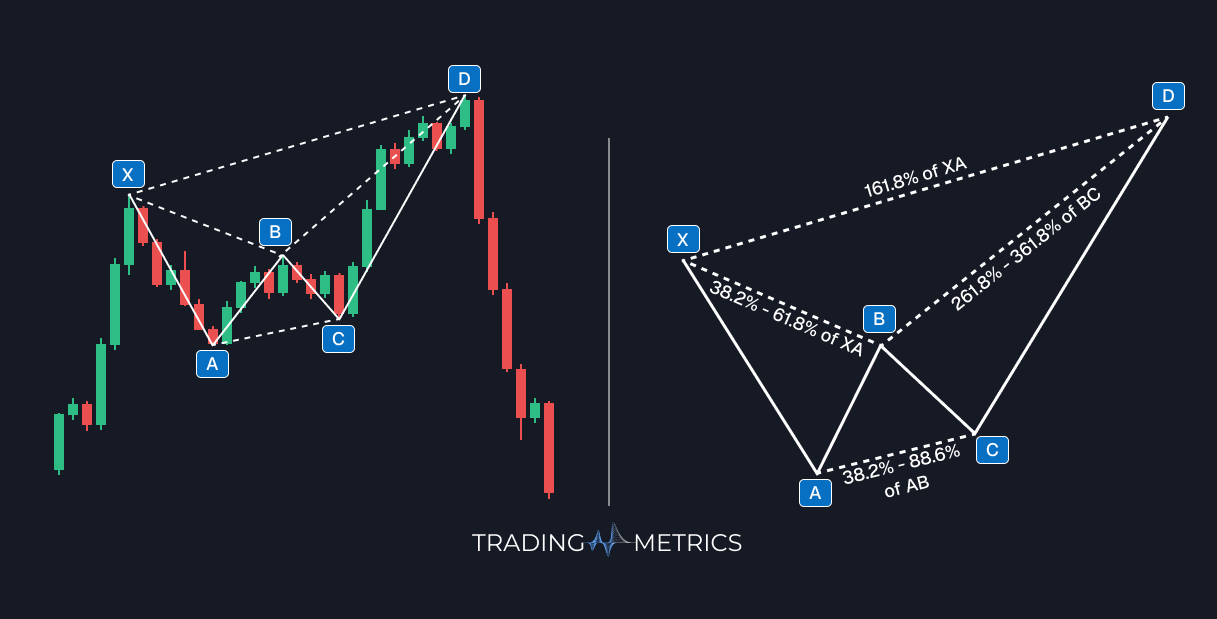

The Bullish Bat signals a strong upside reversal after a deep but measured retracement, while the Bearish Bat points to a sharp downside turn after an extended climb, both guided by strict Fibonacci Ratios.

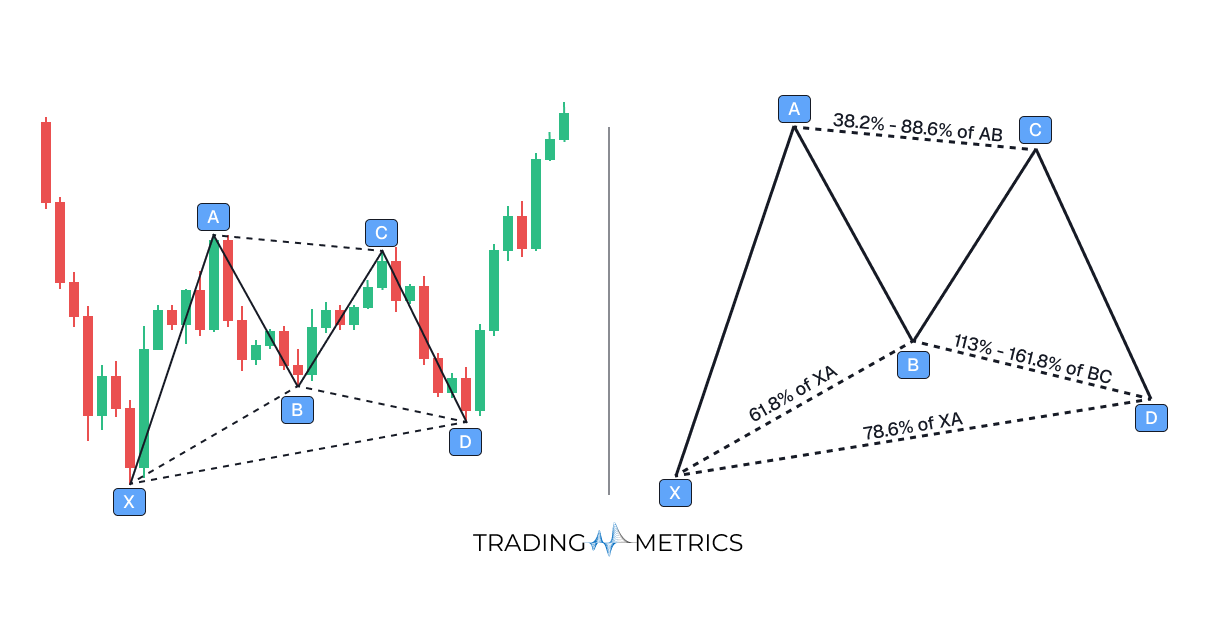

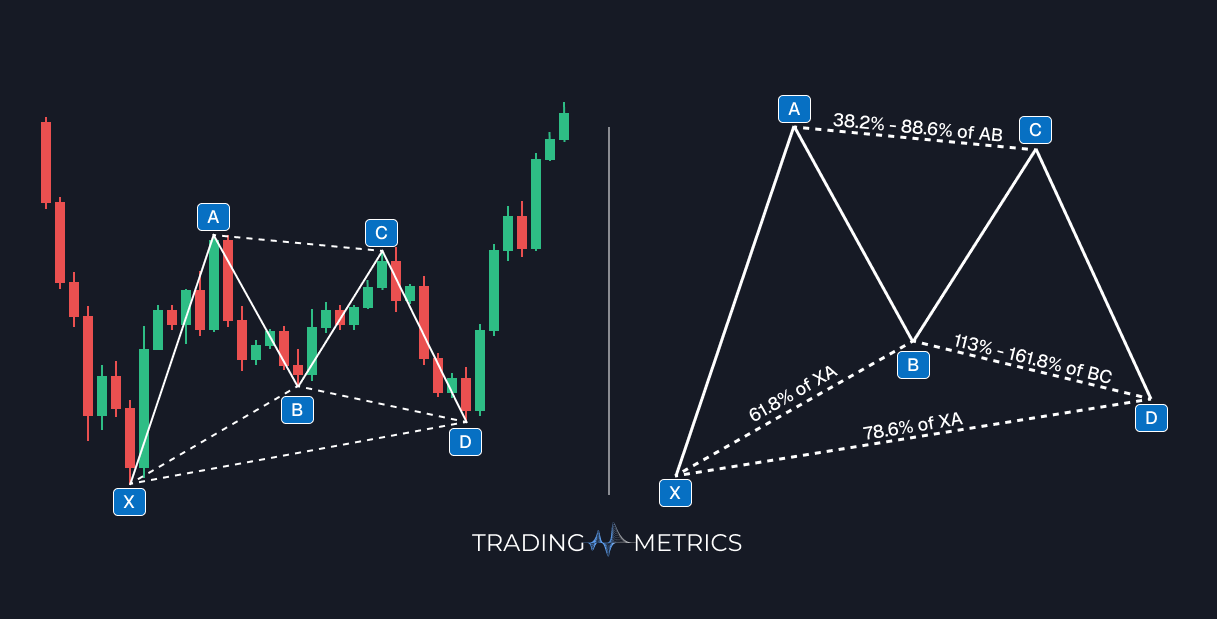

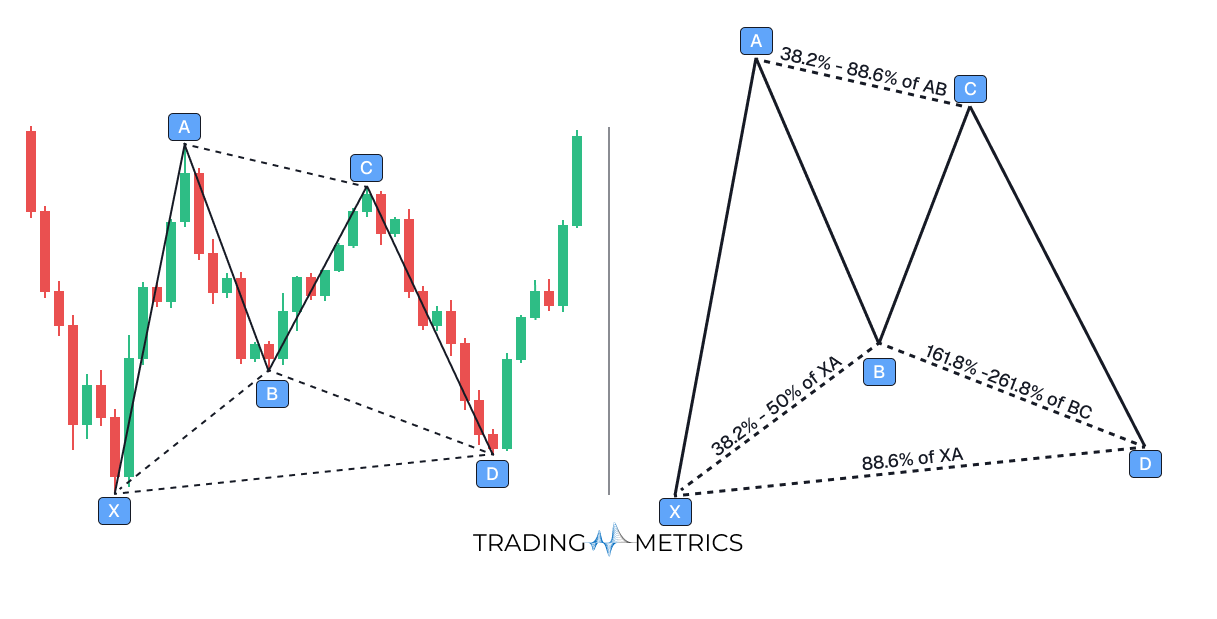

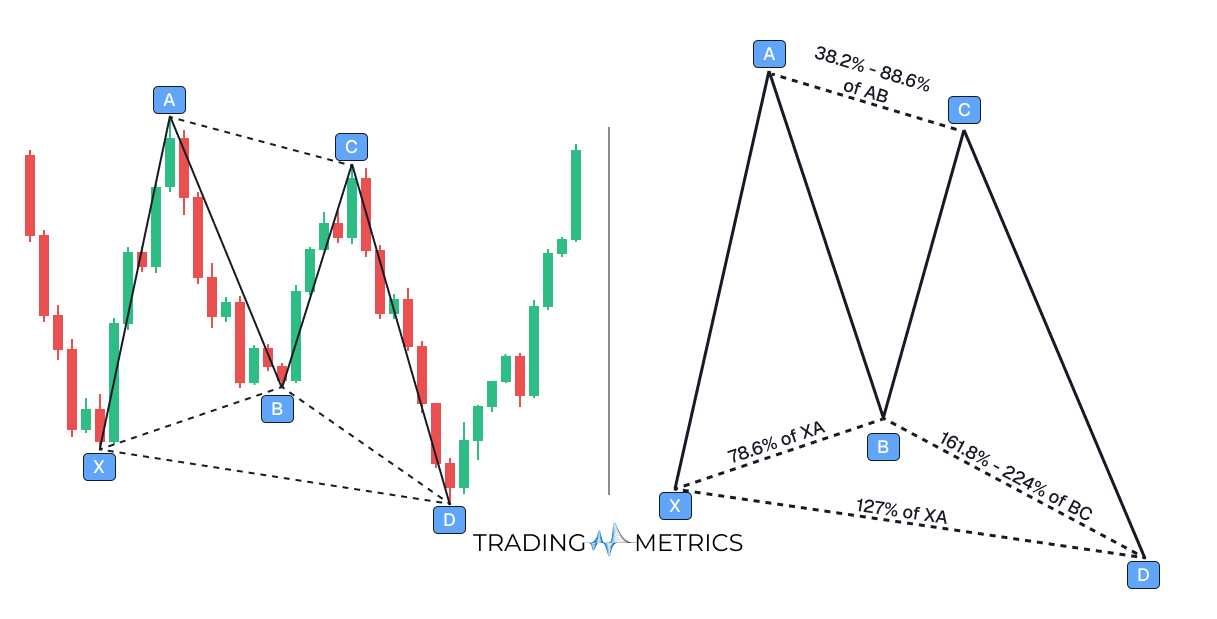

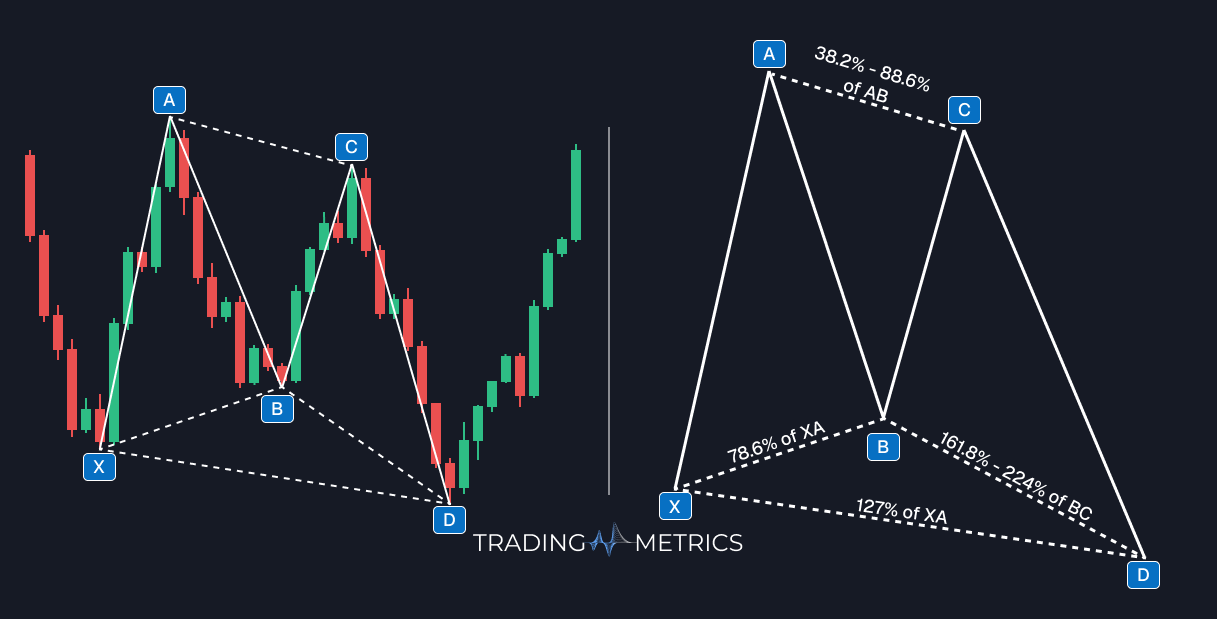

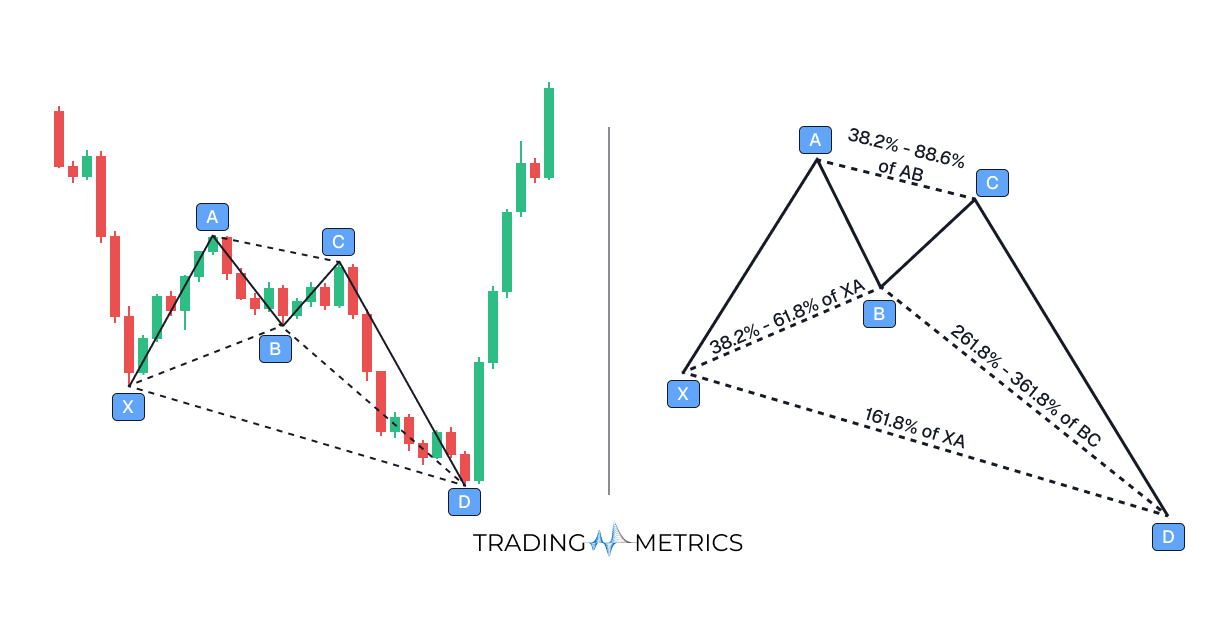

The Bullish Butterfly suggests a powerful rally after an extended decline, while the Bearish Butterfly signals a steep drop after a prolonged rise, both formed through precise Fibonacci extensions.

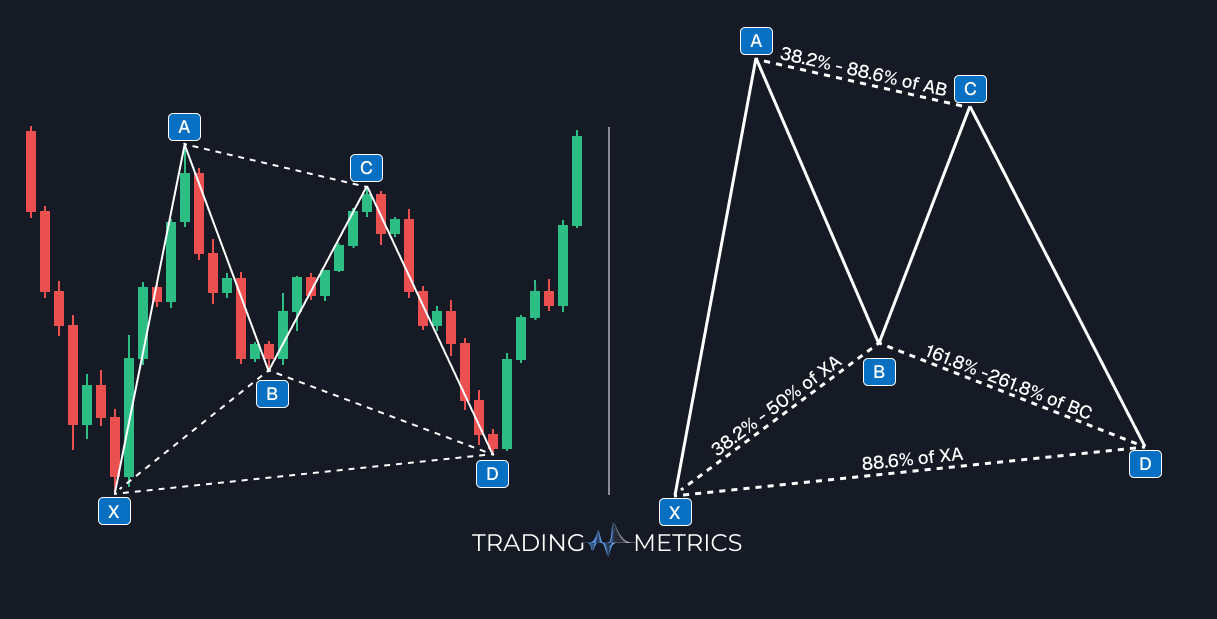

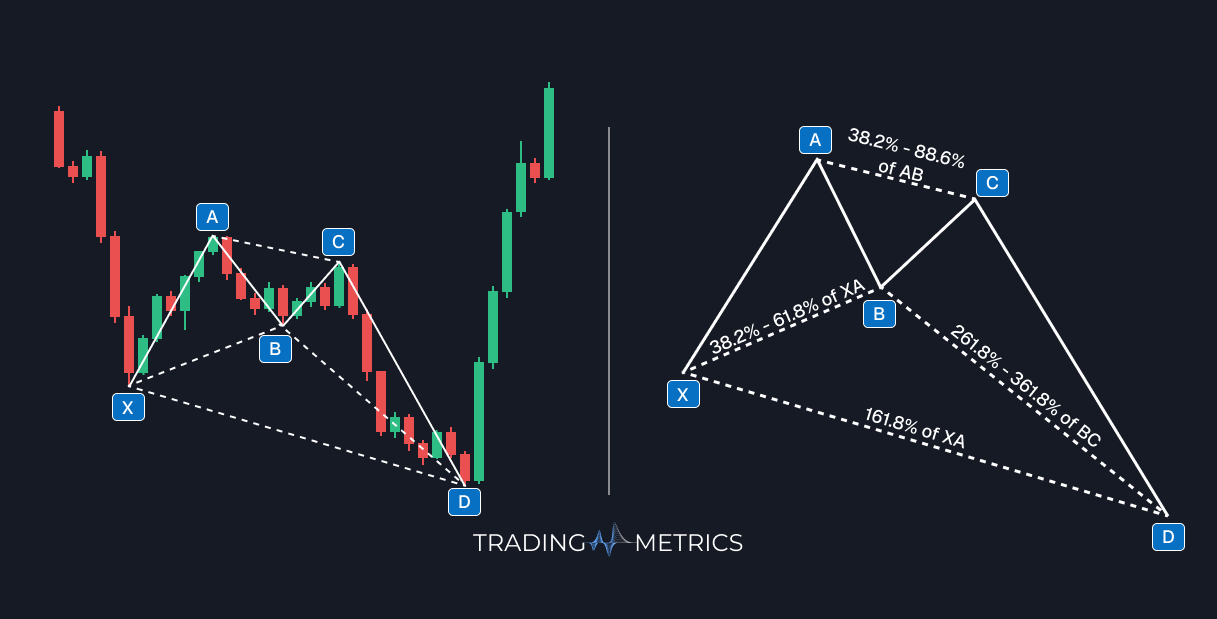

The Bullish Crab signals a sharp bullish reversal at an extreme Fibonacci extension, while the Bearish Crab warns of a strong bearish turn after an overextended rally, both defined by exact harmonic measurements.

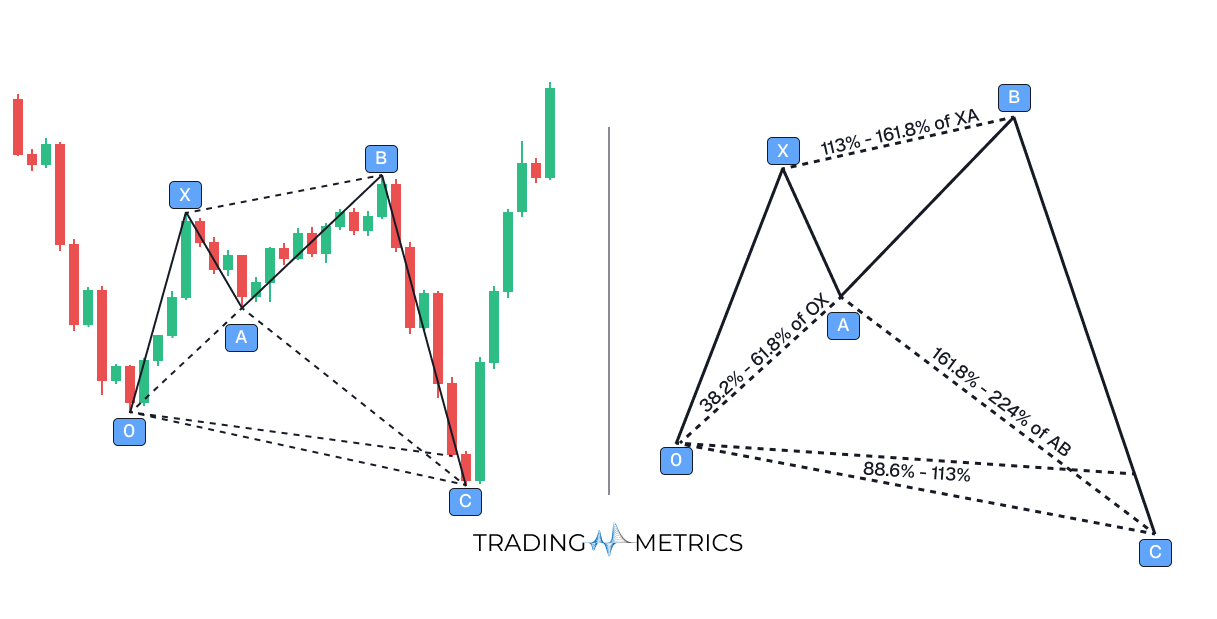

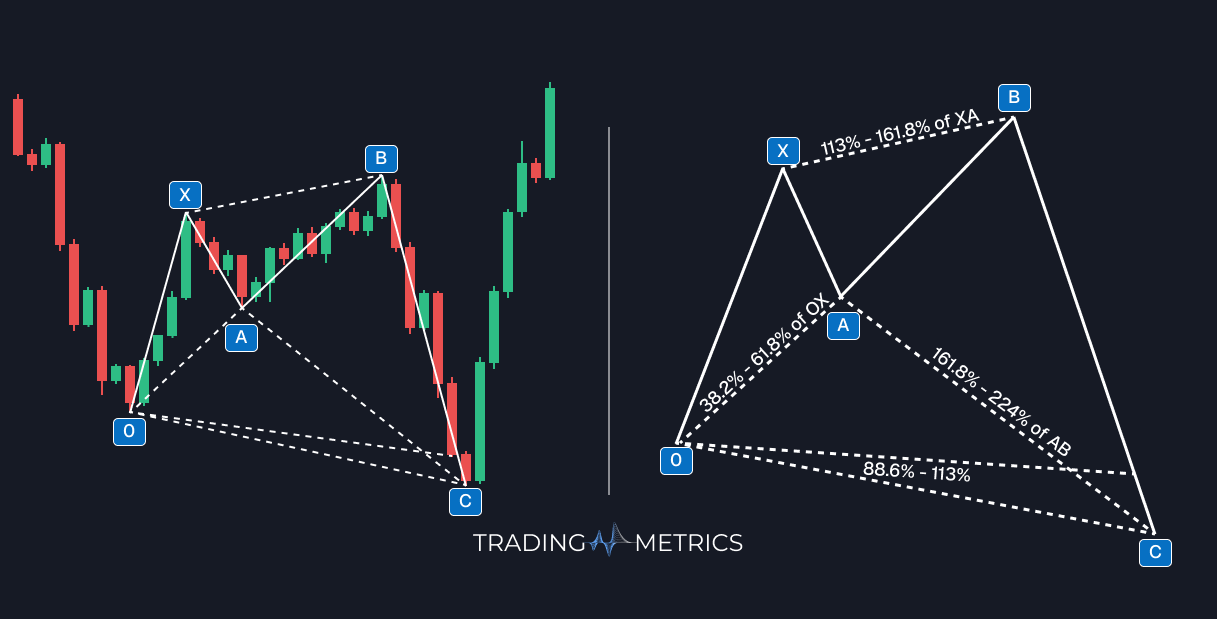

The Bullish Shark indicates a swift bullish reversal from an overextended drop, while the Bearish Shark signals a rapid bearish turn after an excessive rise, both shaped by unique Fibonacci projections.

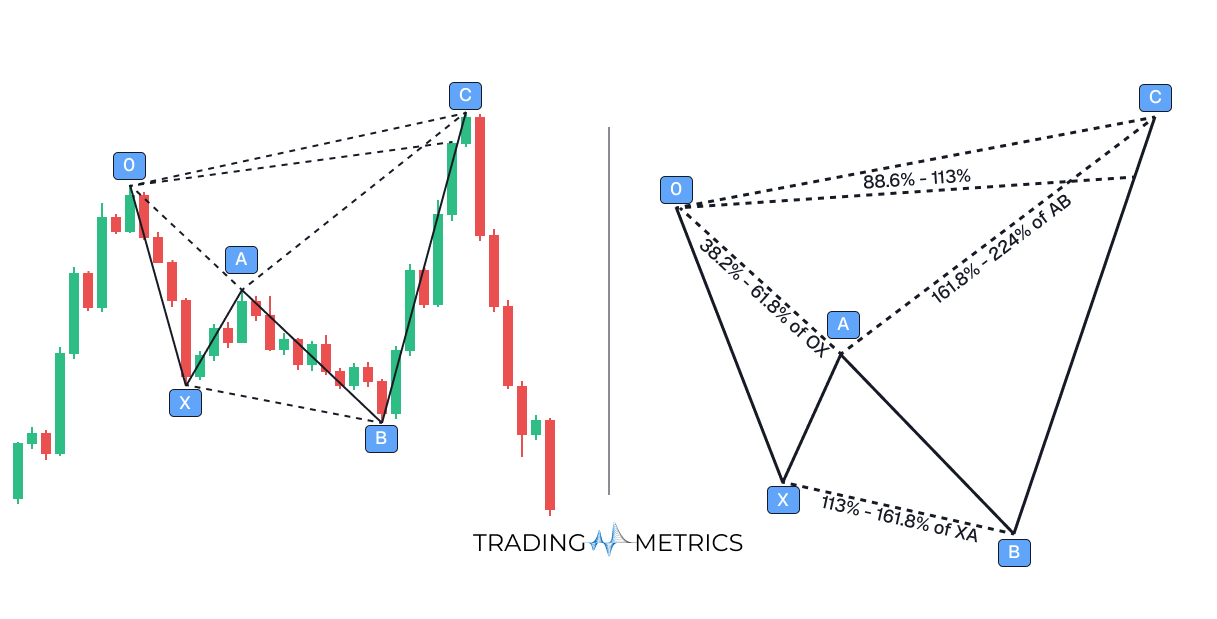

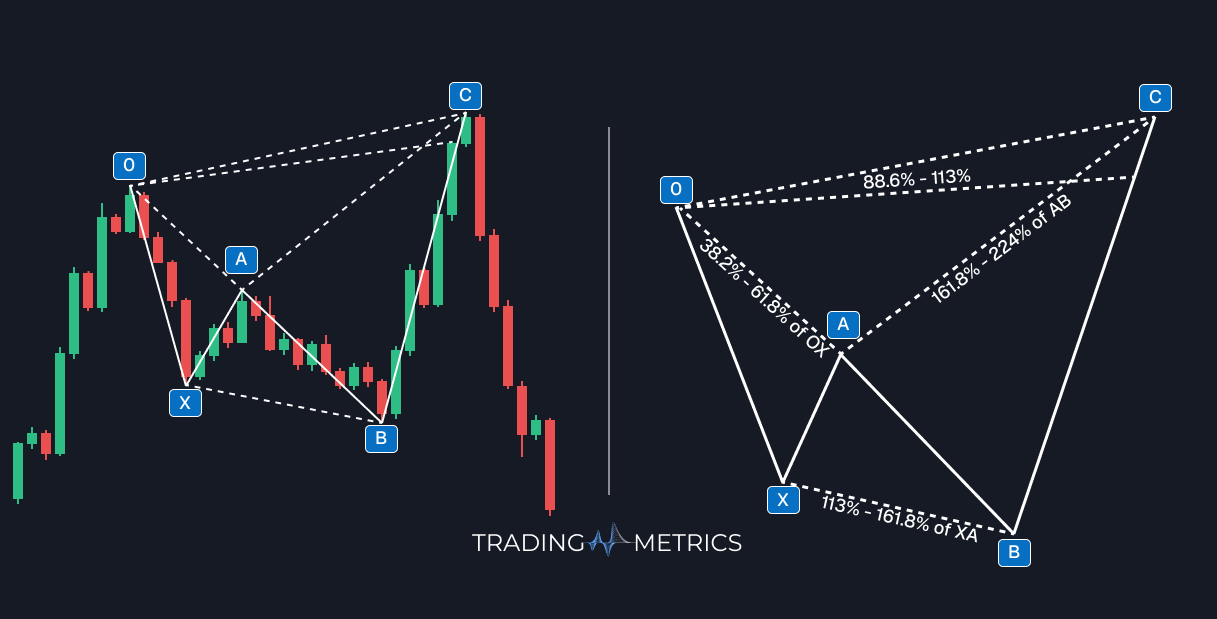

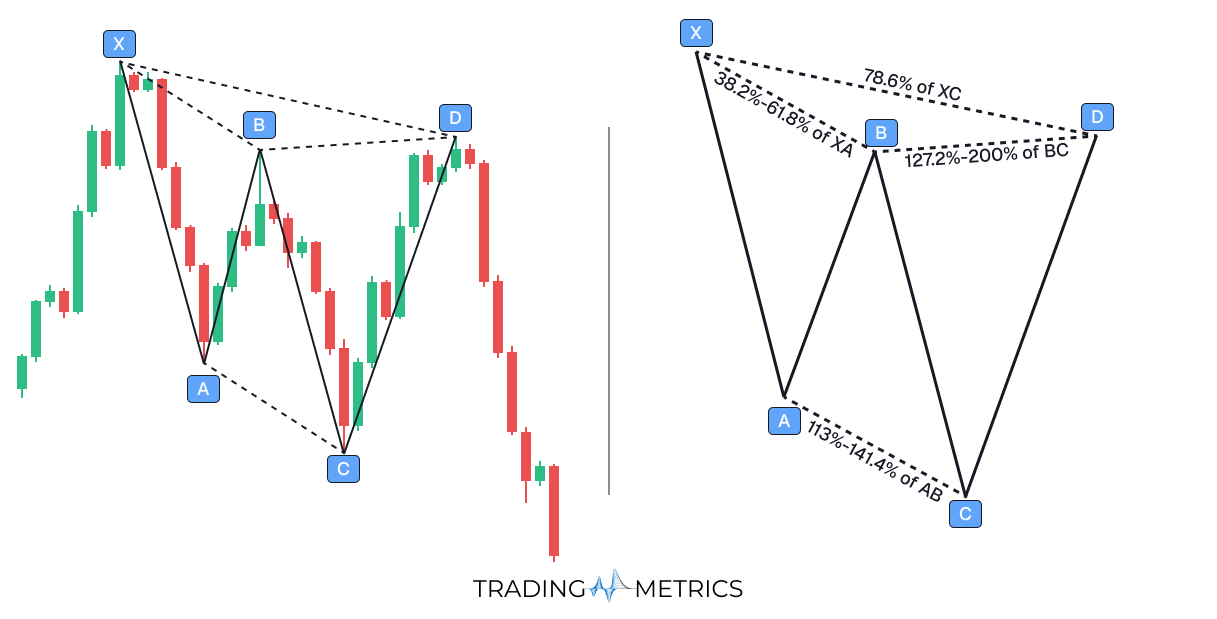

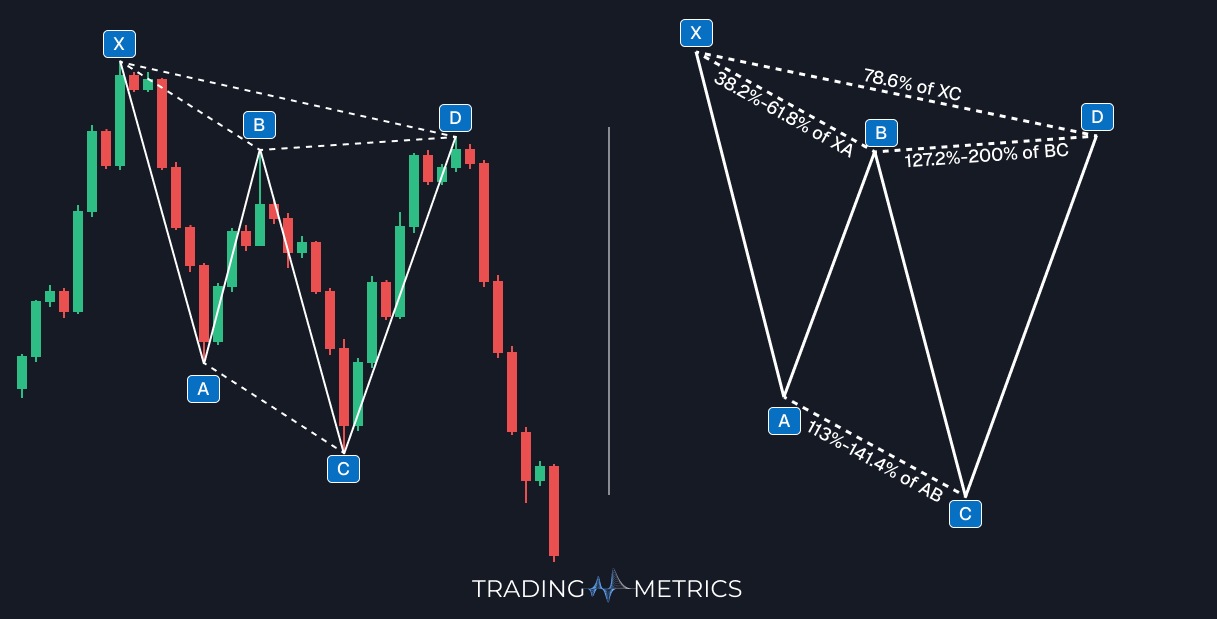

The Bullish Cypher points to a quick bullish reversal after a sharp corrective move, while the Bearish Cypher signals a fast bearish turn following a steep rally, both structured by distinct Fibonacci patterns.

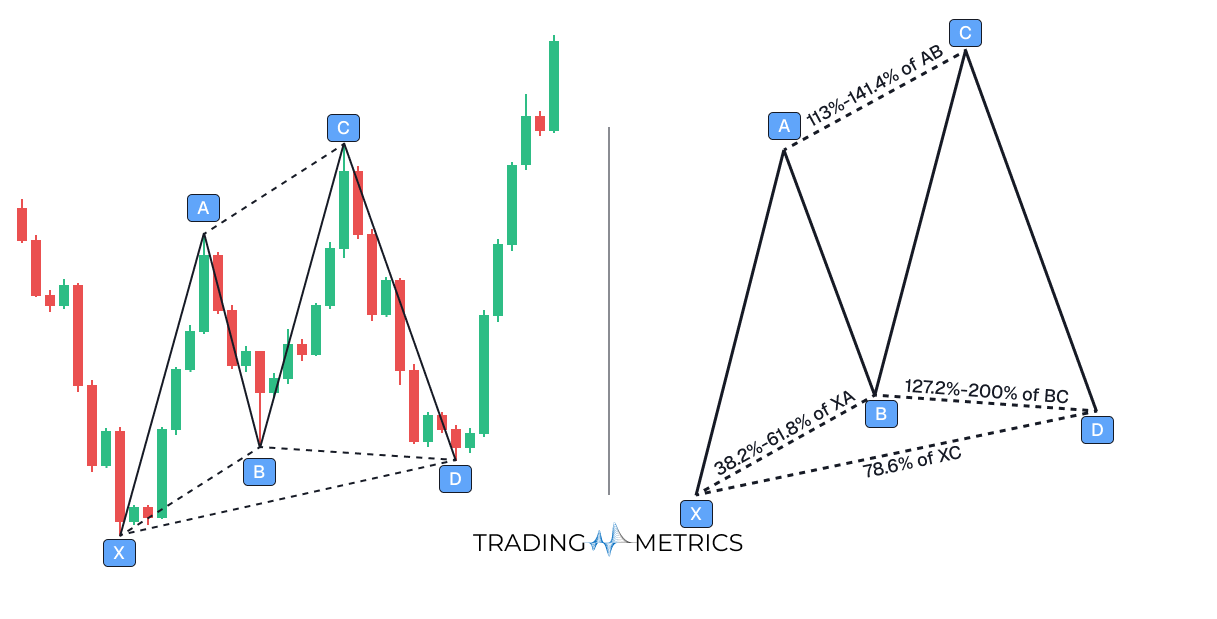

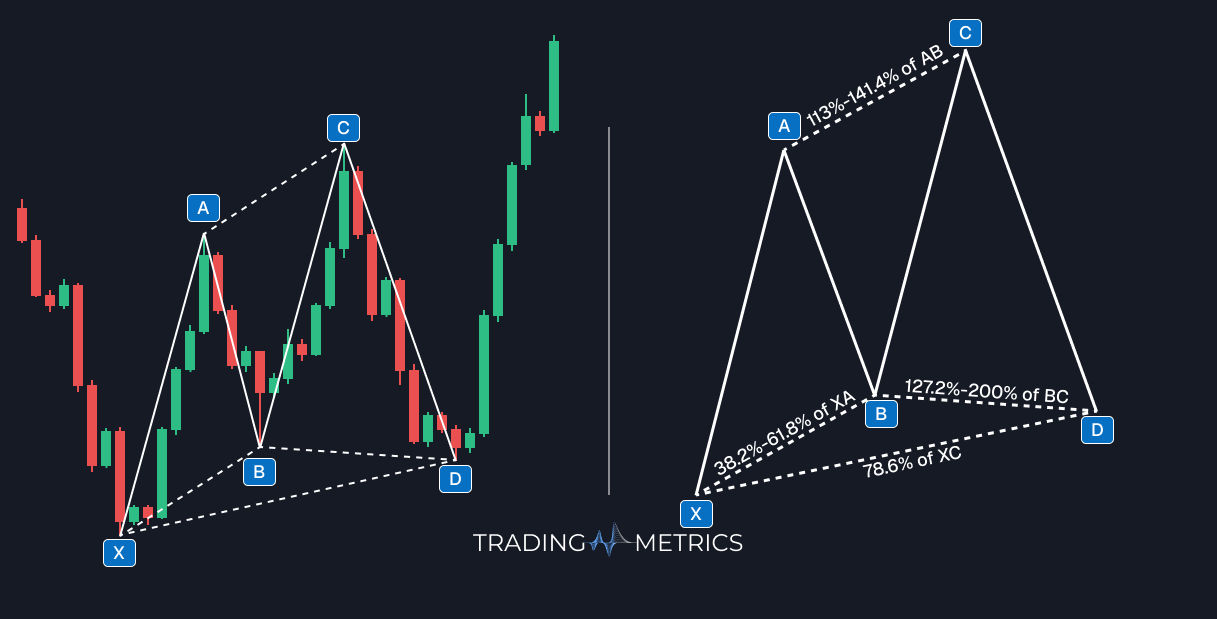

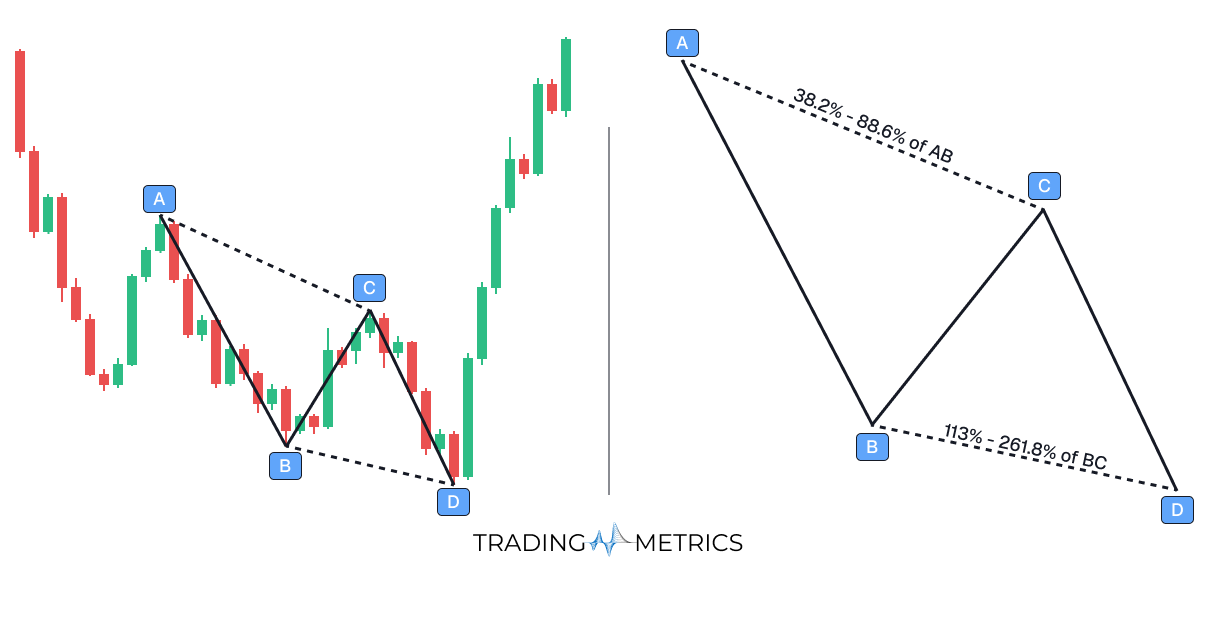

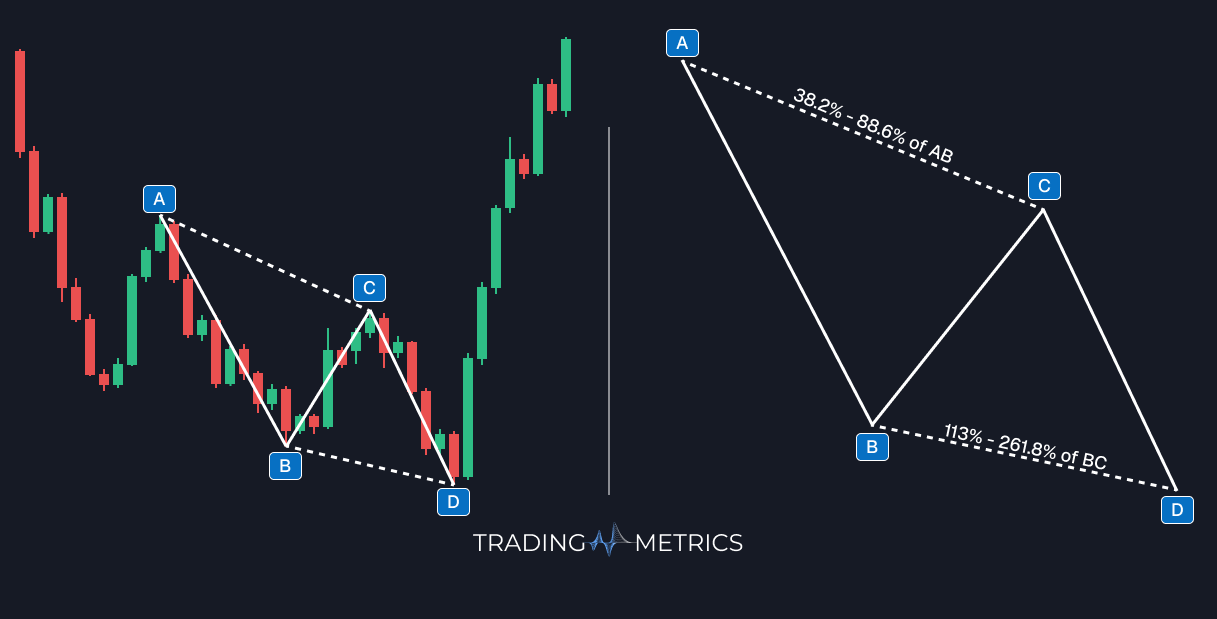

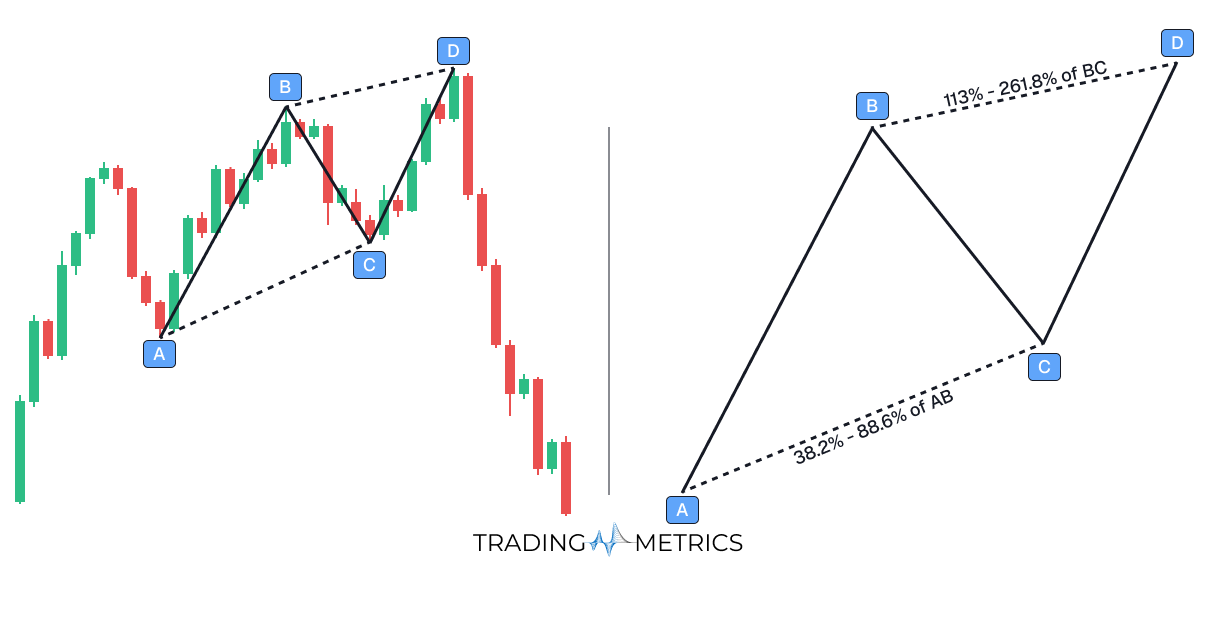

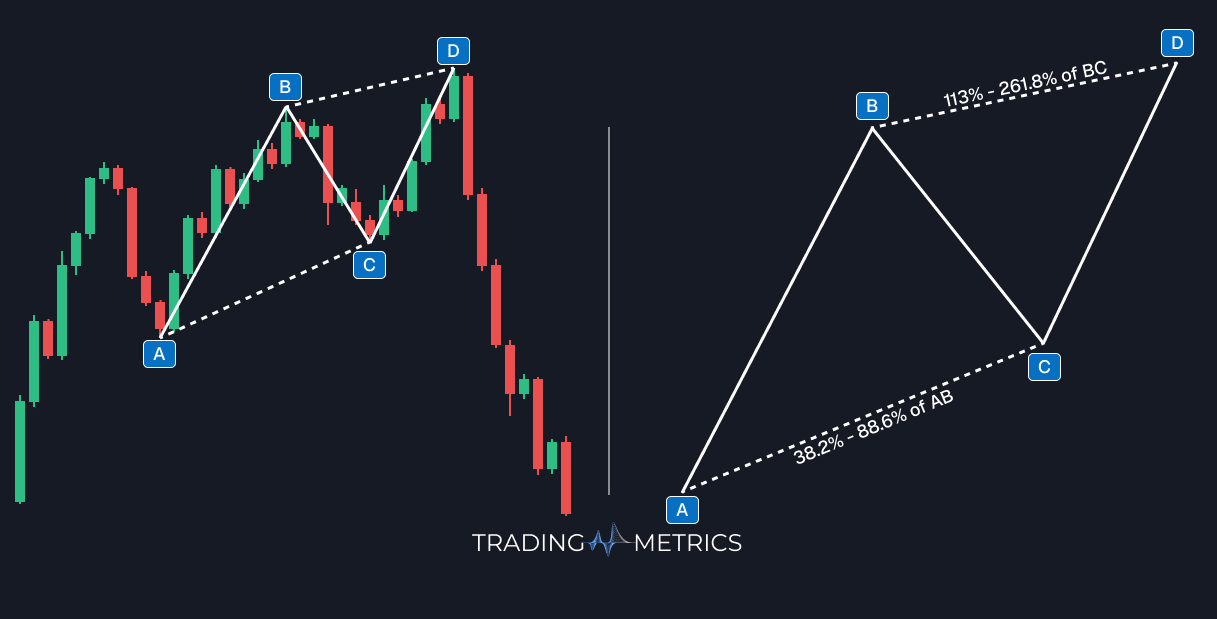

The Bullish AB=CD marks a likely bullish reversal as two equal price legs complete in harmony, while the Bearish AB=CD signals a potential bearish turn under the same symmetrical structure.