Sortino Ratio

The Sortino ratio is a financial metric used to evaluate the risk-adjusted return of an investment. It is a modification of the Sharpe ratio but only penalizes returns that fall below a user-defined threshold, typically the risk-free rate. This makes it more focused on downside risk, as opposed to overall volatility.

The Sortino ratio focuses on the risks that matter, not just any fluctuation in returns.

- Frank A. Sortino

How to Calculate the Sortino Ratio?

The Sortino ratio is calculated using the following formula:

Where:

- Expected portfolio return

- Risk-free rate

- Downside deviation is the standard deviation of negative asset returns.

Importance of the Sortino Ratio in Trading

The Sortino ratio is important in trading because it differentiates between harmful volatility (downside risk) and overall volatility. This is particularly useful for investors who want to focus on minimizing losses rather than just controlling overall risk.

While the Sharpe ratio penalizes all volatility, the Sortino Ratio zeroes in on downside volatility, giving a more accurate view of risk-adjusted performance.

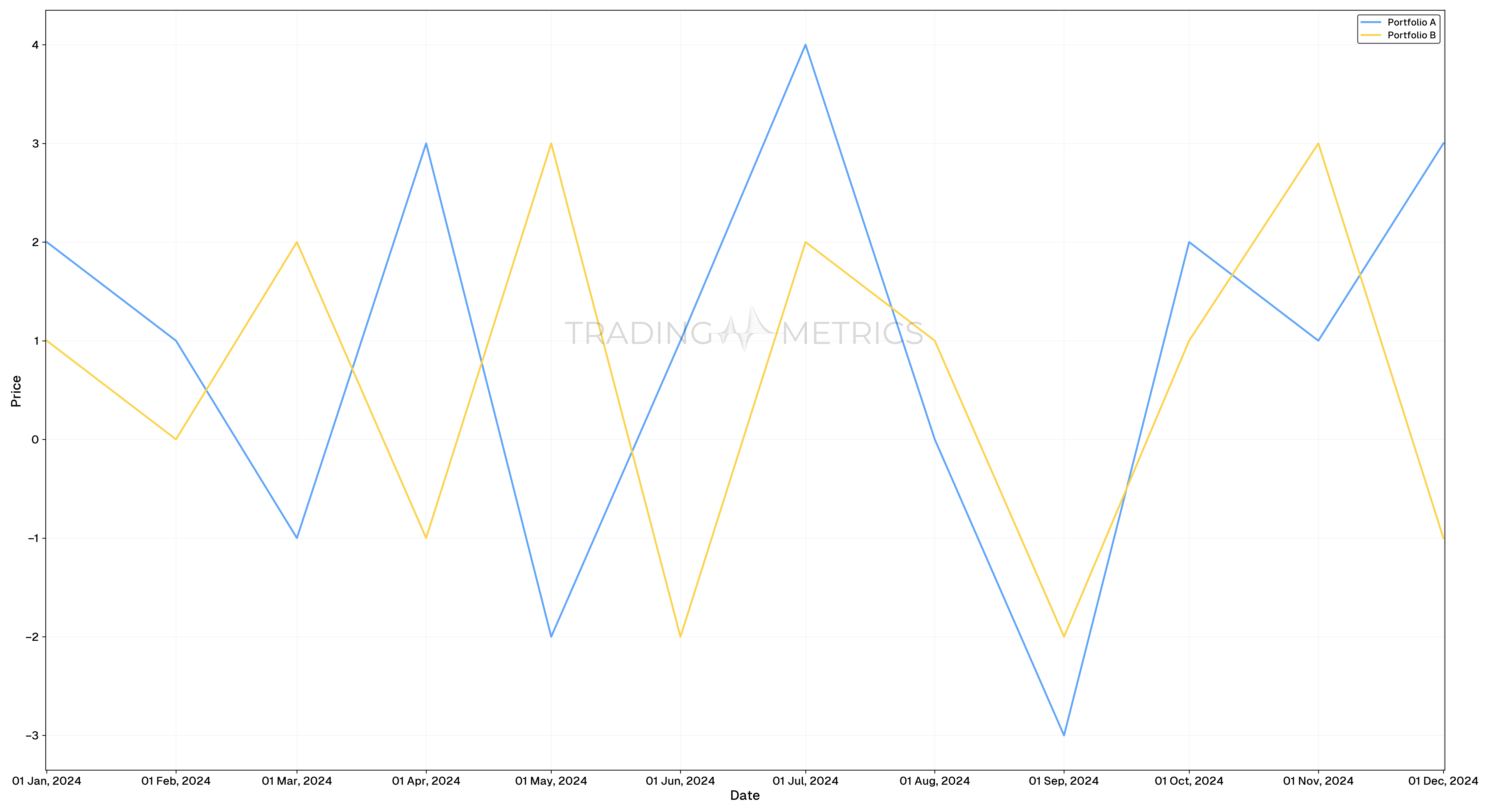

Portfolio Comparison

To bring the concept of the Sortino Ratio to life, let’s explore a practical example using two hypothetical trading portfolios, Portfolio A and Portfolio B. By examining their performance, we can see how the Sortino Ratio helps us understand their risk-adjusted returns.

Let’s assume we have two portfolios, Portfolio A and Portfolio B, each with a different set of returns over a one-year period. We will calculate the Sortino Ratio for both to determine which has a better risk-adjusted return.

Imagine two investors, each managing a different portfolio over a one-year period. Portfolio A has monthly returns that fluctuate significantly, with some months showing positive gains and others experiencing losses. In contrast, Portfolio B displays a more consistent performance, with fewer dramatic swings.

| Month | Portfolio A Return | Portfolio B Return |

|---|---|---|

January | 2% | 1% |

February | 1% | 0% |

March | -1% | 2% |

April | 3% | -1% |

May | -2% | 3% |

June | 1% | -2% |

July | 4% | 2% |

August | 0% | 1% |

September | -3% | -2% |

October | 2% | 1% |

November | 1% | 3% |

December | 3% | -1% |

For instance, Portfolio A starts the year strong with returns of 2% and 1% in January and February, respectively, but then dips into the negative with -1% in March. This pattern continues throughout the year, with highs like 4% in July and lows like -3% in September.

On the other hand, Portfolio B has a steadier path, with returns such as 1% in January, 0% in February, and a high of 3% in May, but with smaller negative returns like -1% in April and -2% in June.

When we delve into the Sortino Ratio, which focuses solely on downside risk, we gain deeper insights into the risk-adjusted performance of these portfolios. Portfolio A, despite its impressive peaks, suffers from a higher frequency of negative returns. These losses are crucial in calculating the downside deviation, which is the key element of the Sortino Ratio. Portfolio A’s downside deviation turns out to be higher, reflecting its more erratic performance.

Portfolio A

The average return

Negative returns for Portfolio A are: (-1%, -2%, -3%)

Calculate the downside deviation

Portfolio B

The average return

Negative returns for Portfolio B are: (-1%, -2%, -1%)

Calculate the downside deviation

Analysis: Conversely, Portfolio B, with its more stable and moderate gains, shows fewer and smaller negative returns. This results in a lower downside deviation, indicating less exposure to downside risk.

By using the Sortino Ratio formula, we find that Portfolio A has a Sortino Ratio of approximately 0.58, whereas Portfolio B boasts a higher Sortino Ratio of around 0.87. This difference clearly illustrates that Portfolio B offers a better risk-adjusted return, focusing only on the downside risk.

Downside Deviation, Not Standard Deviation: Remember, the Sortino Ratio focuses only on negative price movements, avoiding the distortion caused by upside volatility in your calculations.

Combining Sortino Ratio with Other Tools

The Sortino ratio can be combined with other financial metrics to gain a comprehensive view of investment performance:

- Sharpe ratio: To compare overall risk-adjusted performance including upside volatility.

- Maximum Drawdown: To assess the largest peak-to-trough decline.

- Beta (β): To understand the asset’s volatility in relation to the market.

Pair with Other Metrics: The Sortino Ratio works best alongside other performance measures like Win rate and Max Drawdown for a holistic evaluation of your trading strategy.

Key Points

- Focus on Downside Risk: The Sortino Ratio measures risk-adjusted returns by considering only downside volatility, making it a more refined metric than the Sharpe ratio.

- Penalty for Negative Returns: It differentiates between harmful volatility (losses) and general variability, aligning more closely with investor concerns.

- Higher is Better: A higher Sortino Ratio indicates that an investment achieves better returns relative to the risk of losses.

- Downside Deviation: The ratio uses downside deviation instead of standard deviation, providing a clearer view of risks associated with negative outcomes.

- Useful for Comparing Strategies: Particularly effective when evaluating strategies that aim to minimize losses while maintaining upside potential.

- Risk-Free Benchmark: Like the Sharpe ratio, the Sortino Ratio compares returns against a risk-free rate, isolating the reward for taking on downside risk.

- Portfolio Optimization: It helps in selecting investments or constructing portfolios with an emphasis on minimizing downside risks.

- Ideal for Asymmetric Returns: Particularly suited for investments or strategies with non-normal return distributions, such as options or alternative assets.

- Dynamic Across Time Frames: The Sortino Ratio changes with time periods and market conditions, requiring periodic evaluation for relevance.

- Complementary Metric: Use alongside the Sharpe ratio or other risk-adjusted metrics to gain a comprehensive understanding of an investment’s performance.

Conclusion

The Sortino ratio is a powerful tool for investors focused on minimizing downside risk. It provides a clearer picture of risk-adjusted returns by penalizing only the negative volatility. When trading volatile assets like Bitcoin, the Sortino ratio can offer valuable insights that the Sharpe ratio might miss. By focusing on downside risk, the Sortino ratio helps traders and investors better manage their portfolios in volatile markets, ensuring a more stable path towards achieving their financial goals.