Sector Allocation

Sector Allocation is a strategy used by investors to diversify their portfolios by distributing investments across different sectors of the economy. Think of it like a balanced diet for your investment portfolio; just as you wouldn’t eat only fruits or only proteins, you wouldn’t want your investments concentrated in just one industry. By spreading investments across various sectors, such as technology, healthcare, finance, and energy, you can reduce risk and potentially increase returns.

The trend is your friend.

- Anonymous

How to Calculate Sector Allocation?

Calculating sector allocation involves determining the percentage of your total portfolio invested in each sector. Here’s a step-by-step approach:

List Your Investments

Identify all the assets in your portfolio and their corresponding sectors.

Calculate the Value

Determine the current value of each investment.

Sum Up by Sector

Group investments by sector and sum their values.

Percentage Allocation

Divide the total value of investments in each sector by the total portfolio value, then multiply by 100 to get the percentage.

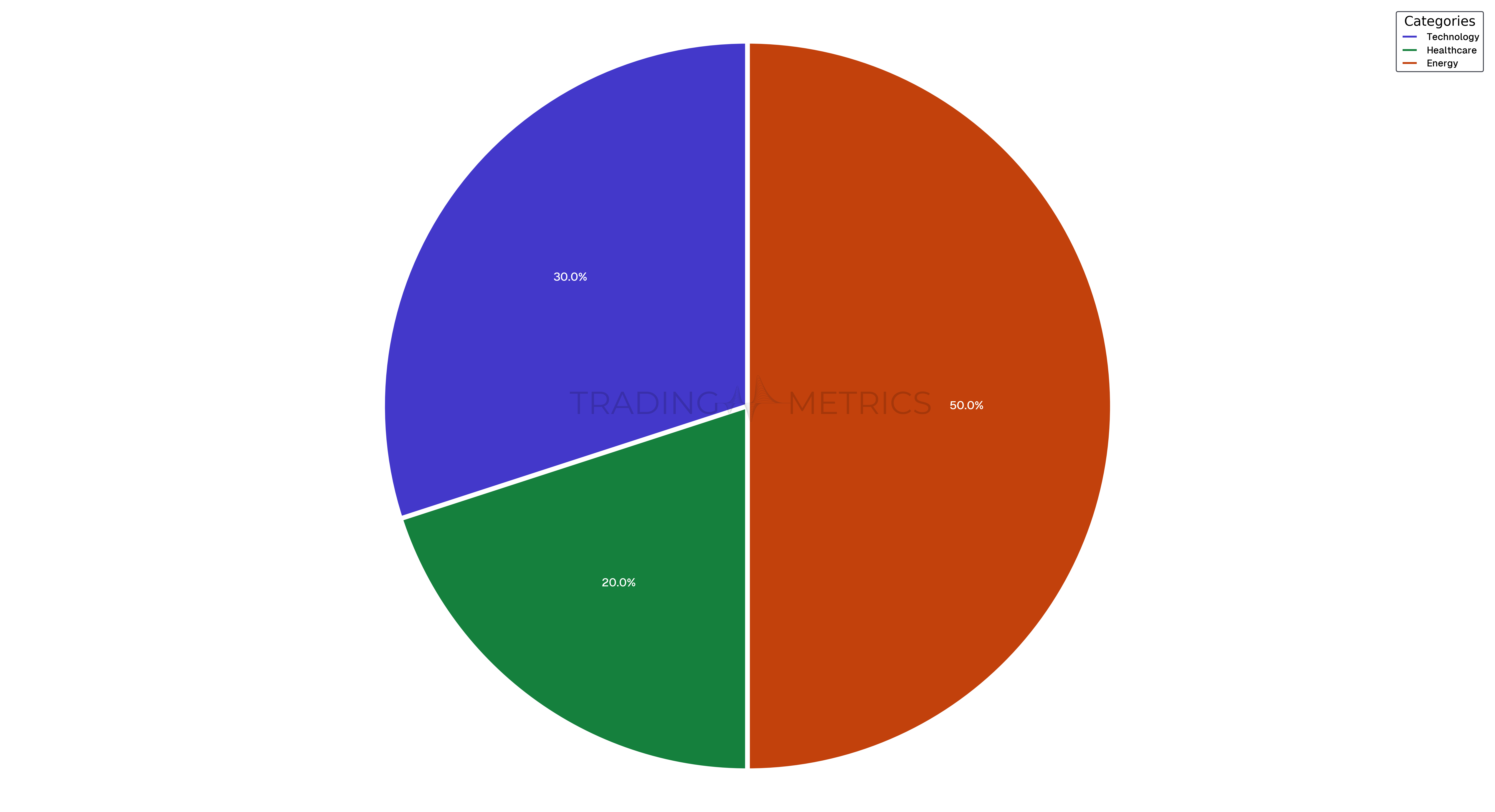

For example, if you have a portfolio worth $100,000, with $30,000 in tech stocks, $20,000 in healthcare, and $50,000 in energy, your sector allocation would be:

- Technology: 30%

- Healthcare: 20%

- Energy: 50%

Sector rotation can supercharge your portfolio. Focus on sectors gaining momentum in the current economic cycle to optimize your returns.

Importance of Sector Allocation in Trading

Sector allocation plays a crucial role in trading by aiding in risk management, maximizing returns, and maintaining portfolio balance. Diversifying across sectors helps mitigate sector-specific risks, ensuring that underperformance in one sector can be offset by gains in another. Additionally, strategic sector allocation allows traders to capitalize on growth opportunities as different sectors perform differently under varying economic conditions. Regularly reviewing and adjusting your sector allocation ensures alignment with investment goals and adaptability to changing market dynamics.

Deep analysis leads to smart allocation. Research sector fundamentals and technicals to spot hidden opportunities.

Strategic Sector Allocation

Strategic sector allocation involves distributing investments across various market sectors to achieve a balanced portfolio tailored to specific goals and market conditions. By understanding sector dynamics, traders and investors can optimize their portfolios for growth, stability, or income generation.

This approach considers factors such as economic cycles, sector performance trends, and individual risk tolerance. Whether focusing on high-growth sectors like Technology or defensive areas like Healthcare, strategic allocation helps diversify risk while capitalizing on sector-specific opportunities.

The examples below explore diversified allocations, historical sector performance, and the impact of sector rotation during different economic phases to guide effective portfolio management.

Diversified Sector Allocation

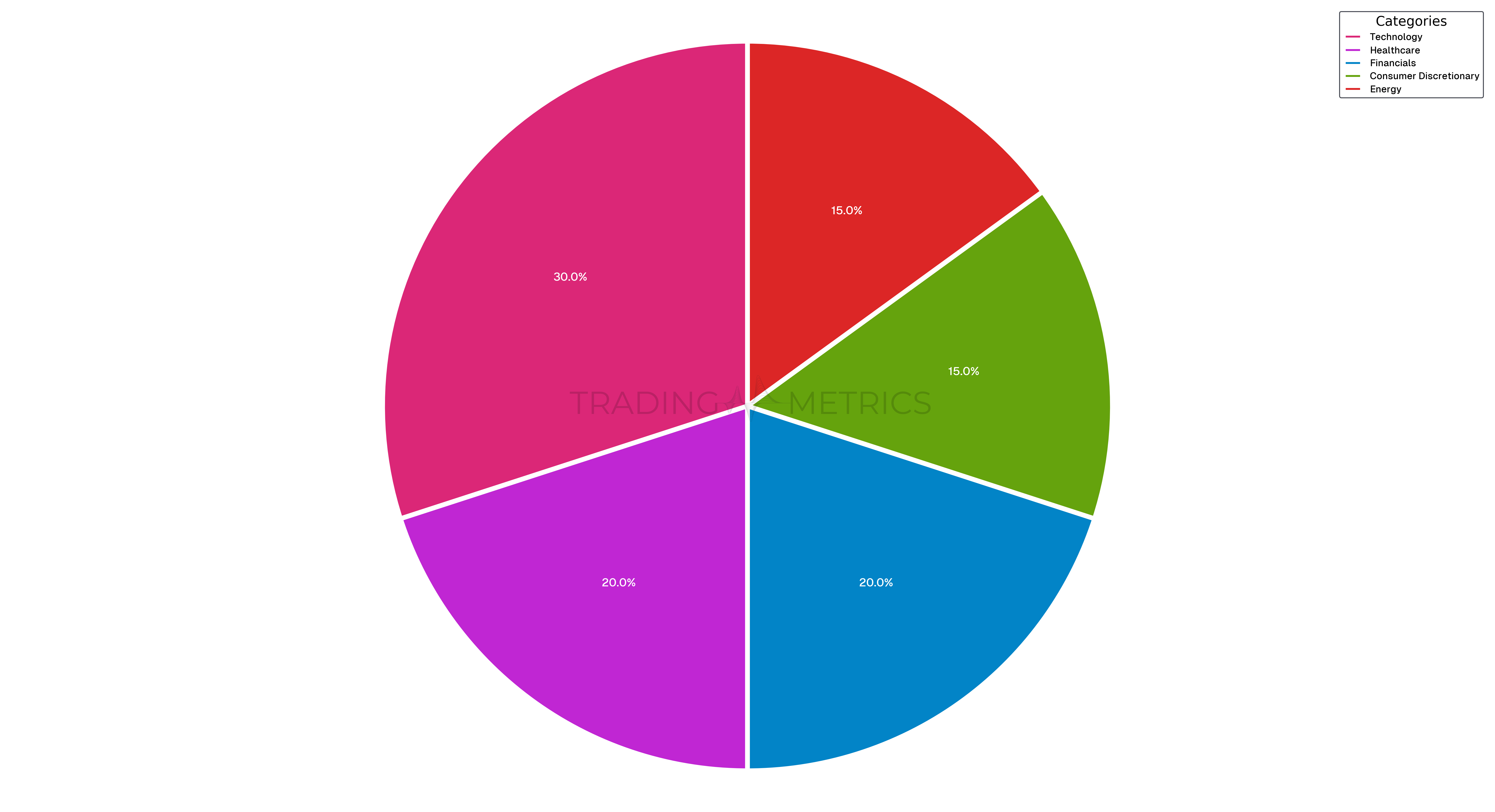

Consider a portfolio with investments spread across five major sectors: Technology, Healthcare, Financials, Consumer Discretionary, and Energy. Here’s how the allocation might look:

| Sector | Allocation |

|---|---|

Technology | 30% |

Healthcare | 20% |

Financials | 20% |

Consumer Discretionary | 15% |

Energy | 15% |

Analysis: This diversified allocation balances growth and stability. Technology and Healthcare sectors often provide high growth potential, while Financials and Energy can offer stability and dividends. Consumer Discretionary adds an element of cyclicality, capturing consumer spending trends.

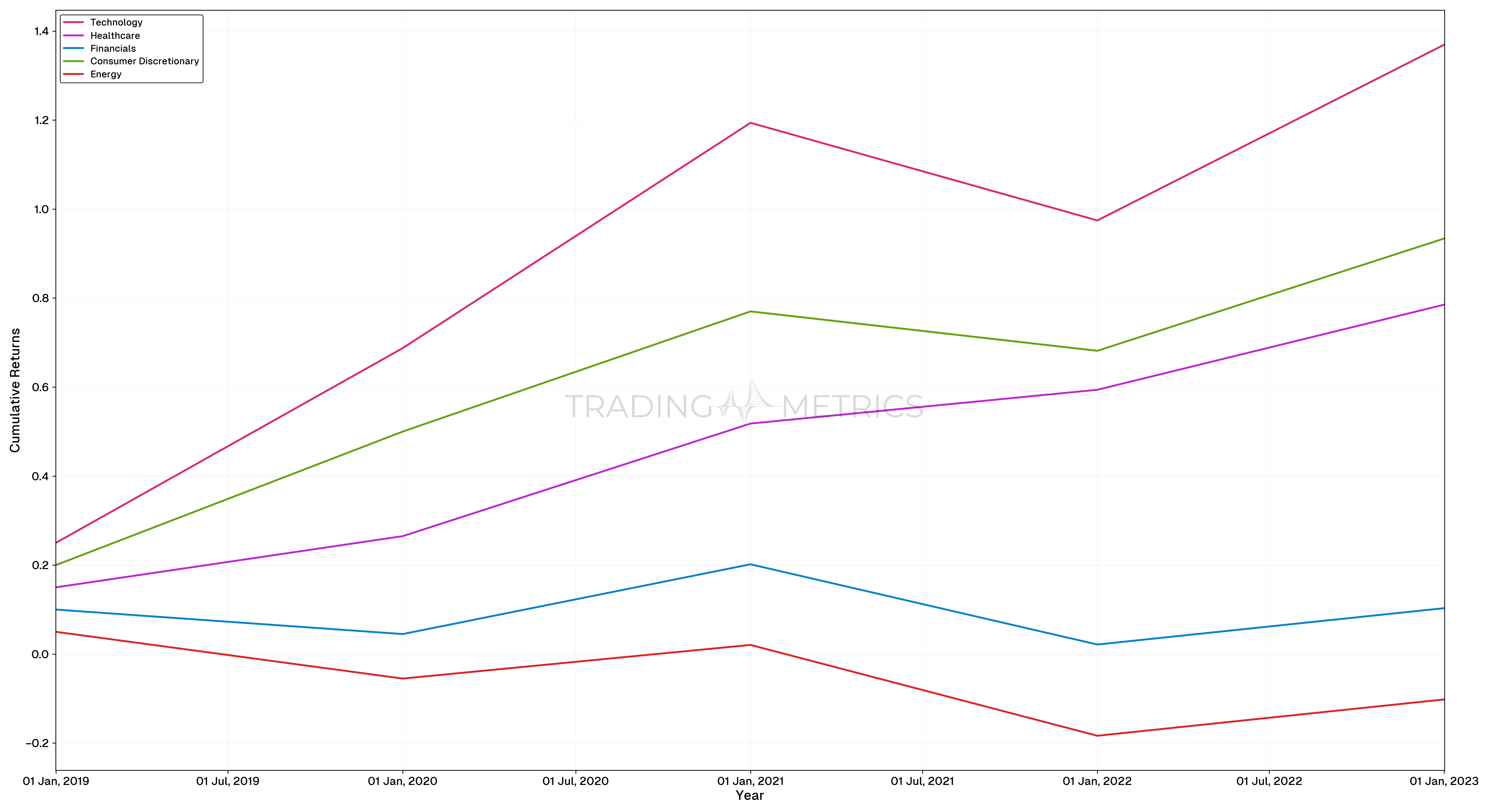

Sector Performance Over Time

To understand the impact of sector allocation on returns, let’s analyze the performance of these sectors over the past five years. We’ll use hypothetical data for the annual returns of each sector:

| Year | Technology | Healthcare | Financials | Consumer Discretionary | Energy |

|---|---|---|---|---|---|

2019 | 25% | 15% | 10% | 20% | 5% |

2020 | 35% | 10% | -5% | 25% | -10% |

2021 | 30% | 20% | 15% | 18% | 8% |

2022 | -10% | 5% | -15% | -5% | -20% |

2023 | 20% | 12% | 8% | 15% | 10% |

Analysis: The line graph clearly shows the cumulative performance of each sector over the five-year period:

- Technology: Demonstrates significant growth, particularly in 2020 and 2021, driven by digital transformation and increased reliance on technology during the pandemic. Despite a dip in 2022, it rebounds in 2023.

- Healthcare: Exhibits steady growth, benefiting from ongoing medical innovations and increased healthcare demand.

- Financials: Shows cyclical behavior with fluctuations based on economic conditions, including a dip in 2020 and 2022 due to financial market uncertainties.

- Consumer Discretionary: Strong performance during economic upswings, especially in 2020 and 2021, reflecting robust consumer spending. It faces a downturn in 2022 but recovers in 2023.

- Energy: Volatile performance, heavily influenced by oil prices and global energy demand. It experiences significant downturns in 2020 and 2022 but shows a recovery in 2023.

By analyzing this data, traders can better understand the potential returns and risks associated with each sector, informing their sector allocation decisions.

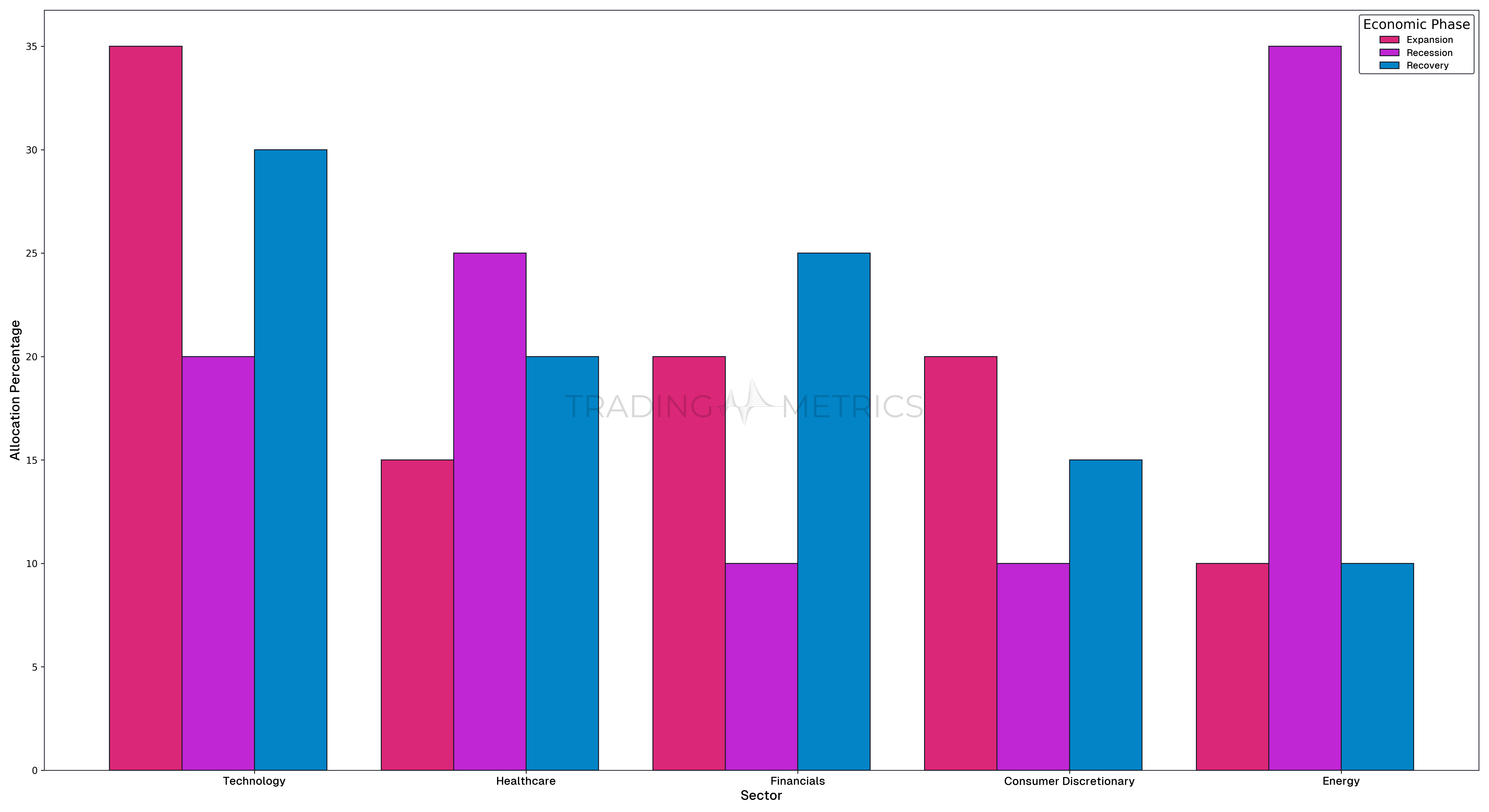

Impact of Sector Rotation

Sector rotation involves shifting investments from one sector to another based on economic cycles and market conditions. Let’s consider three different economic phases: Expansion, Recession, and Recovery. Here’s how the sector allocation might change during each phase:

| Sector | Expansion | Recession | Recovery |

|---|---|---|---|

Technology | 35% | 20% | 30% |

Healthcare | 15% | 25% | 20% |

Financials | 20% | 10% | 25% |

Consumer Discretionary | 20% | 10% | 15% |

Energy | 10% | 35% | 10% |

Analysis: The bar chart illustrates how sector allocation shifts based on economic conditions:

-

Expansion: During economic expansion, the portfolio is heavily weighted towards Technology (35%) and Consumer Discretionary (20%) to capture growth opportunities. Financials (20%) also have a significant allocation to benefit from economic growth.

-

Recession: In a recession, the allocation shifts to more defensive sectors such as Healthcare (25%) and Energy (35%). Technology and Consumer Discretionary allocations are reduced, reflecting a move towards stability and essential services.

-

Recovery: As the economy recovers, the portfolio reallocates towards sectors expected to benefit from economic rebound, such as Financials (25%) and Technology (30%). Healthcare (20%) and Consumer Discretionary (15%) maintain moderate allocations.

Diversification reduces risk. Allocating across multiple sectors helps cushion against unexpected downturns in specific industries.

Combining Sector Allocation with Other Tools

Sector allocation can be enhanced by integrating it with other analytical tools:

- Technical Analysis: Use charts and technical indicators to identify trends within sectors.

- Fundamental Analysis: Evaluate the financial health and growth prospects of companies within each sector.

- Economic Indicators: Monitor economic data that could impact different sectors, such as interest rates, inflation, and GDP growth.

Trends are your allies. Pay attention to macroeconomic shifts and news driving sector performance.

Key Points

- Diversification Strategy: Sector allocation spreads investments across different sectors, reducing concentration risk and enhancing portfolio stability.

- Economic Cycle Sensitivity: Certain sectors perform better during specific phases of the economic cycle; align sector allocation with current and expected market conditions.

- Risk-Return Balance: A balanced sector allocation minimizes overexposure to volatile or underperforming sectors, improving the overall risk-return profile.

- Benchmark Comparison: Comparing your portfolio’s sector allocation to relevant indices (e.g., S&P 500) helps identify underweight or overweight positions.

- Sector Rotation Opportunities: Adjust sector allocation dynamically to capitalize on trends or shifts, such as moving into defensive sectors during market downturns.

- Correlation Impact: Low correlation between sectors enhances diversification benefits, reducing portfolio risk.

- Performance Drivers: Identify sectors with strong growth potential or favorable market conditions to optimize allocation for higher returns.

- Geographic Implications: Sector performance can vary by region; consider global factors when allocating to sectors like technology, energy, or healthcare.

- Regular Rebalancing: Periodically review and adjust sector allocations to ensure alignment with portfolio goals and changing market conditions.

- Long-Term Alignment: Ensure sector allocation aligns with your long-term investment strategy and risk tolerance, avoiding impulsive changes driven by short-term events.

Conclusion

Sector allocation is a vital strategy for diversifying your investment portfolio, managing risk, and optimizing returns. By spreading investments across various sectors, you can cushion against sector-specific downturns and capitalize on growth opportunities. By understanding and implementing sector allocation, you can build a more resilient and potentially more profitable investment portfolio.