Trading Psychology & Risk Acceptance

Risk management isn’t just about numbers, formulas, and stop-losses. The most sophisticated position sizing system or risk-reward ratio will fail if you can’t execute it consistently. The real battleground of trading isn’t on the chart - it’s in your mind.

Trading Psychology and Risk Acceptance form the foundation upon which all technical risk management rests. Without the proper mindset, even the best trading plan becomes worthless under emotional pressure.

Most traders fail not because they lack a good strategy, but because they can’t execute it consistently when fear, hope, or ego take control.

These limits aren’t about giving up - they’re about protecting your mental capital. Just like financial capital, once psychological capital is depleted, you can’t execute effectively.

Why Psychology Matters More Than Strategy

Every trader has experienced this: you know what you should do, but you can’t pull the trigger. Or you move your stop-loss “just a little wider” because the market “shouldn’t” hit it. Or you skip valid setups after a losing streak.

These aren’t strategy problems - they’re psychological problems.

The market is inherently uncertain. No amount of analysis can eliminate that uncertainty. The only thing you can control is:

- How you respond to uncertainty

- How consistently you execute your plan

- How well you accept that any single trade can go either way

Professional traders don’t predict outcomes - they execute their edge with flawless consistency and let probabilities work over time.

The 5 Fundamental Truths of Trading

Mark Douglas, in his book Trading in the Zone, identified five core beliefs that every consistently profitable trader must internalize. These truths shift your mindset from outcome-focused to process-focused thinking.

Anything Can Happen

No matter how perfect your setup looks, the market can always do something unexpected. There are always hidden variables - a news event, a large institutional order, a liquidity grab - that you cannot see or predict.

Application: Never enter a trade assuming you know what will happen next. Always define your stop-loss first.

You Don’t Need to Know What Will Happen Next to Make Money

Profitability comes from executing an edge repeatedly over a large sample size, not from being right on any individual trade. Casinos don’t know which hand will win - they just know their edge pays off over thousands of hands.

Application: Focus on executing your plan, not on predicting market movement. Your job is consistency, not clairvoyance.

There Is a Random Distribution Between Wins and Losses

Even the best trading system produces wins and losses in unpredictable sequences. You might get 5 winners in a row, then 4 losers, then 2 winners, then 3 losers. This randomness is unavoidable.

Application: Never judge your system based on the last 3-5 trades. Track performance over 50-100+ trades minimum.

An Edge Is Simply a Higher Probability, Not Certainty

Your strategy might win 60% of the time, but that means it loses 40% of the time. Every individual trade is still uncertain. The edge only manifests across many trades.

Application: Accept that even your “best” setups can and will lose. Risk only what you can afford to lose on every single trade.

Every Moment in the Market Is Unique

No two patterns are ever truly identical. Small differences in volatility, volume, market structure, or order flow can produce completely different outcomes from similar-looking setups.

Application: Don’t assume that because a pattern worked last time, it will work this time. Stay present and objective.

These truths remove the need to be right and replace it with the need to be consistent. When you truly internalize them, fear and hesitation disappear because you’ve accepted uncertainty as part of the game.

What Is Risk Acceptance?

Risk Acceptance is the psychological state where you have fully internalized that the money you’re risking on a trade is already gone. It’s not about being reckless - it’s about being emotionally prepared for either outcome before you enter.

When you truly accept risk, you experience:

- No hesitation when your setup appears

- No fear while the trade is running

- No emotional attachment to the outcome

- No urge to move your stop-loss or exit early

The Test of True Risk Acceptance

Ask yourself before every trade:

“If my stop gets hit immediately, will I feel calm and ready to take the next valid setup?”

If the answer is no, your position size is too large or you’re not mentally prepared for the trade.

Saying “I accept the risk” while feeling anxious about the trade is not acceptance - it’s denial. True acceptance is felt emotionally, not just stated intellectually.

Pre-Trade Psychological Checklist

Use this checklist before every trade to ensure you’re in the right mental state:

| Question | Safe to Trade? |

|---|---|

| Is my risk predefined and emotionally acceptable? | ✅ Must be YES |

| Am I calm and neutral about the outcome? | ✅ Must be YES |

| Is this setup part of my defined edge? | ✅ Must be YES |

| Am I trying to 'make back' previous losses? | ❌ Must be NO |

| Am I feeling bored or looking for action? | ❌ Must be NO |

| Will I honor my stop without hesitation if hit? | ✅ Must be YES |

If any answer is wrong, do not take the trade. A trade taken from the wrong mental state is already a losing trade, regardless of outcome.

Execution vs. Outcome: How to Grade Yourself

One of the most important psychological shifts you can make is grading yourself on execution, not outcome.

The Problem with Outcome-Based Thinking

If you judge trades by profit/loss:

- Winning trades feel validating, even if you broke your rules

- Losing trades feel like failures, even if you executed perfectly

- You develop bad habits that get reinforced by luck

- You lose confidence when random distribution produces normal losing streaks

The Solution: Process-Based Grading

Grade every trade A, B, C, D, or F based solely on rule execution:

| Grade | Execution Quality | Example |

|---|---|---|

A | Flawless execution of plan | Perfect entry, proper size, honored stop, no emotional interference |

B | Minor deviation, still disciplined | Slightly early entry but within parameters, small hesitation |

C | Noticeable rule violation | Oversized position, moved stop once, exited early due to fear |

D | Major emotional trading | Revenge trade, no stop defined, FOMO entry, widened stop multiple times |

F | Complete breakdown | Gambling, tilt trading, no plan at all |

Key insight: A losing trade with an A grade is a success. A winning trade with a D grade is a failure.

Over time, A-grade execution produces consistent profitability because your edge gets full opportunity to express itself.

Your only job is to collect as many A-grades as possible. The market will take care of the profits.

Building a Probability-Based Mindset

To think like a professional trader, you must shift from single-event thinking to probability thinking.

Single-Event Thinking (Amateur)

- “This trade better work”

- “I can’t afford another loss”

- “I knew I should have waited”

- Confidence rises and falls with recent results

Probability Thinking (Professional)

- “This is one trade in a series of 100+”

- “Losses are simply the cost of doing business”

- “I followed my plan - outcome is irrelevant”

- Confidence comes from process execution, not results

How to Train Probability Thinking

- Track in series: Review performance in 20-trade blocks, not individual trades

- Use R-Multiple: Measure every trade in R units to normalize outcomes

- Accept randomness: Flip a coin 50 times and observe streaks - this is how wins/losses distribute

- Focus on expectancy: Calculate your edge mathematically, then trust it

A casino doesn’t panic after 10 losing hands in a row. They know their edge plays out over thousands of hands. You must adopt the same mindset.

Journaling for Psychological Growth

Journaling becomes exponentially more powerful when it includes psychological metrics alongside technical data. Self-awareness through structured journaling is fundamental to behavioral change and performance improvement.

Essential Psychological Journal Fields

For every trade, record:

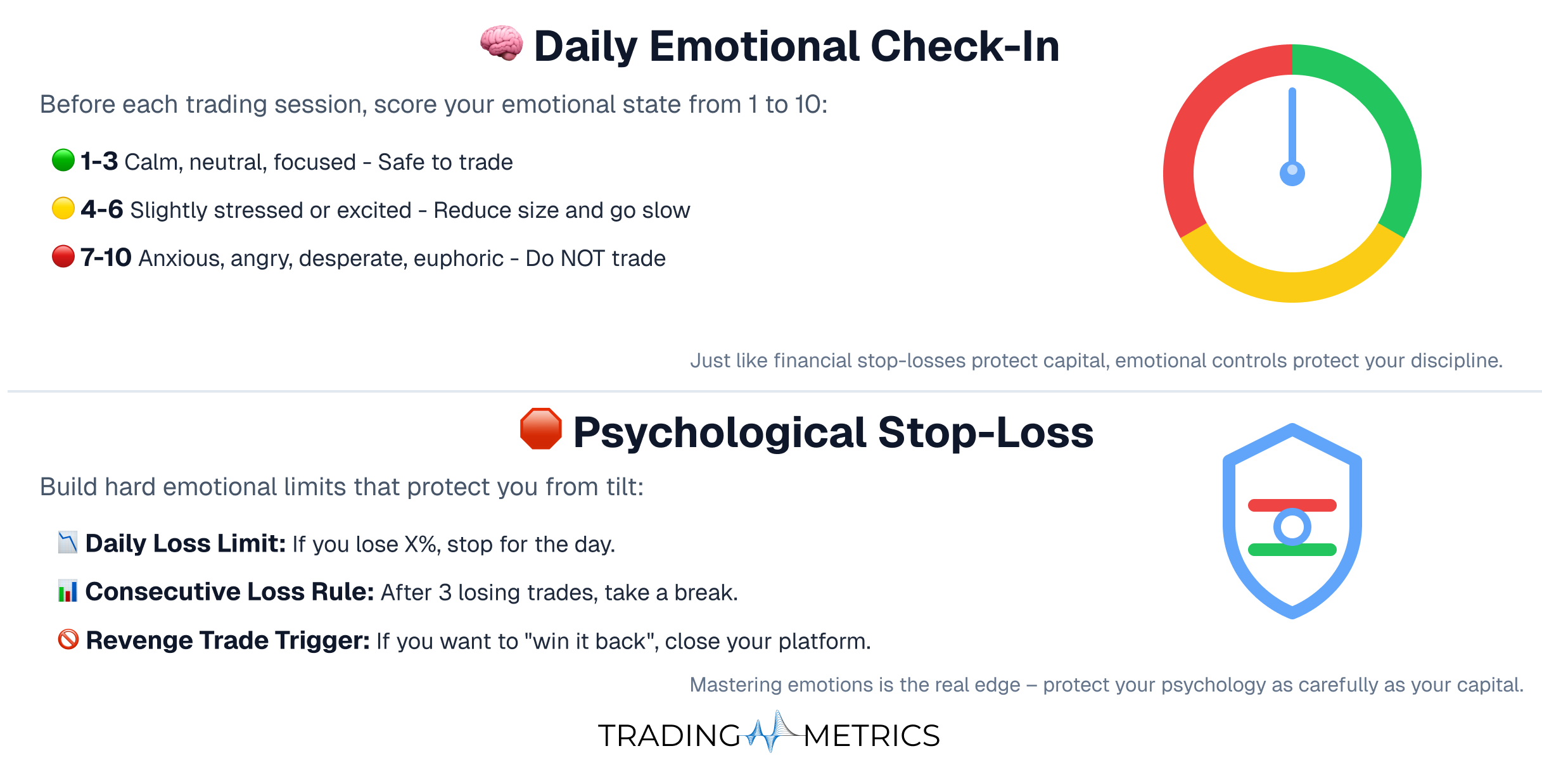

- Emotional state before entry (1-10 scale)

- Was risk fully accepted? (Yes/No)

- Any hesitation or fear during execution? (Yes/No)

- Did emotions influence decisions? (Yes/No + describe)

- Execution grade (A-F)

- What I learned about myself (free text)

Weekly Psychological Review

Every week, analyze:

- How many trades had emotional interference?

- Which emotions appeared most often? (fear, greed, FOMO, revenge)

- What triggers caused discipline breakdowns?

- What percentage of trades were A-grade execution?

- One psychological skill to improve next week

This process builds self-awareness, which is the foundation of behavioral change.

Combining Psychological Risk Management with Other Tools

Trading Psychology doesn’t replace technical risk management – it makes it usable in real time. Combine mindset work with:

- Position Sizing: Keeps each trade small enough that you can think clearly and avoid panic.

- Stop-Loss: Defines risk in advance so you can accept the loss and execute without hesitation.

- Risk-Reward Ratio: Gives you a clear plan for targets vs. risk, reducing second-guessing once you’re in the trade.

- Drawdown Limits: Act as emotional circuit breakers during losing streaks, protecting you from tilt and overtrading.

- Journaling: Creates a feedback loop for your behavior so you can see patterns and improve your psychology over time.

Think of it this way: technical risk management tells you what to do. Psychological risk management enables you to actually do it.

Common Psychological Traps & How to Avoid Them

These cognitive biases, extensively documented in behavioral economics research, manifest uniquely in trading contexts:

| Trap | Symptom | Solution |

|---|---|---|

Need to be right | Moving stops, refusing to exit losers | Accept Truth #1: Anything can happen. Detach ego from outcome. |

Fear of missing out (FOMO) | Chasing price, entering without setup | Remember Truth #5: Every moment is unique. Wait for your edge. |

Revenge trading | Oversizing after losses, forcing trades | Implement tilt limits. Stop after 2-3 consecutive losses. |

Recency bias | Confidence swings based on last few trades | Review performance in 20+ trade samples, not individual trades. |

Analysis paralysis | Hesitation, waiting for more confirmation | Accept Truth #2: You don't need certainty. Execute when edge appears. |

The Three Stages of Trader Development

As you develop psychological mastery, you’ll progress through three distinct stages:

Mechanical

Stage 1 - Rigid rule-following

You’re building discipline by executing your system without deviation. Profitability isn’t the goal yet - consistency is. You’re learning to trust the process and eliminate random behavior.

Mindset: “I will follow my rules perfectly, regardless of outcome.”

Subjective

Stage 2 - Experience-based discretion

You still follow your core rules, but now you can recognize subtle context - when a setup is “clean” vs. “forced,” when volatility conditions favor your edge, when to skip even valid setups due to market structure.

Mindset: “I understand my edge well enough to apply intelligent discretion.”

Intuitive (The Zone)

Stage 3 - Effortless, confident execution

You’ve fully internalized the 5 Fundamental Truths. Fear is gone because risk is completely accepted. Decisions feel instinctive but are actually based on thousands of hours of pattern recognition. You execute without internal conflict.

Mindset: “I am one with my process. I observe and respond without attachment.”

Most traders try to skip to Stage 3 immediately. You cannot. Each stage builds upon the previous one. Embrace the journey.

Key Points

- Risk management is 80% psychology, 20% math - without the right mindset, even perfect formulas fail.

- The 5 Fundamental Truths shift your thinking from outcome-focused to probability-focused.

- Risk acceptance means being emotionally prepared for either outcome before entering a trade.

- Use emotional risk controls (daily check-ins, tilt limits) to protect psychological capital.

- Grade yourself on execution, not outcome - an A-grade losing trade is still a success.

- Probability thinking means viewing each trade as one event in a series of 100+, not as a make-or-break moment.

- Journal psychological metrics alongside technical data to build self-awareness and track behavioral improvement.

- Progress through the three stages (Mechanical → Subjective → Intuitive) - each builds on the previous.

- Combine psychological discipline with technical tools like position sizing, stops, and drawdown limits for complete risk management.

Conclusion

The market doesn’t care about your emotions, your bills, or your need to be right. It simply offers opportunities - and it’s your psychological discipline that determines whether you can consistently execute when those opportunities appear.

Technical risk management protects your capital. Psychological risk management protects your ability to stay in the game long enough for your edge to work.

Master both, and you’ll join the small percentage of traders who survive and thrive over the long term. Ignore psychology, and you’ll join the majority who flame out despite having good strategies.

Consistency isn’t about strategy - it’s about mindset. Accept uncertainty, execute your edge without attachment, and let probabilities work over time. This is how professionals trade.