Bearish Abandoned Baby

The Bearish Abandoned Baby is a rare bearish reversal candlestick pattern that forms after an uptrend. It consists of a bullish candle, a gap-up Doji that is fully isolated by gaps on both sides, and a strong bearish candle that confirms the reversal. This pattern signals that bullish momentum has failed, often marking the start of a new downtrend and offering traders shorting opportunities.

How to Identify the Bearish Abandoned Baby Pattern in Trading

The Bearish Abandoned Baby is a bearish reversal candlestick pattern. It appears at the peak of an uptrend, marked by a Doji isolated between a bullish and a bearish gap, signaling a sharp shift in momentum. Here’s the step-by-step guide.

Start with the Big Picture

This pattern shows up after an uptrend. It highlights buyer exhaustion and a sudden bearish takeover, making it one of the more reliable reversal signals due to its rarity.

Trace the Candle Sequence

The setup develops in three candles:

- First Candle: A long bullish candle, extending the uptrend with strong momentum.

- Second Candle: A Doji that gaps up from the first candle and remains isolated by gaps on both sides.

- Third Candle: A long bearish candle, gapped down from the Doji, closing well below - confirming bearish control.

Zero in on the Confirmation Level

The confirmation level is the low of the Doji. A close below this point strengthens the reversal, though the gap structure often speaks for itself.

Watch the Breakout

The bearish trigger comes when the third candle closes below the Doji’s low, completing the setup. That’s your entry point. (Because of the strong structure, traders often act immediately.)

Check Volume for Additional Confirmation

Volume behavior can validate the signal:

- Rises on the first candle, showing strong buying.

- Drops on the Doji, reflecting hesitation.

- Spikes on the third candle, reinforcing the bearish reversal.

Drop Gap: Use the Doji-to-third-candle range as an initial measure, while confirming with nearby support or Fibonacci Retracement levels.

How to Trade the Bearish Abandoned Baby Pattern (Trading Example)

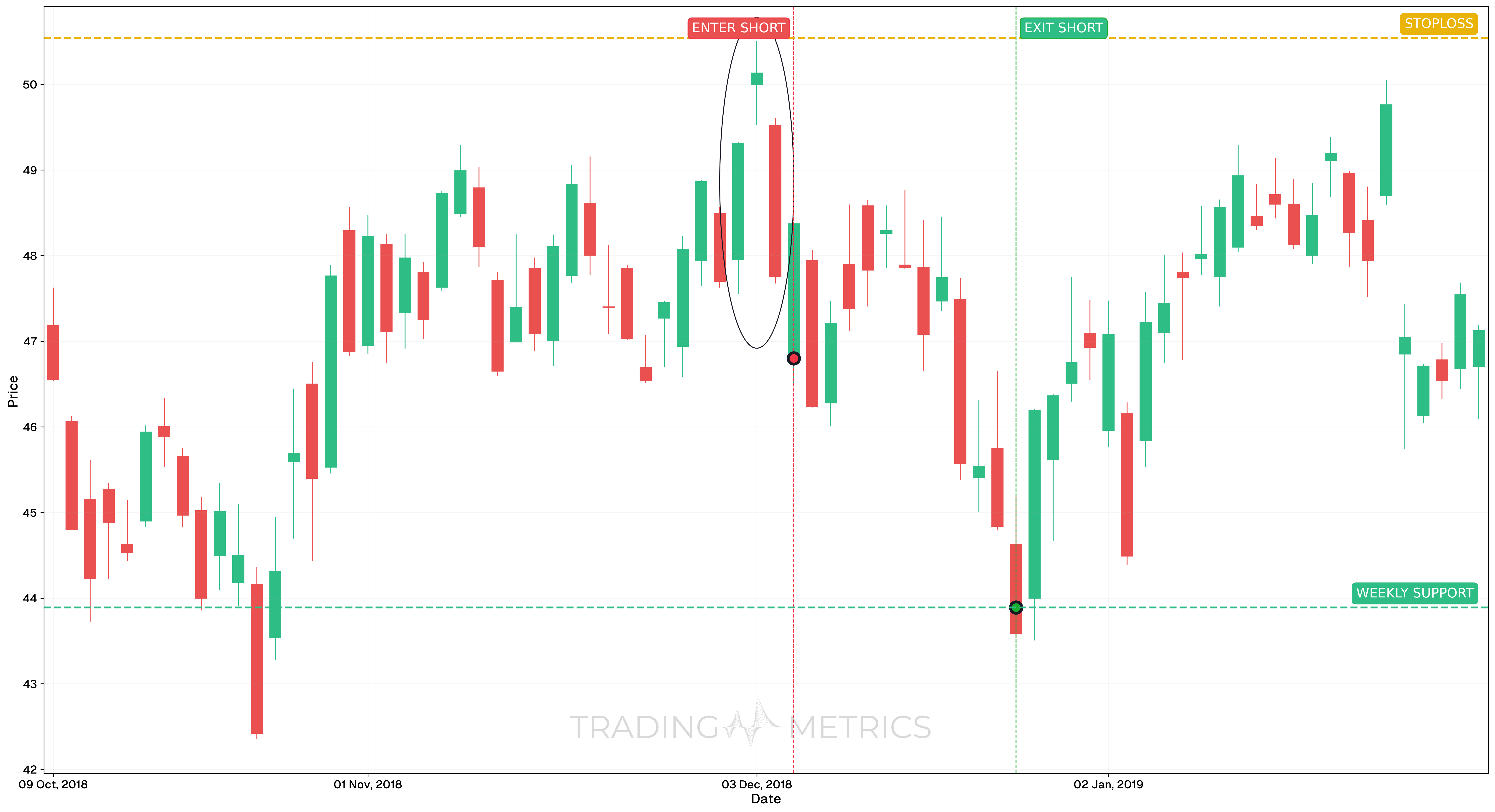

To illustrate how the Abandoned Baby (Bearish) pattern can be used to enter a trade, we will analyze the INTEL stock on the daily chart. This is a classic bearish reversal setup that occurred after a prior uptrend and signaled a momentum shift during a volatile market phase.

Analysis

On June 12, 2018, INTEL formed a well-defined Abandoned Baby (Bearish) pattern following a strong upward move. The structure consisted of a bullish candle, followed by a gapped doji, and then a bearish confirmation candle that gapped lower, indicating a sharp shift in sentiment. This setup appeared near prior resistance, hinting at a potential medium-term reversal.

Trade Setup

-

Entry: The short entry was executed on June 12, 2018, at $46.80, directly after confirmation of the Abandoned Baby (Bearish). Technical confirmation included:

-

Exit: The position was closed on December 24, 2018, at $43.89, when StochRSI crossed upward again and the price approached previous support/resistance.

-

Outcome: The trade captured a moderate retracement within a broader market context. Though not a deep breakdown, it reflected disciplined technical entry and exit using momentum cues.

Risk Management

- Stop-Loss placement: The stop-loss was placed at $50.54, just above the pattern’s high and gap zone. This protected against invalidation while respecting the pattern’s integrity.

- Position sizing: The trade followed a 2% capital risk model, scaled to account for the relatively tight stop range.

- Volatility Consideration: The trade occurred during increased volatility, particularly around macro-driven price swings. Entering only after confirmation helped avoid false breakdowns.

- Risk-Reward Ratio: This setup resulted in a modest Risk-Reward Ratio of 1:0.78, reflecting limited downside movement. Still, the structure was technically sound.

- Adaptive Exit Strategy: Exiting when StochRSI reversed helped preserve gains and avoid Drawdown in a volatile range-bound environment.

Volume Plunge: A volume spike on the third candle plunges the pattern into a bearish drop, sealing the reversal’s strength.

Pre-Trade Checklist

Plunge the Proof: Pair the pattern with volume surges and indicators like RSI to dodge fakes and boost your odds.

Key Points

- Gap Isolation: Distinct gaps before and after the Doji boost reliability - overlaps dilute it.

- Time Frame: Plunges deepest on daily or weekly charts after uptrends.

- Combine with Indicators: Use moving averages or RSI to confirm the reversal.

- Breakout Confirmation: A strong bearish close below the Doji’s low confirms the reversal. The third candle must show clear downside strength

- Price Target: Measure the Doji-to-third-candle drop or use support levels for a target below the close.

- Risk Management: Set a stop-loss above the Doji’s high to limit losses if it fails.

Wait for the Plunge: Acting before the third candle confirms risks an abandoned trap - let the reversal drop.

Conclusion

The Bearish Abandoned Baby pattern is a trader’s rare and potent tool for catching bearish reversals. Its forsaken gaps, paired with volume, RSI, and moving averages, can plunge into big gains. Whether in crypto, stocks, or forex, this pattern sharpens your edge. Stay vigilant, manage your risk, and let the abandonment settle - that isolated Doji could drop into a winning trade.