Special Candlestick Patterns

Special candlestick patterns highlight unique market behaviors that reveal shifts in trend strength, momentum, or indecision. Recognizing these setups can help traders anticipate potential breakouts, reversals, or trend continuations with greater confidence.

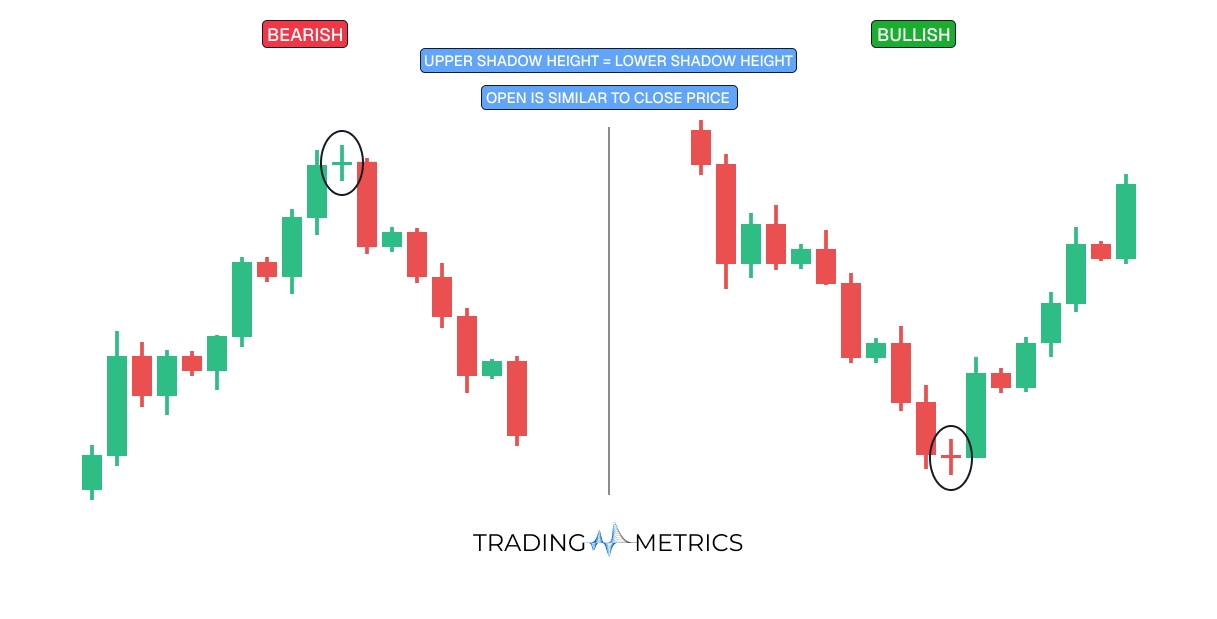

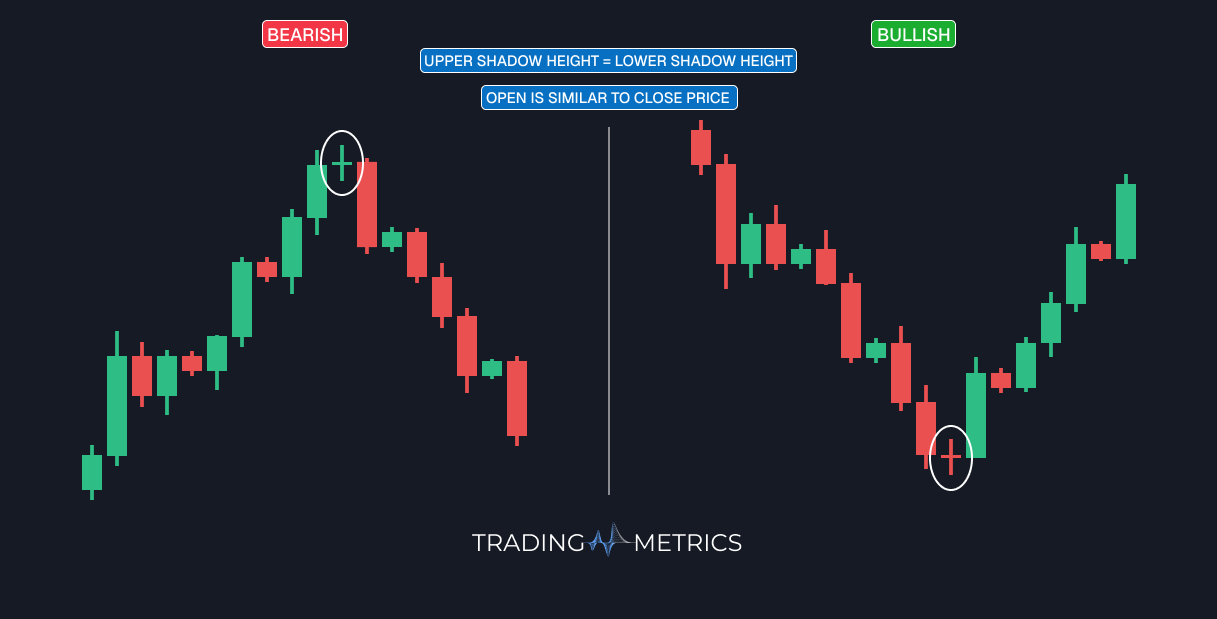

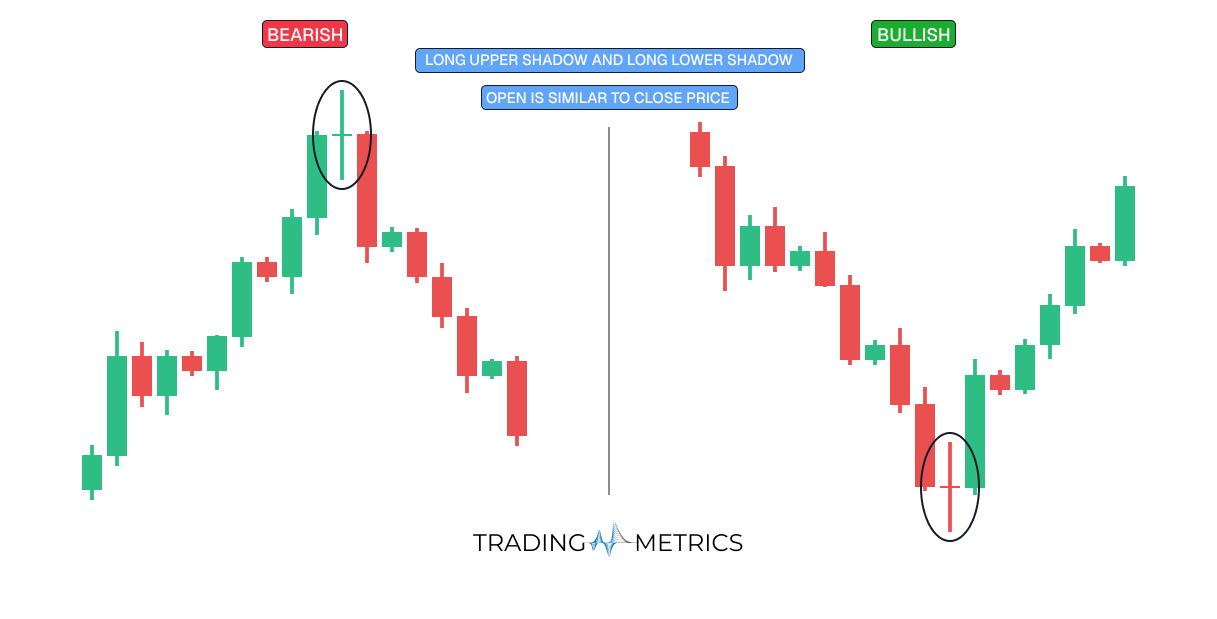

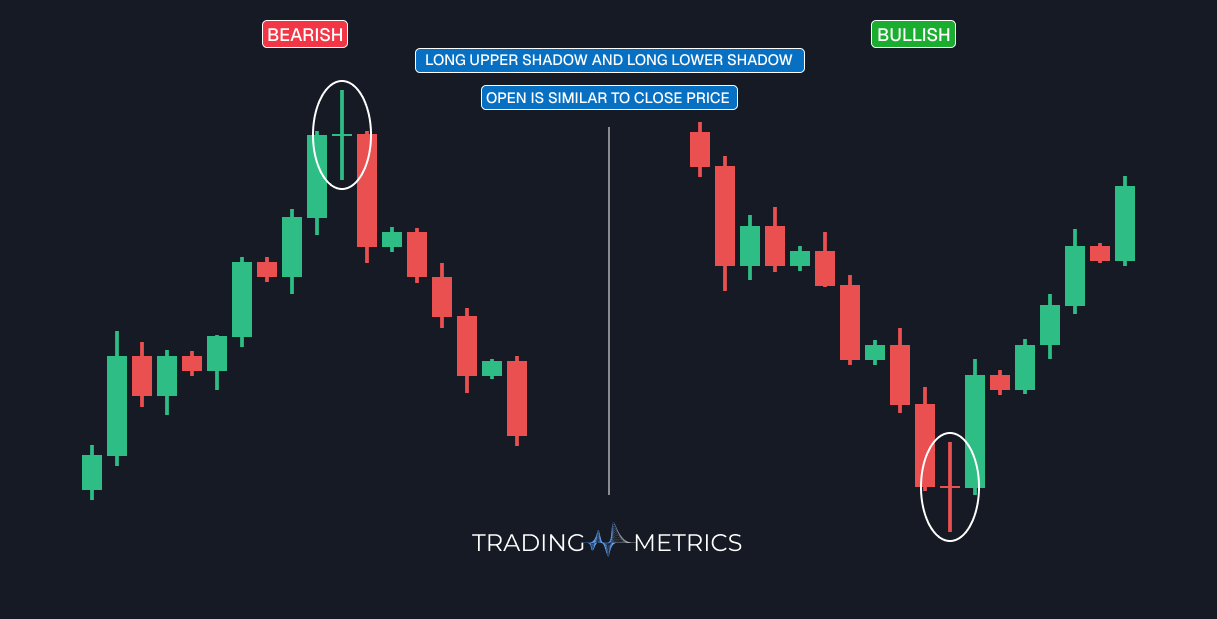

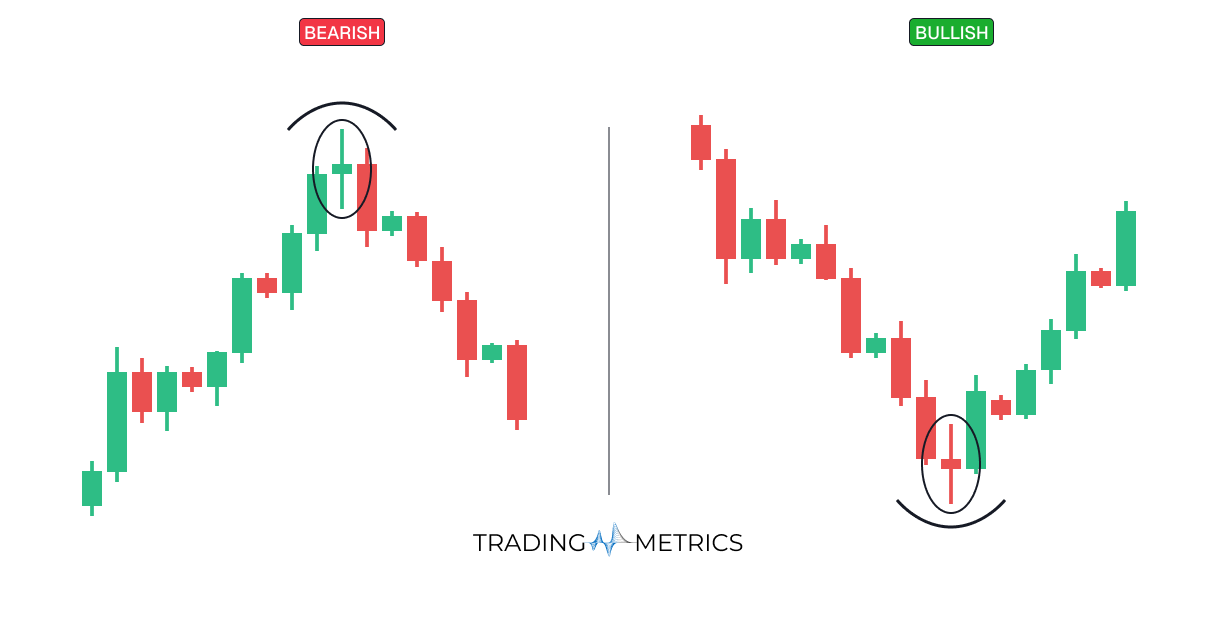

Neutral Candlestick Patterns

Neutral candlestick patterns reflect market indecision, where neither buyers nor sellers hold a clear advantage. These formations often appear during consolidation phases or near significant support and resistance zones. While they don’t strongly signal direction, they can indicate potential breakouts or trend pauses.

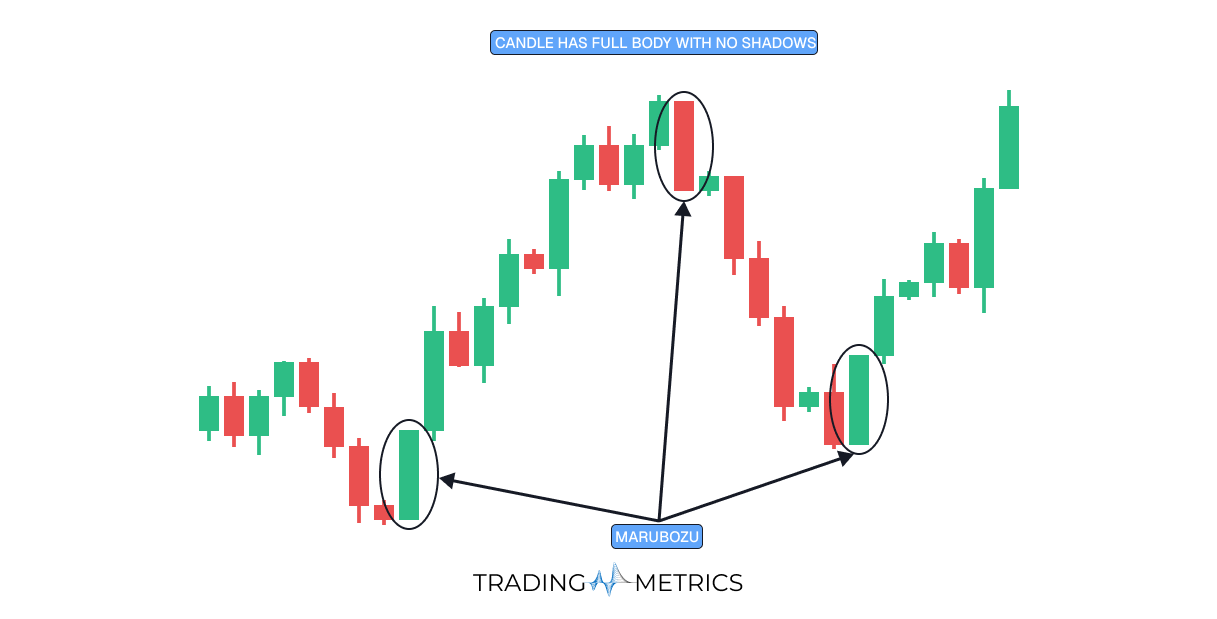

Momentum Candlestick Patterns

Momentum candlestick patterns reveal strong market conviction, where either buyers or sellers dominate price action. These patterns often appear at the start of powerful trends, signaling potential continuation and intensity of movement.

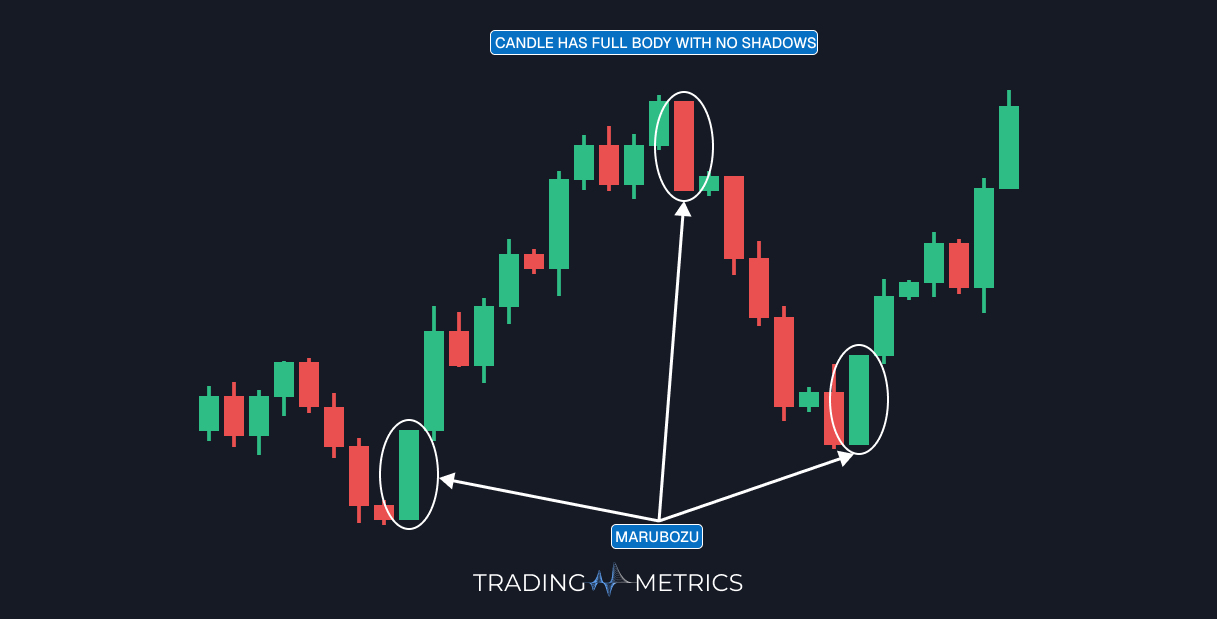

The Marubozu is a prime example of a momentum candlestick pattern. With no shadows (wicks) on either end, it reflects pure buying or selling pressure, suggesting strong directional momentum without hesitation.