Average Directional Index (ADX)

The Average Directional Index (ADX) is a technical analysis indicator used to measure the strength and direction of a trend. Developed by J. Welles Wilder, ADX helps traders assess whether a market is trending or not. Unlike other indicators that might only show the direction of the price movement, ADX focuses on the strength of the trend, which can be crucial for making informed trading decisions.

The trend is your friend, but the ADX tells you how strong that friend is.

- Anonymous

How to Use the Average Directional Index (ADX)?

ADX is part of a system that includes the Plus Directional Indicator (+DI) and the Minus Directional Indicator (-DI). Here’s a short guide on how to use it:

- Calculate the +DI and -DI: These indicate the strength of upward and downward movements respectively.

- Calculate the ADX: It’s derived from the difference between +DI and -DI, smoothed over a certain period (usually 14 days).

Understand Trend Strength: ADX values above 25 suggest a strong trend, while values below 20 indicate a weak or ranging market.

How to Calculate ADX?

To calculate the ADX, follow these steps:

Calculate the True Range (TR)

Where:

- The current high minus the current low

- The absolute value of the current high minus the previous close

- The absolute value of the current low minus the previous close

Calculate the Directional Movement (+DM and -DM)

Positive Directional Movement (+DM)

| Step | Details |

|---|---|

Calculate | Current High - Previous High |

Compare | Is Current High - Previous High greater than Previous Low - Current Low? |

If Yes | Use the value Current High - Previous High |

If No | The result is 0 |

Negative Directional Movement (-DM)

| Step | Details |

|---|---|

Calculate | Previous Low - Current Low |

Compare | Is Previous Low - Current Low greater than Current High - Previous High? |

If Yes | Use the value Previous Low - Current Low |

If No | The result is 0 |

Calculate the Smoothed True Range (ATR), +DI, and -DI

Average True Range (ATR):

Positive Directional Indicator (+DI):

Negative Directional Indicator (-DI):

Calculate the Directional Index (DX)

Calculate the Average Directional Index (ADX)

Importance of ADX in Trading

The Average Directional Index (ADX) is a vital tool in trading, as it measures the strength of a trend, helping traders determine whether to follow or avoid trend-based strategies. A high ADX value indicates a strong trend, signaling potential opportunities, while a low value suggests a range-bound market where other strategies like mean reversion might be more effective. By filtering trades based on trend strength, ADX enhances decision-making and reduces the likelihood of false signals, improving overall trading efficiency.

Avoid trend traps: A rising ADX doesn’t mean the price is trending upward - it just shows the trend is strengthening, regardless of direction.

Decoding the ADX: A Trend Strength Compass

When you’re navigating the treacherous seas of trading, the ADX serves as your compass, pointing you towards the strength of a trend. Let’s break down how traders interpret ADX values and turn these numbers into actionable insights, complete with colorful analogies to make it more interesting!

0-25: The Desert of Weak Trends

Imagine you’re an explorer in a vast desert. The ADX value between 0 and 25 signifies a weak trend, akin to the mirage you see in the distance. It’s a market where price movement is as flat as the desert sand, offering little direction or momentum.

Ethereum’s ADX is at 20. The market is moving sideways, much like our desert scenario. You notice small price fluctuations but nothing significant. It’s a time to conserve your energy, perhaps trading within a narrow range or simply observing.

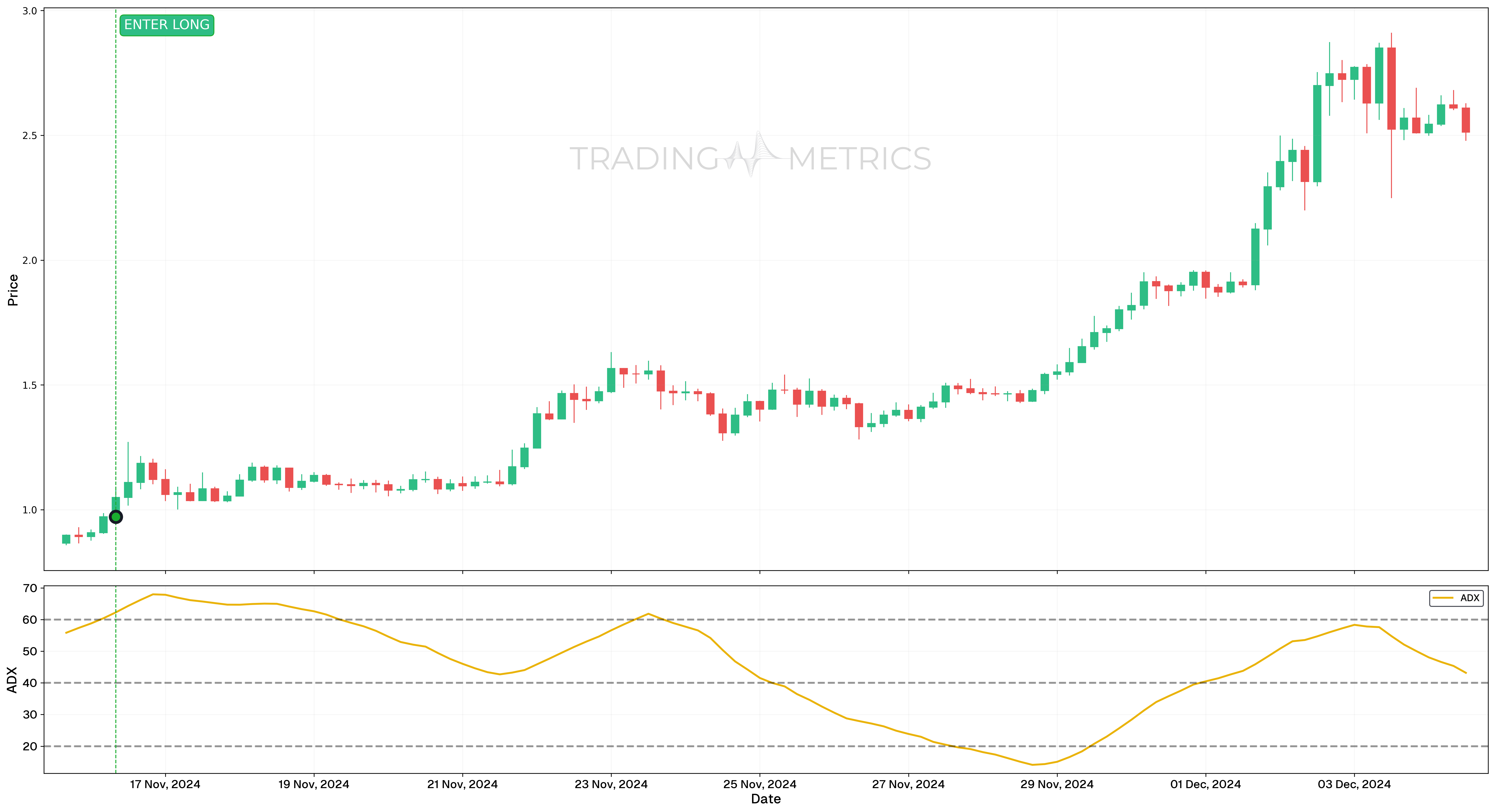

In the above chart, when the ADX hovers around 20, the market shows little trend strength. This period suggests minimal trading activity or adopting range-bound strategies.

Trading Tip: In this environment, it’s best to stay flat in money and avoid making big moves. Focus on short-term trades or wait for a clearer trend to emerge.

25-50: The Rolling Hills of Strong Trends

As the ADX climbs to the 25-50 range, picture yourself entering rolling hills. The market is starting to show direction, and trends are becoming more apparent, like the gentle slopes guiding your path.

Bitcoin’s ADX rises to 30. The cryptocurrency shows a clear upward trend, like those gentle hills guiding your journey. You decide to go long, using a moving average crossover as your entry signal. As the trend strengthens, you ride the wave, keeping an eye on your stop losses.

When the ADX crosses above 30, it confirms a strong trend. Here, you can see the Bitcoin price rising, and entering a long position would be beneficial.

Trading Tip: This is a good time to consider entering trades in the direction of the trend. Use other indicators to confirm your entry points and ride the gentle waves of the market.

50-75: The Rocky Mountains of Very Strong Trends

With ADX values between 50 and 75, you’re now in the majestic Rocky Mountains. The trends are robust, and the market shows strong momentum, much like the towering peaks that dominate the landscape.

Ripple’s ADX hits 60, indicating a very strong trend. The market is moving decisively, and you jump in, going long on XRP. You set wider stop losses, understanding the trend’s strength might lead to significant price swings. The climb is steep, but the rewards are great.

An ADX value of 60 signifies a very strong trend. The Ripple market shows decisive movement, suitable for traders looking to capitalize on strong momentum.

Trading Tip: This is prime territory for trend-following strategies. Position yourself in the direction of the trend, but be mindful of the altitude. Set wider stop losses to accommodate the strong price movements and avoid getting stopped out prematurely.

75-100: The Volcanic Eruption of Extremely Strong Trends

Finally, when ADX values soar to 75-100, you’re witnessing a volcanic eruption. The market is explosive, with trends so powerful they can reshape the landscape in an instant.

Trading Tip: Handle with care! While the potential for profit is high, so is the risk. Ensure your risk management strategies are solid. It might be wise to take profits incrementally as the trend moves in your favor.

These examples, backed by real data, demonstrate how the ADX can be a powerful tool in identifying and confirming trends, helping traders make more informed decisions.

Combining ADX with Other Tools

ADX works well with other indicators to provide a more comprehensive analysis:

- Moving Averages: Confirm trend direction.

- Relative Strength Index (RSI): Determine overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): Identify potential buy/sell signals.

Watch for reversals: Declining ADX from high levels can signal trend exhaustion or a potential reversal.

Key Points

- Trend Strength Indicator: The Average Directional Index (ADX) measures the strength of a trend, regardless of its direction, on a scale from 0 to 100.

- ADX below 20 indicates a weak or no trend (range-bound market).

- ADX above 25 suggests a strong trend is present.

- Directional Components: ADX is often used alongside the +DI (Positive Directional Indicator) and -DI (Negative Directional Indicator) to assess trend direction and strength.

- Trend Confirmation: Increasing ADX values confirm that the trend is gaining strength, while decreasing values suggest weakening momentum.

- Works Across Markets: ADX is versatile and can be applied to any market or time frame, making it useful for both short-term and long-term traders.

- Combination with Other Tools: Use ADX with trend-following indicators, such as moving averages or RSI, to confirm entry and exit points.

- Avoid Choppy Markets: In low ADX environments, avoid trend-following strategies as they are less effective in range-bound conditions.

- Customizable Settings: The default period for ADX is 14, but traders can adjust this to make the indicator more responsive or stable based on the asset’s volatility.

- No Directional Bias: ADX measures trend strength only and does not indicate whether the trend is bullish or bearish.

- Backtesting and Monitoring: Regularly backtest ADX-based strategies and monitor live trading performance to optimize its use for specific market conditions.

Conclusion

The ADX is a powerful tool for measuring trend strength and can significantly enhance trading strategies. By identifying the strength of a trend, traders can make more informed decisions on entry and exit points, set appropriate stop losses, and avoid choppy markets. In summary, the ADX is a valuable indicator for traders seeking to understand market trends. By combining it with other tools and paying attention to its signals, traders can improve their trading outcomes and avoid common pitfalls. Whether trading stocks or cryptocurrencies, incorporating ADX into your analysis can provide a clearer picture of market conditions and enhance your trading strategy.