Bullish Candlestick Patterns

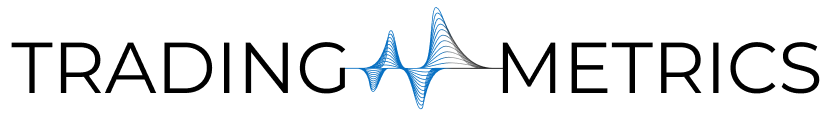

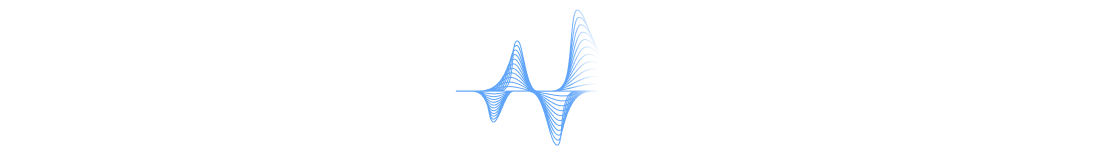

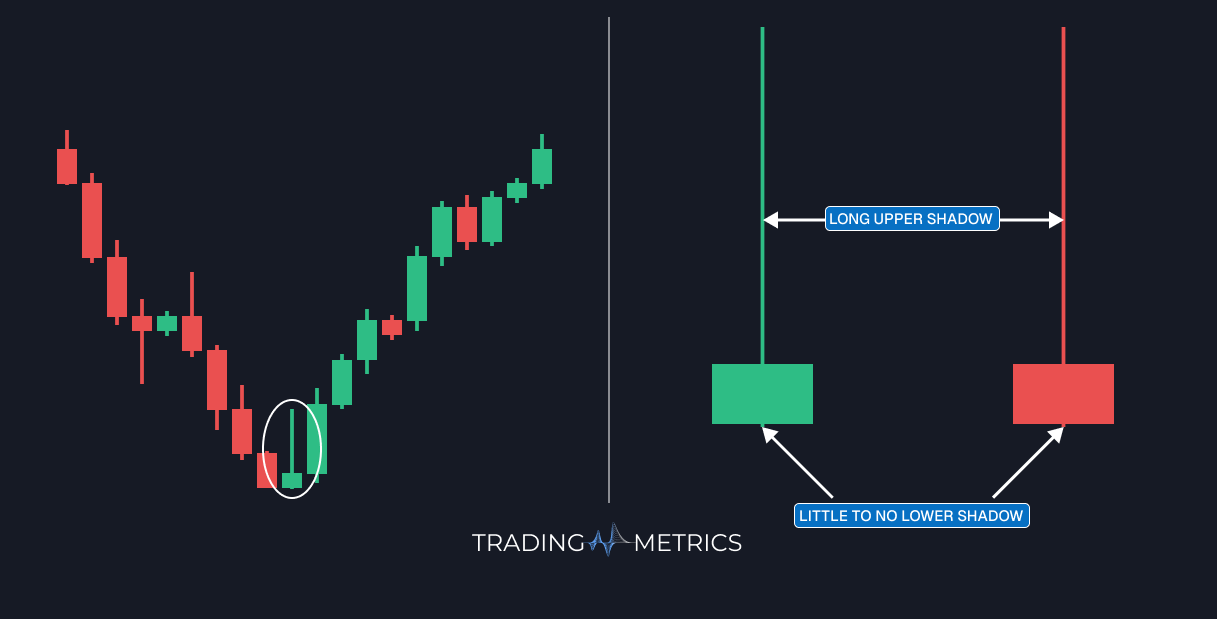

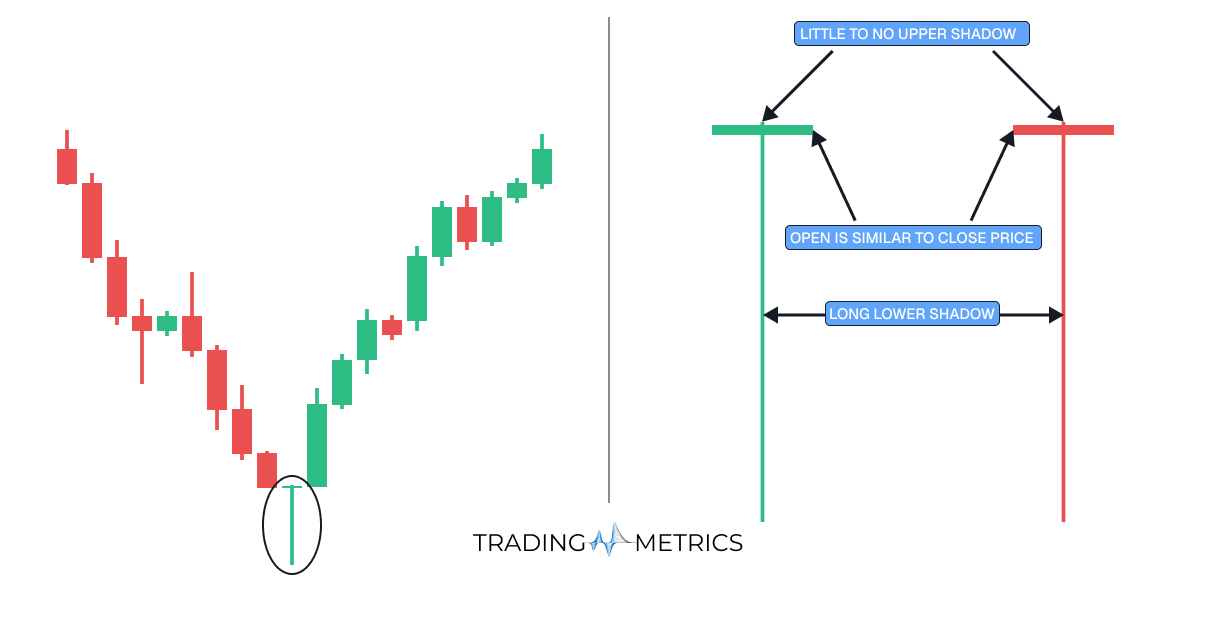

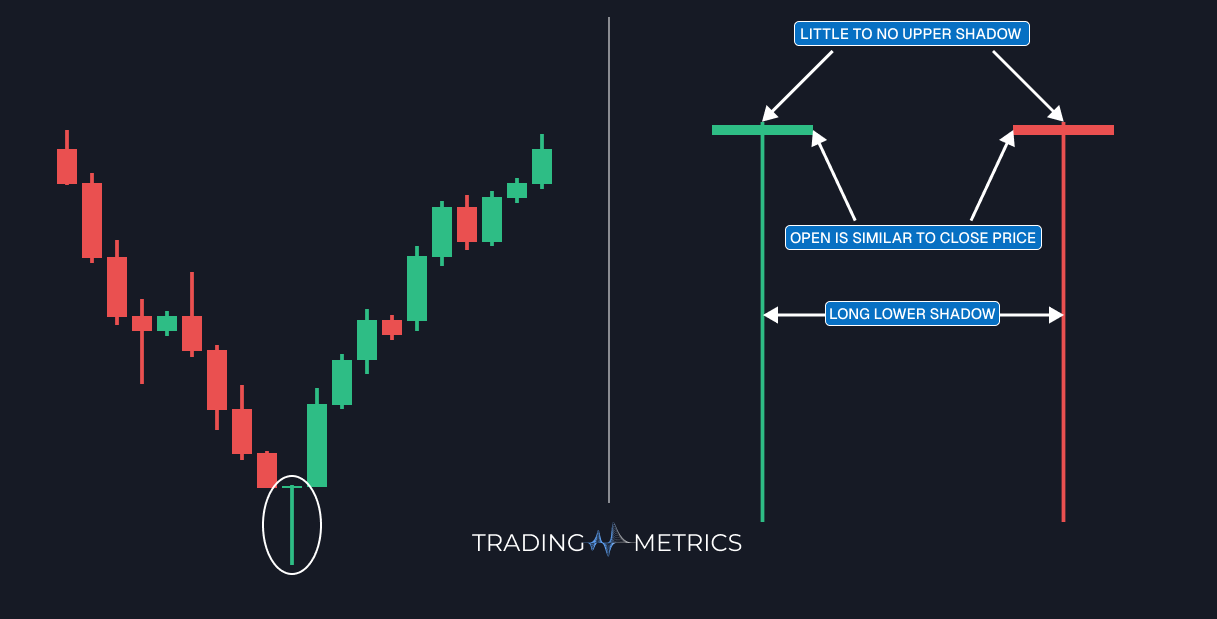

Bullish Single Candlestick Patterns

Bullish single candlestick patterns are technical signals indicating potential reversals from bearish to bullish market conditions. These patterns typically form at the end of downward trends, highlighting weakening bearish momentum and providing opportunities for entering long positions or closing shorts.

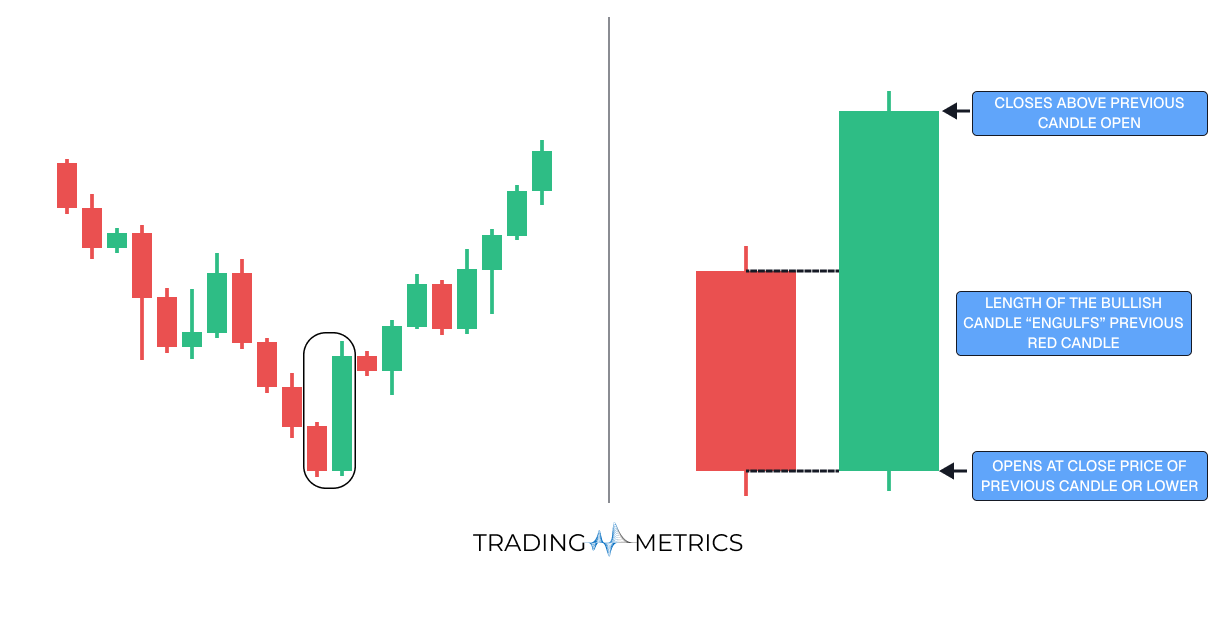

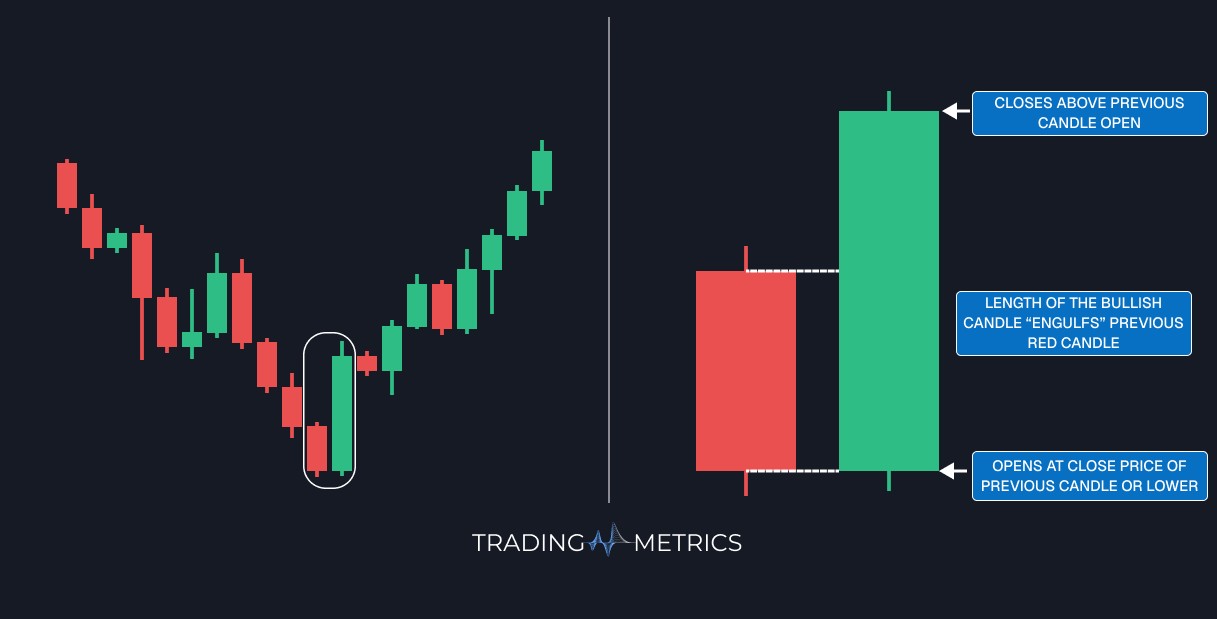

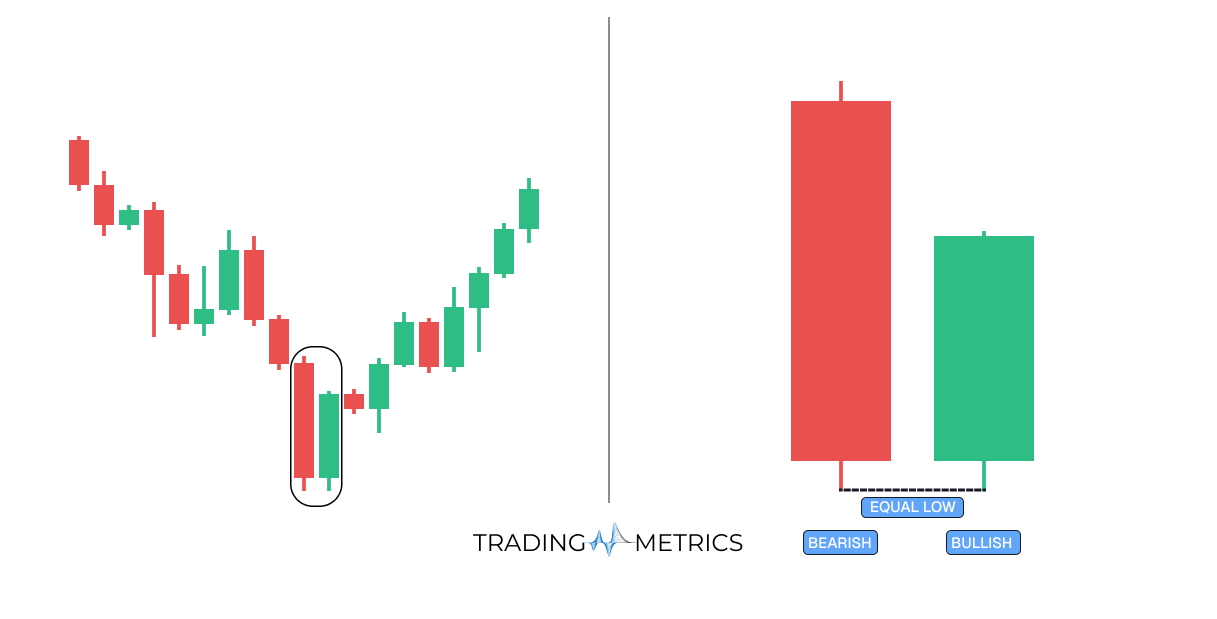

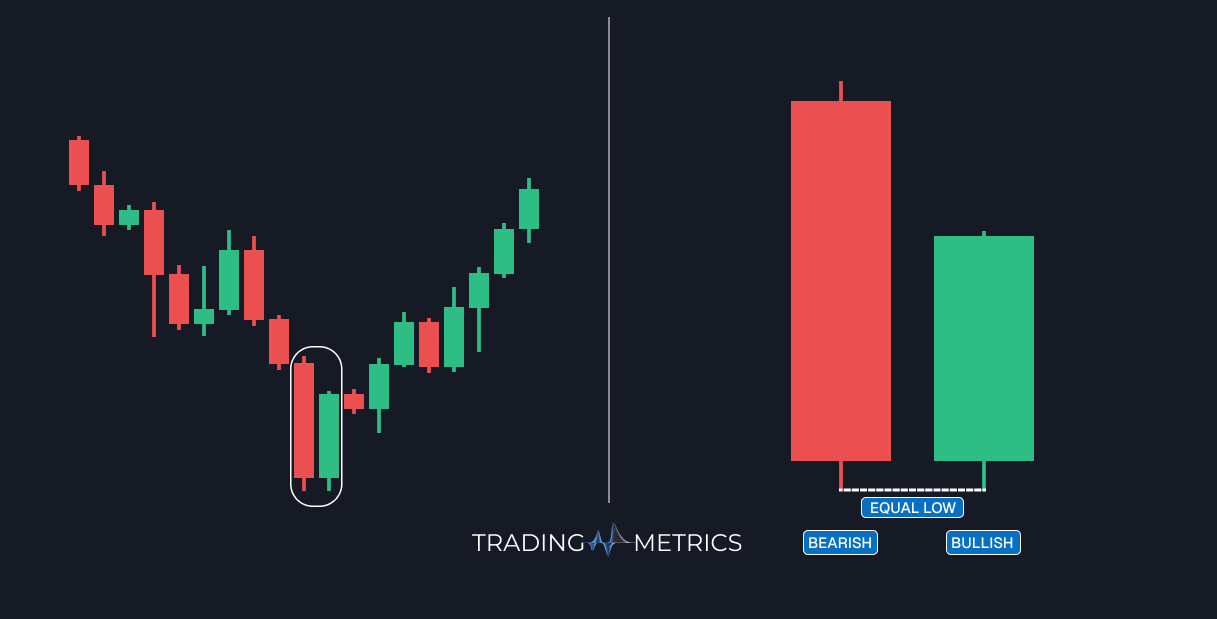

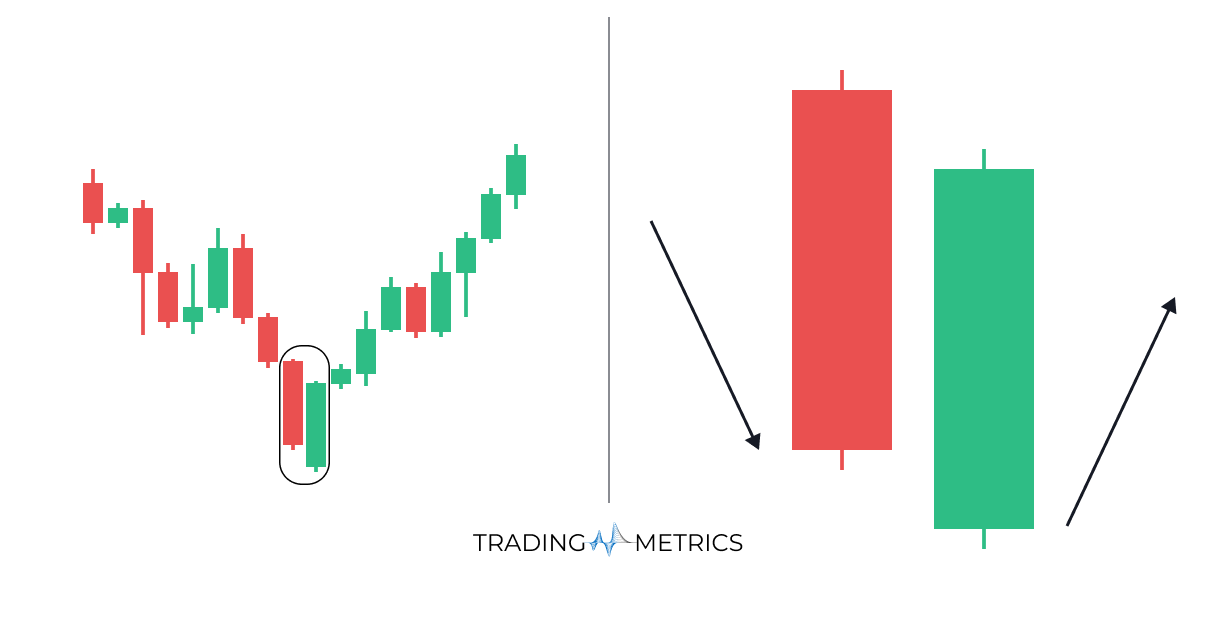

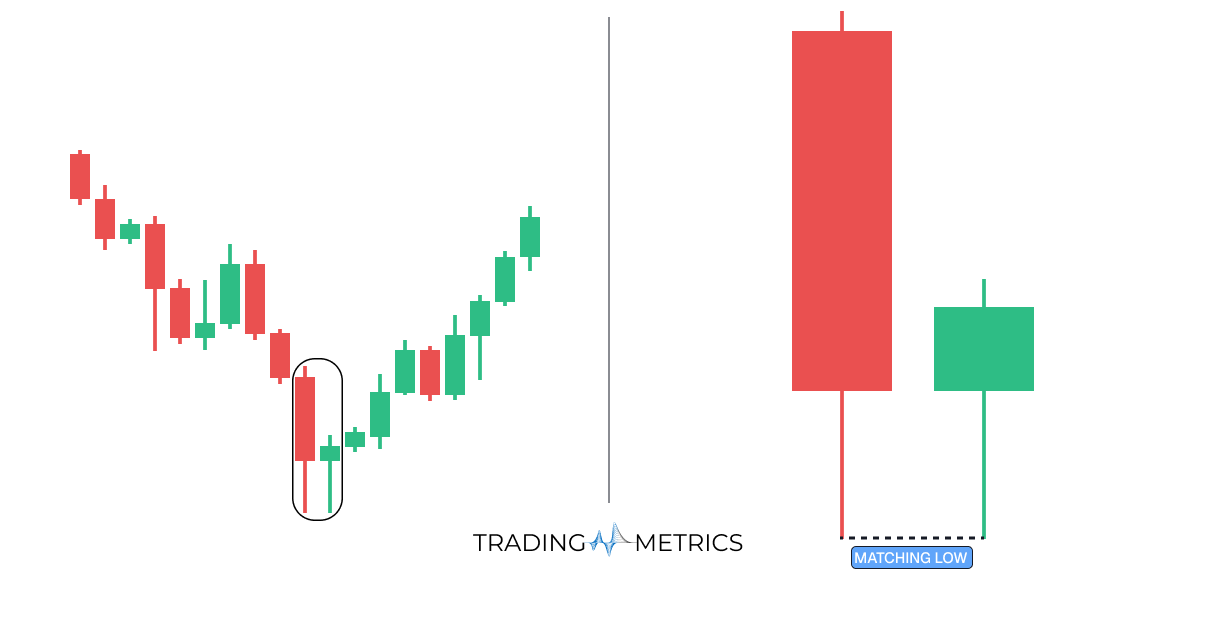

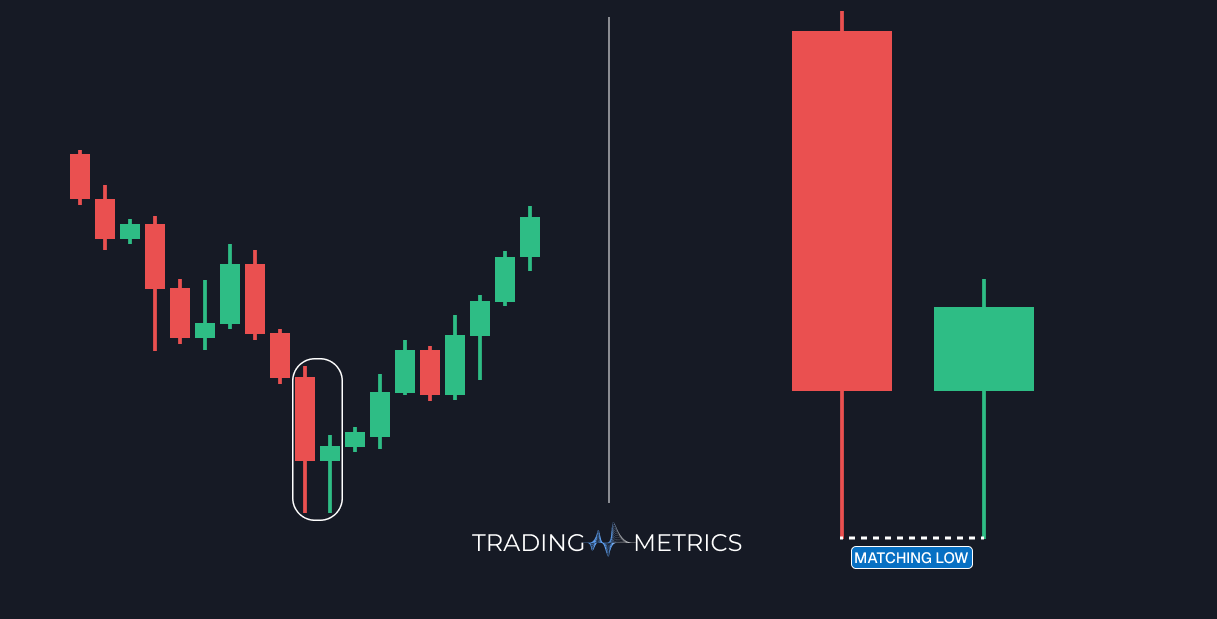

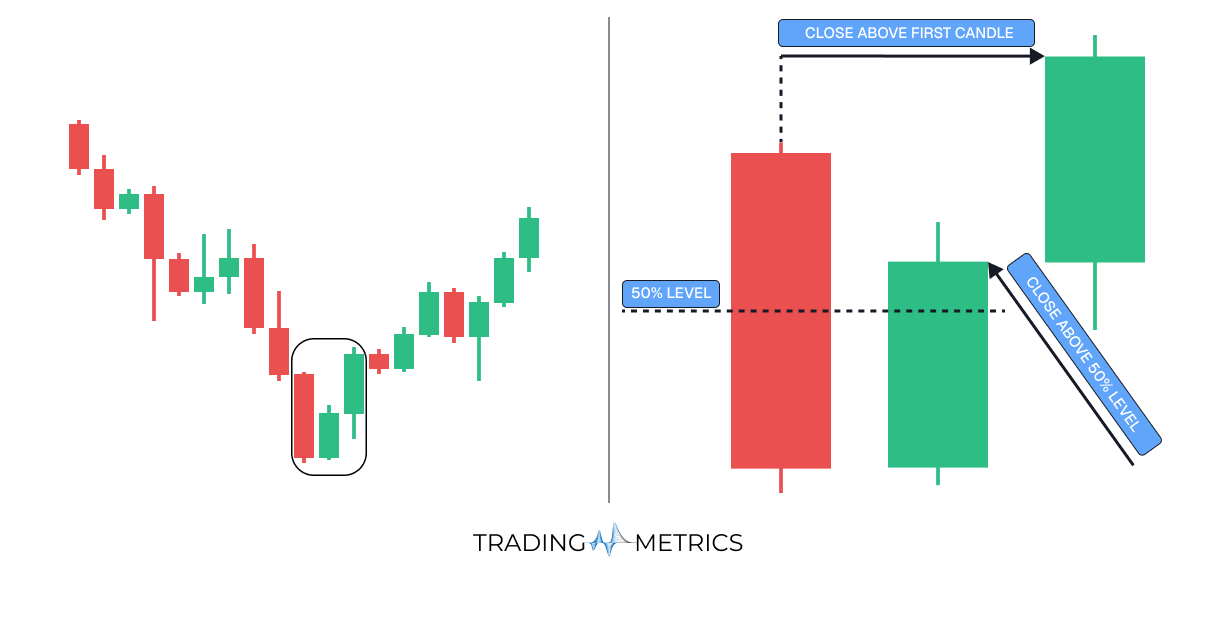

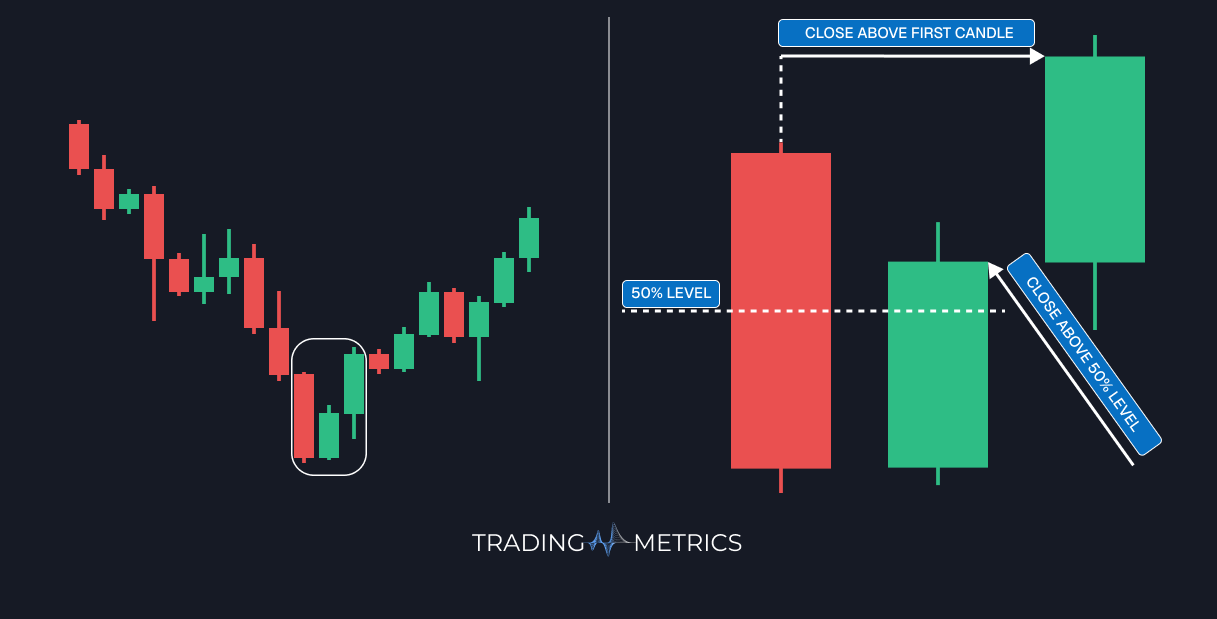

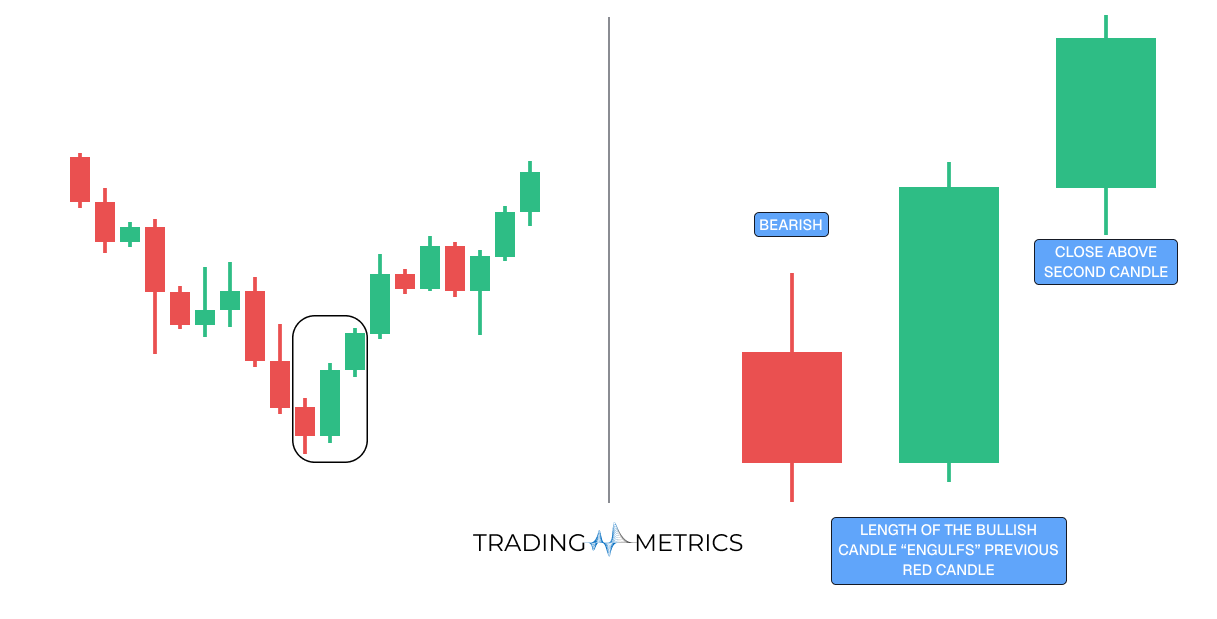

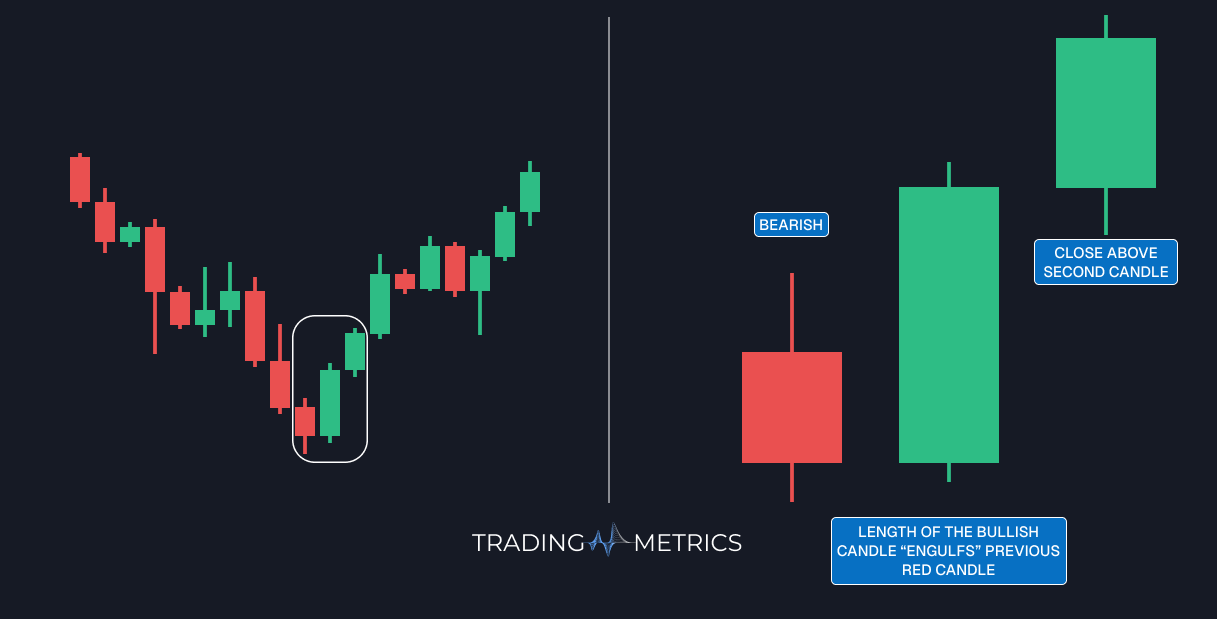

Bullish Double Candlestick Patterns

Bullish double candlestick patterns are technical signals indicating potential reversals from bearish to bullish market conditions. These patterns typically appear at the end of downward trends, consisting of two candlest Wicks that together suggest a surge in bullish momentum and the possibility of an upward shift. They provide traders with opportunities to consider entering long positions or closing short positions based on the strengthening upward trend.

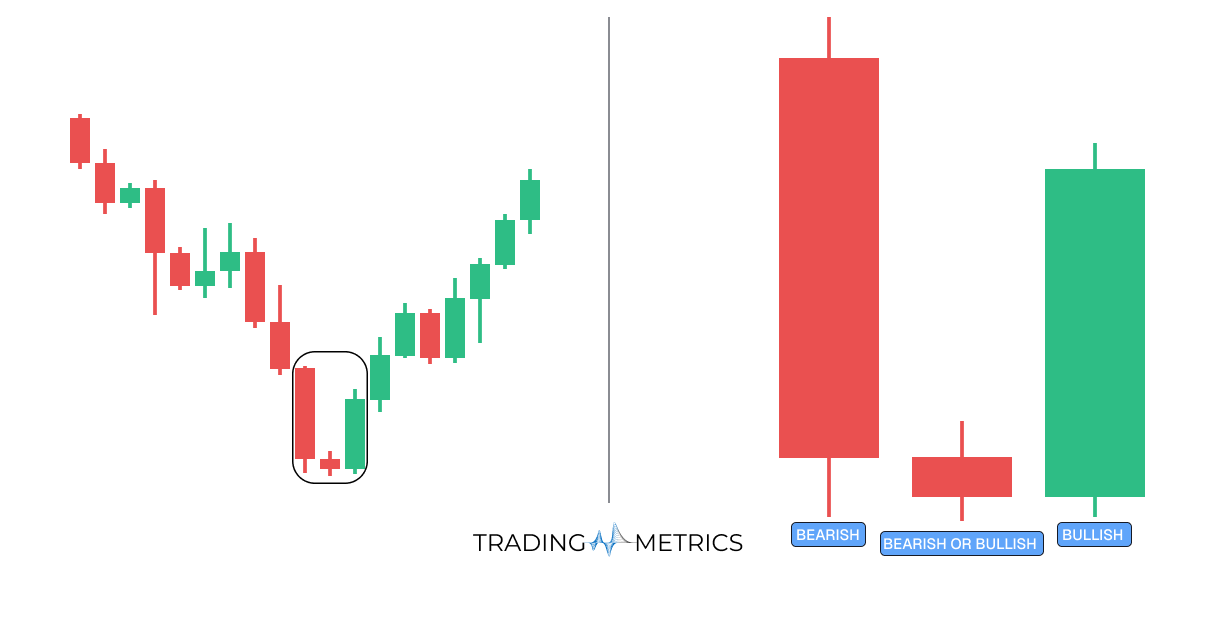

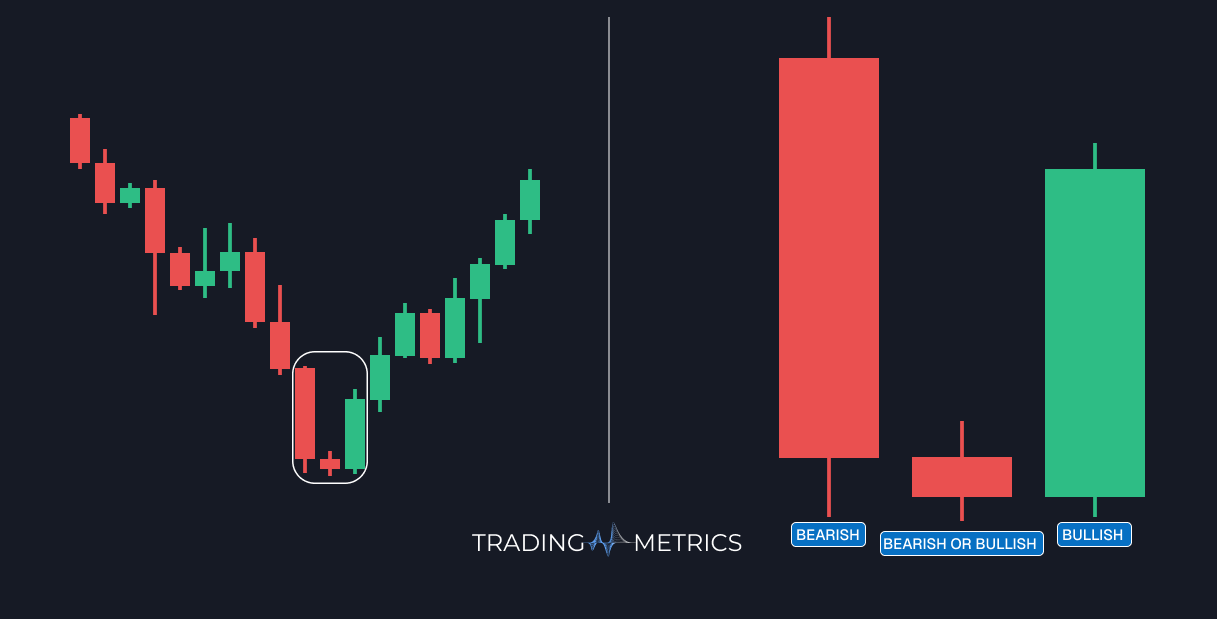

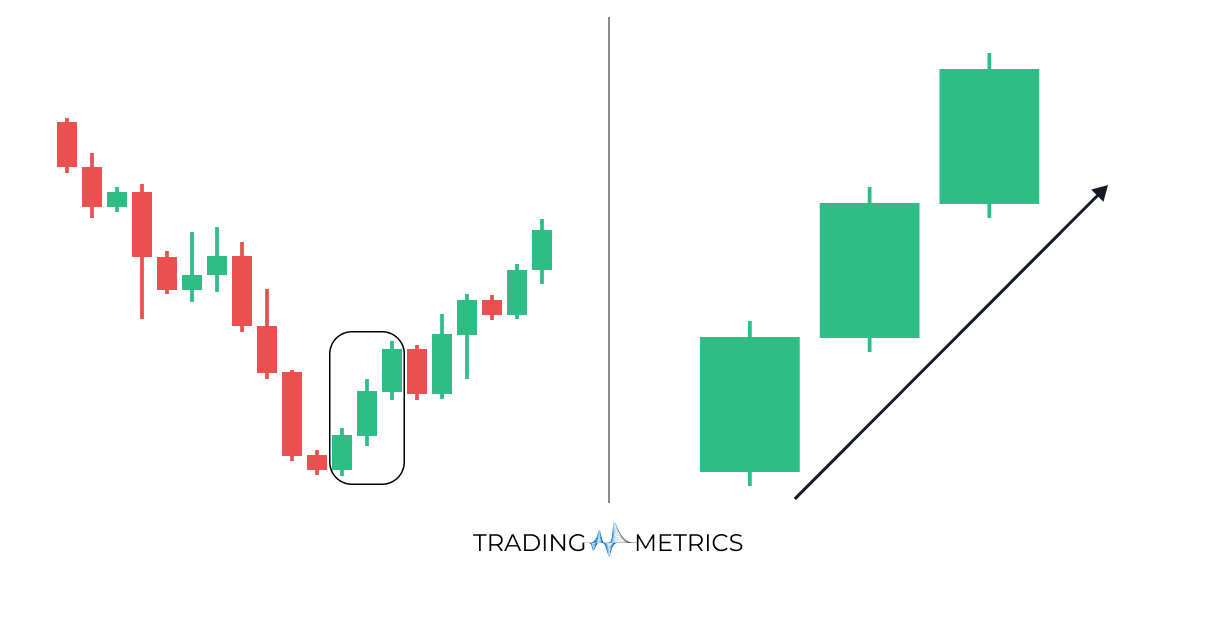

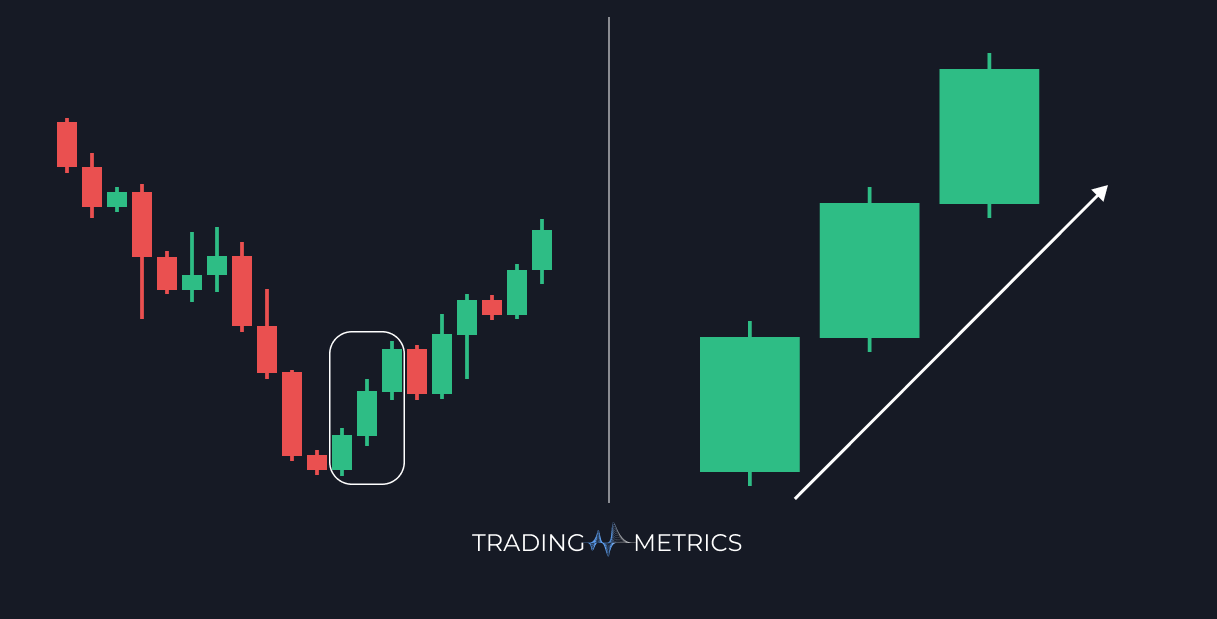

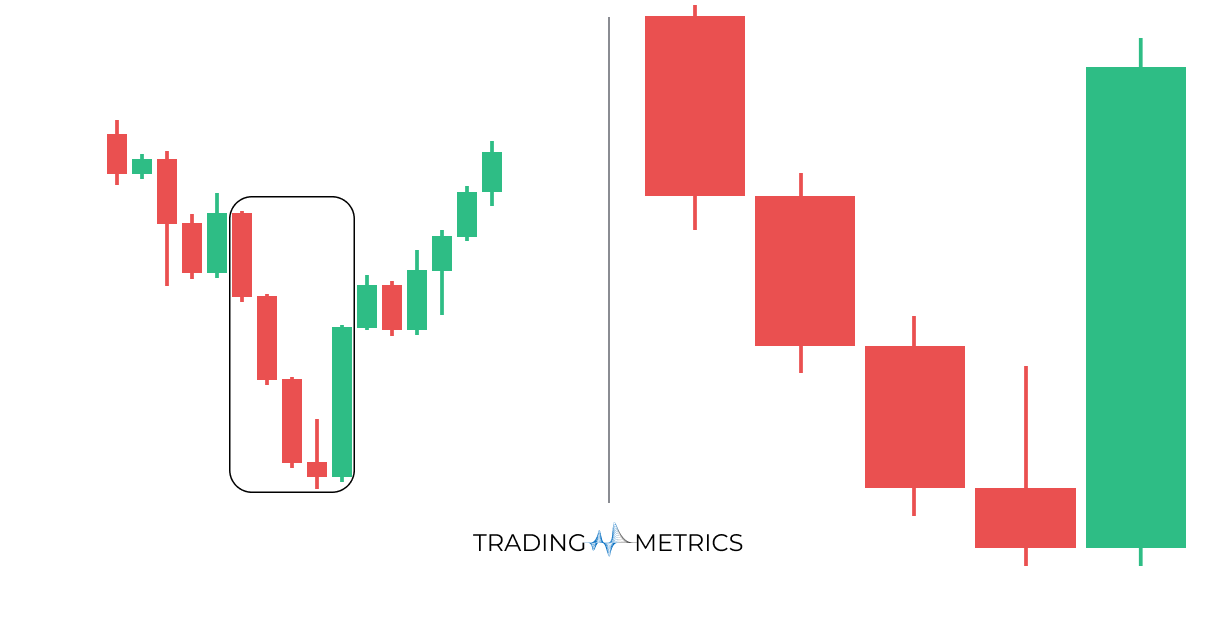

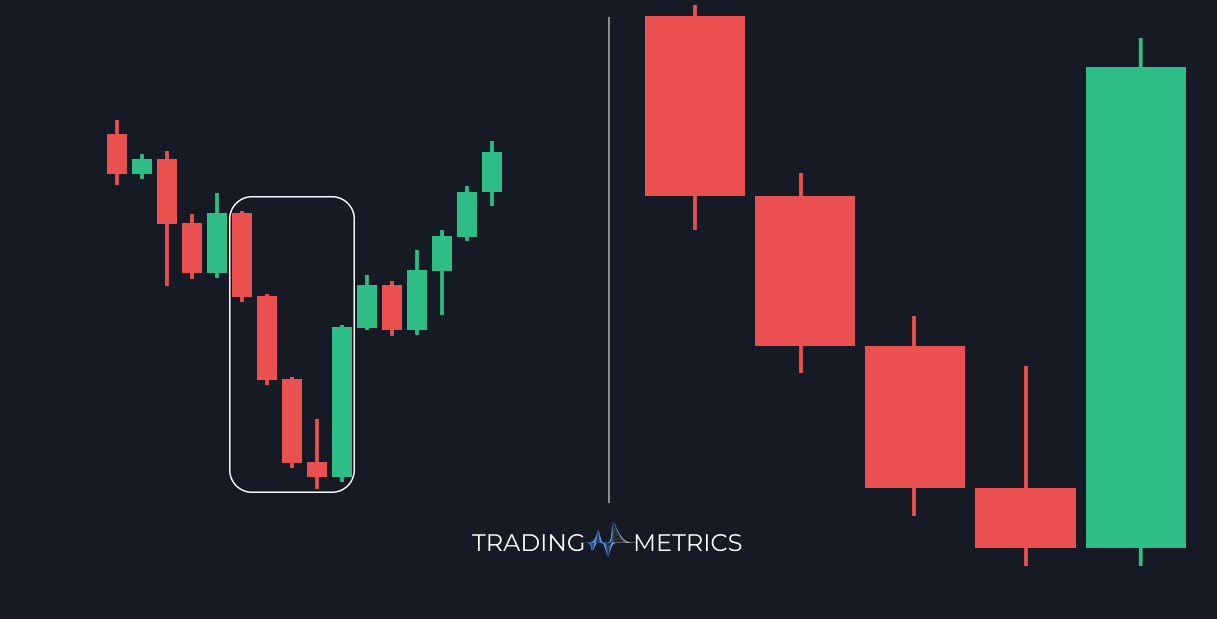

Bullish Triple Candlestick Patterns

Bullish triple candlestick patterns are technical signals indicating potential reversals from bearish to bullish market conditions. These patterns typically emerge at the end of downward trends, consisting of three candlesticks that together suggest a decline in bearish momentum and the possibility of an upward shift. They provide traders with opportunities to consider entering long positions or exiting short positions based on the strengthening upward trend.

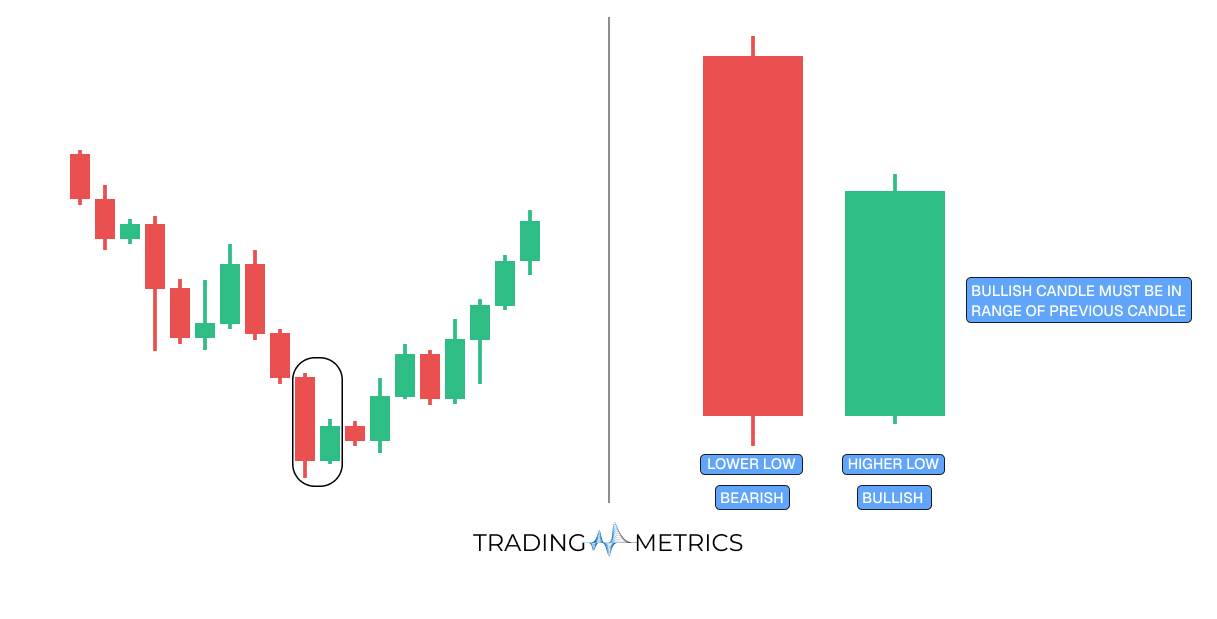

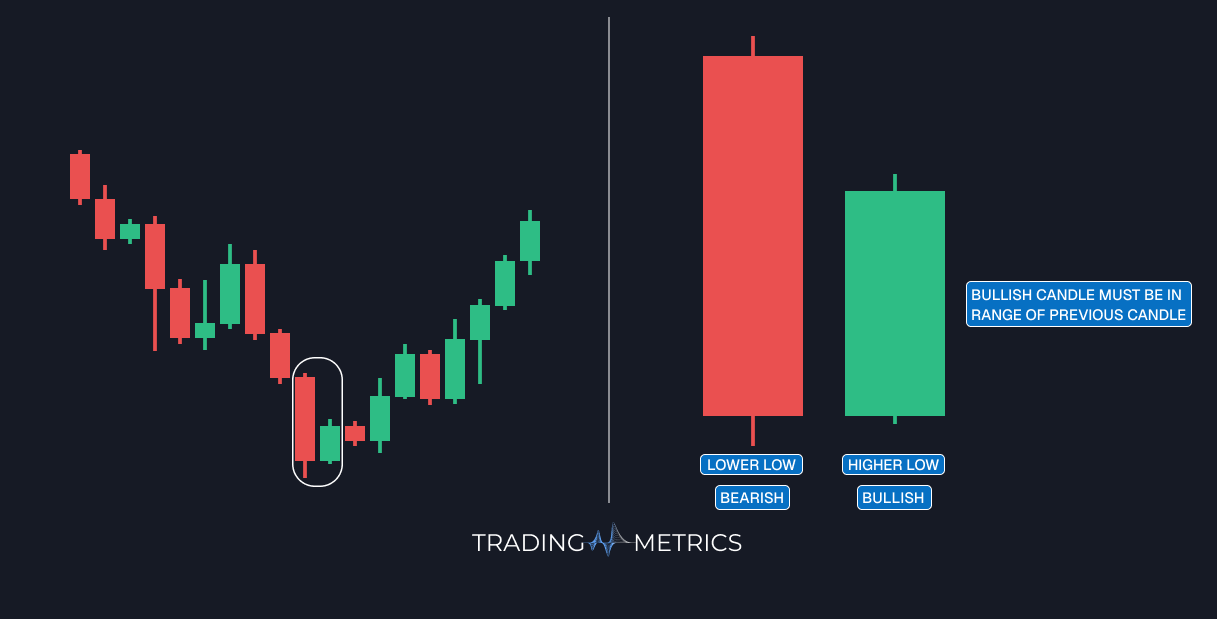

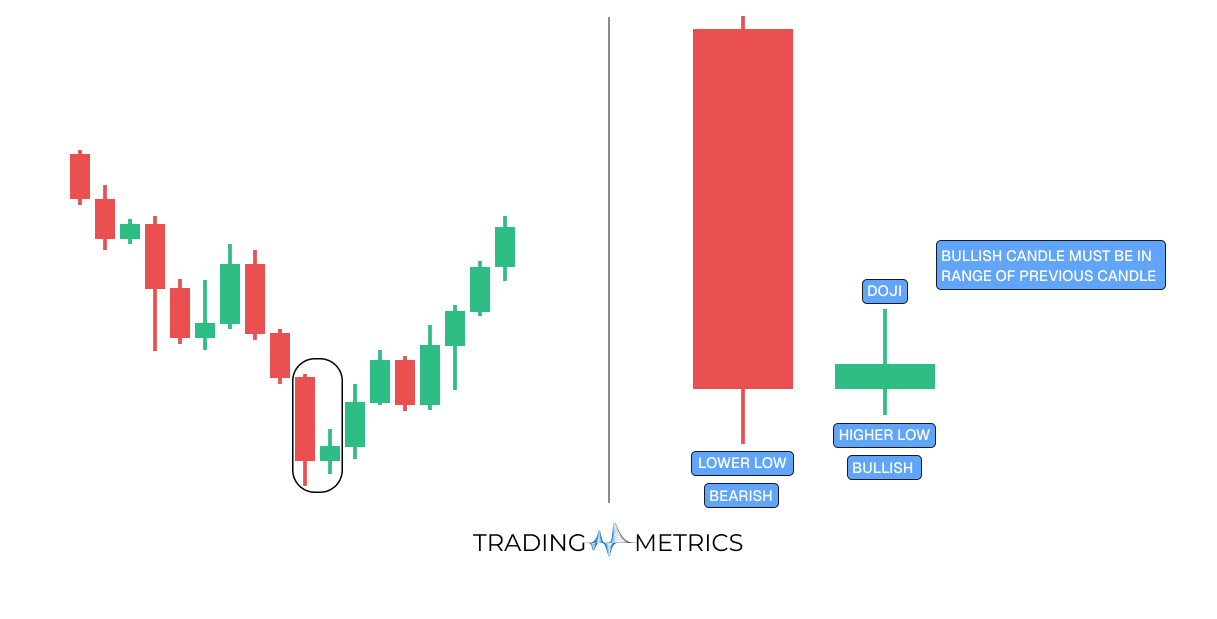

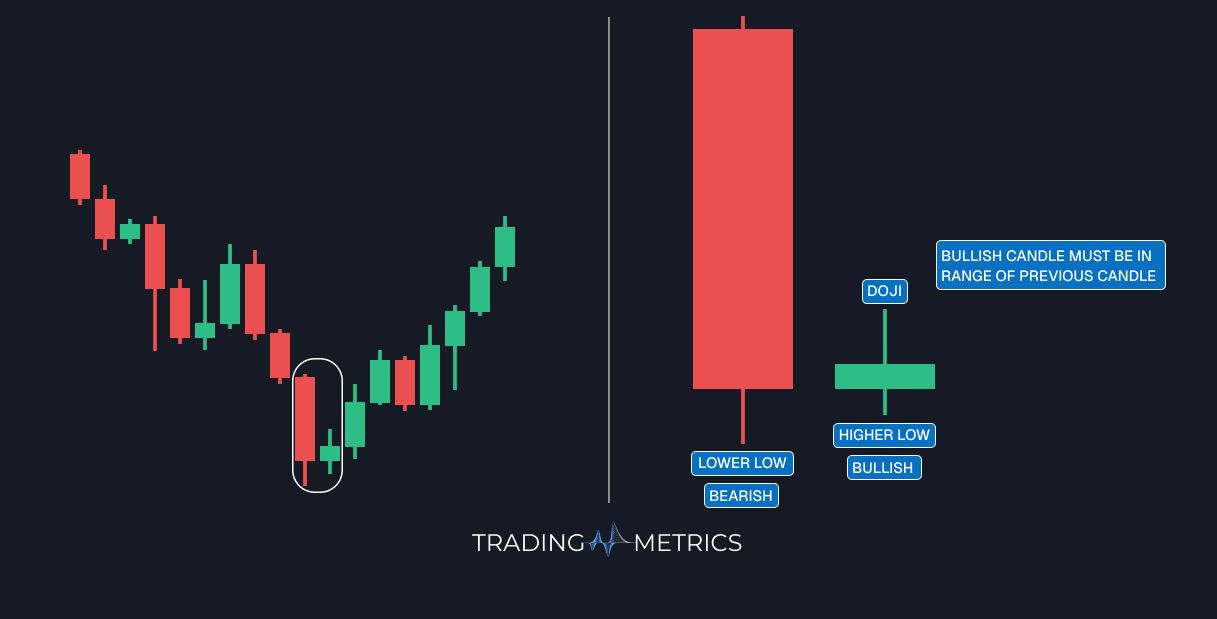

Bullish Multiple Candlestick Patterns

Bullish multiple candlestick patterns are chart formations that indicate a potential shift from bearish to bullish momentum. Unlike single or double candlestick signals, these patterns rely on the interaction of three or more candles, providing stronger confirmation of a possible trend reversal or continuation. They typically appear after a downtrend and signal that buying pressure is increasing while selling pressure is weakening. Traders often view these setups as opportunities to initiate long positions or close existing shorts with greater confidence. By analyzing multiple candlestick structures, traders gain deeper insight into market sentiment, improving the accuracy of trade entries and exits in anticipation of a bullish move.