Monthly Return

Monthly Return provides a clear snapshot of an investment’s performance over a single month. It measures the percentage change in value from the start to the end of the month, offering investors and traders a quick, easy way to gauge short-term progress and assess how their investment is performing.

Building wealth is a marathon, not a sprint.

- Dave Ramsey

How to Calculate Monthly Return?

The formula to calculate the monthly return is fairly straightforward:

Where:

- Ending Value is the price of the asset at the end of the month.

- Beginning Value is the price of the asset at the start of the month.

A steady 2% monthly return compounds to over 26% annually slow and steady wins the trading race!

Importance of Monthly Return in Trading

Monthly returns play a crucial role in trading by offering valuable insights into performance, risk management, and decision-making. They enable traders to track their progress over time, allowing them to evaluate their strategies and make necessary adjustments to improve outcomes.

Analyzing monthly returns also helps traders identify periods of high volatility, which is essential for refining risk management strategies and safeguarding investments during unpredictable market conditions. Furthermore, regular performance reviews based on monthly returns empower traders to make informed decisions, such as whether to hold, sell, or increase their position in an asset, ensuring they stay aligned with their financial goals.

A small monthly return can grow exponentially over time focus on the process, not the jackpot.

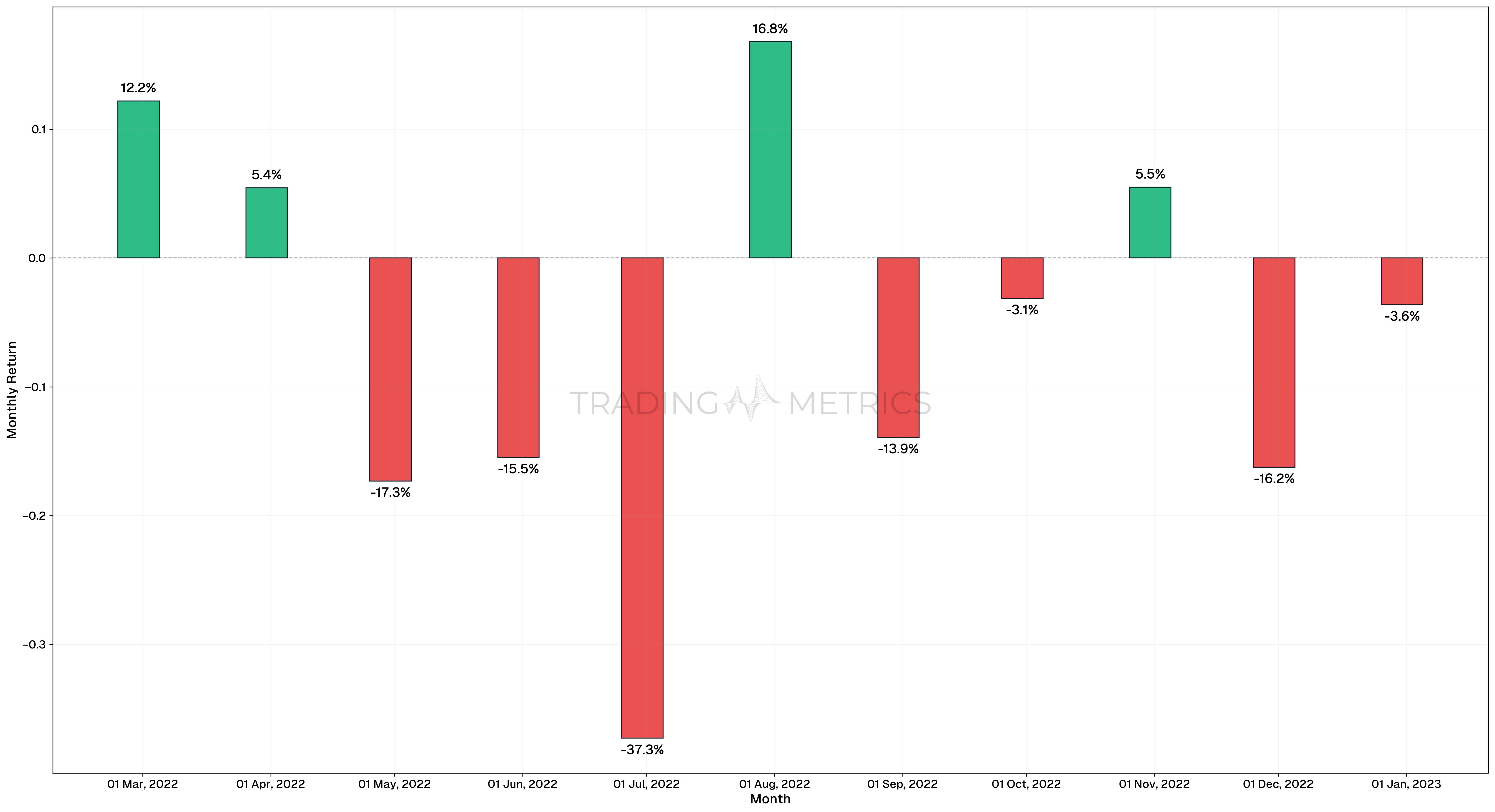

Profitability Metrics by Month

This analysis provides an overview of BTC’s monthly performance in 2022, showcasing the profitable and non-profitable periods. The tables below summarize key metrics such as starting and ending prices, the number of days in each month, and the monthly return. These insights help identify trends and evaluate market dynamics during periods of growth and decline.

Profitable Months

| Date | Start price | End price | Number of Days | Monthly Return Formula | Monthly Return |

|---|---|---|---|---|---|

| Feb 2022 | $37,903.02 | $42,528.98 | 28 | 12.20% | |

| Mar 2022 | $42,528.98 | $44,855.48 | 31 | 5.45% | |

| Jul 2022 | $19,281.73 | $22,518.73 | 31 | 16.80% | |

| Oct 2022 | $19,426.98 | $20,492.00 | 31 | 5.50% |

Analysis of Profitable Months

During the profitable months of 2022, BTC experienced significant growth. For example, in February 2022, the monthly return was 12.20%, indicating a strong upward trend. Similarly, March and October also saw positive returns of 5.45% and 5.50%, respectively. July had the highest monthly return of 16.80%, showing a robust recovery phase.

Protect your capital first - consistent monthly returns follow disciplined risk management.

Non-Profitable Months

| Date | Start price | End price | Number of Days | Monthly Return Formula | Monthly Return |

|---|---|---|---|---|---|

| Apr 2022 | $44,855.48 | $37,094.05 | 30 | -17.31% | |

| May 2022 | $37,094.05 | $31,320.62 | 31 | -15.49% | |

| Jun 2022 | $31,320.62 | $19,640.53 | 30 | -37.29% | |

| Aug 2022 | $22,518.73 | $19,386.65 | 31 | -13.92% | |

| Sep 2022 | $19,386.65 | $18,840.62 | 30 | -3.13% | |

| Nov 2022 | $20,492.00 | $17,162.90 | 30 | -16.24% | |

| Dec 2022 | $17,162.90 | $16,538.23 | 31 | -3.62% |

Analysis of Non-Profitable Months

The non-profitable months in 2022 saw significant declines in BTC prices. April, May, and June witnessed considerable losses of 17.31%, 15.49%, and 37.29%, respectively. This trend indicates a bearish phase in the market. The months of August, September, November, and December also recorded negative returns, reflecting continued volatility and downward pressure on BTC prices.

Fewer high quality trades can often yield better monthly returns than chasing every market move.

Combining Monthly Return with Other Tools

To gain deeper insights, monthly returns can be combined with:

- Moving Averages: Smoothens price data to identify trends over specific periods.

- Volatility Index: Measures the degree of variation in trading prices over time.

- Relative Strength Index (RSI): Indicates overbought or oversold conditions in the market.

When monthly targets dictate trades, emotions take over. So stick to your strategy instead!

Key Points

- Short-Term Performance Insight: Monthly return provides a snapshot of an investment’s performance over a single month, useful for tracking short-term trends.

- Volatility Awareness: Monthly returns can be more volatile compared to longer-term metrics, offering insights into market fluctuations and risk levels.

- Building Blocks for Annual Analysis: Monthly returns can be aggregated or annualized to evaluate longer-term performance and identify seasonal trends.

- Comparative Analysis: Use monthly returns to compare the performance of investments during specific market conditions or time frames.

- Consistency Matters: Regularly positive monthly returns indicate stability and can build confidence in an investment strategy.

- Performance Context: Assess monthly returns against relevant market indices or sector averages to gauge how the asset performs in comparison to broader trends.

- Risk Management: Monitoring monthly returns can highlight emerging risks or underperformance, prompting timely adjustments to a portfolio.

- Strategy Evaluation: Useful for evaluating the effectiveness of short-term trading strategies or tactical portfolio changes.

- Adjust for Outliers: Consider how one-off events or anomalies in monthly returns can skew overall performance, and evaluate in a broader context.

Conclusion

Monthly returns are an essential resource for traders, offering valuable insights into short-term investment performance. By understanding and analyzing these returns, traders can make smarter decisions, manage risks effectively, and refine their strategies. Leveraging monthly returns empowers traders to navigate the market with confidence and work toward achieving stronger investment outcomes.