Risk-Reward Ratio

The risk-reward ratio is a fundamental concept in trading and investing that compares the potential profit of a trade to its possible loss. It helps traders assess whether a trade’s potential reward justifies the risk involved, supporting disciplined decision-making. By calculating this ratio before entering a trade, traders can better align their strategies with their risk tolerance and overall goals. A well-structured risk-reward ratio is essential for long-term success, as it fosters consistency and improves the likelihood of achieving favorable outcomes over time.

How to Calculate RRR?

Calculating the risk-to-reward ratio (RRR) helps traders assess the potential or actual profitability of a trade relative to its risk. The potential RRR is calculated before entering a trade to plan risk management, while the actual RRR evaluates the trade’s performance after it is closed.

Potential RRR

To evaluate a trade’s potential risk-to-reward ratio (RRR), calculate it using this formula:

- For long trades:

- For short trades:

Understanding the potential RRR helps traders evaluate a trade’s risk before execution. Let’s consider a long trade scenario.

| Metric | Value |

|---|---|

Entry Price | $100 |

Target Price | $115 |

Stop-Loss Price | $95 |

Potential Reward | 115 - 100 = 15 |

Potential Risk | 100 - 95 = 5 |

Risk-Reward Ratio |

The potential RRR is 1:3, meaning the potential reward is three times the risk.

Avoid Over-Risking: Even a 1:3 ratio won’t help if you risk too much per trade. Always calculate position sizes to align with your account risk tolerance.

Actual RRR

To measure a trade’s actual risk-to-reward ratio (RRR) after it is closed, calculate it using this formula:

- For long trades:

- For short trades:

Understanding the actual RRR helps traders evaluate trade performance after execution. Let’s consider a long trade example that has been closed.

Positive Trade Example

| Metric | Value |

|---|---|

Entry Price | $100 |

Stop-Loss Price | $95 |

Exit Price | $110 |

Actual Reward | 110 - 100 = 10 |

Risk | 100 - 95 = 5 |

Actual RRR |

The actual RRR is 1:2, meaning the achieved reward is twice the risk.

Negative Trade Example

| Metric | Value |

|---|---|

Entry Price | $100 |

Stop-Loss Price | $95 |

Exit Price | $94 |

Actual Loss | 100 - 94 = 6 |

Risk | 100 - 95 = 5 |

Actual RRR |

The actual RRR is -1.2, indicating a larger loss relative to the initial risk.

Stay Disciplined: Chasing profits is tempting, but disciplined adherence to a solid Risk-Reward Ratio keeps emotions in check and safeguards your capital.

Importance of RRR in Trading

The Risk-Reward Ratio (RRR) is important in trading as it helps traders evaluate whether potential rewards justify the risks of a trade, ensuring better decision-making and consistency over time. By maintaining a favorable RRR (e.g., 1:2 or higher), traders can achieve profitability even with a lower win rate, fostering long-term sustainability.

Limitations of RRR in Trading

The Risk-Reward Ratio (RRR) has limitations as it focuses solely on potential outcomes, often ignoring the probabilities of success and market dynamics. Relying too heavily on RRR without considering factors like win rate, volatility, and execution can lead to unrealistic expectations and poor decision-making.

Analyze before entry: Evaluate the potential reward relative to the risk before executing a trade. A planned approach beats impulsive decisions every time.

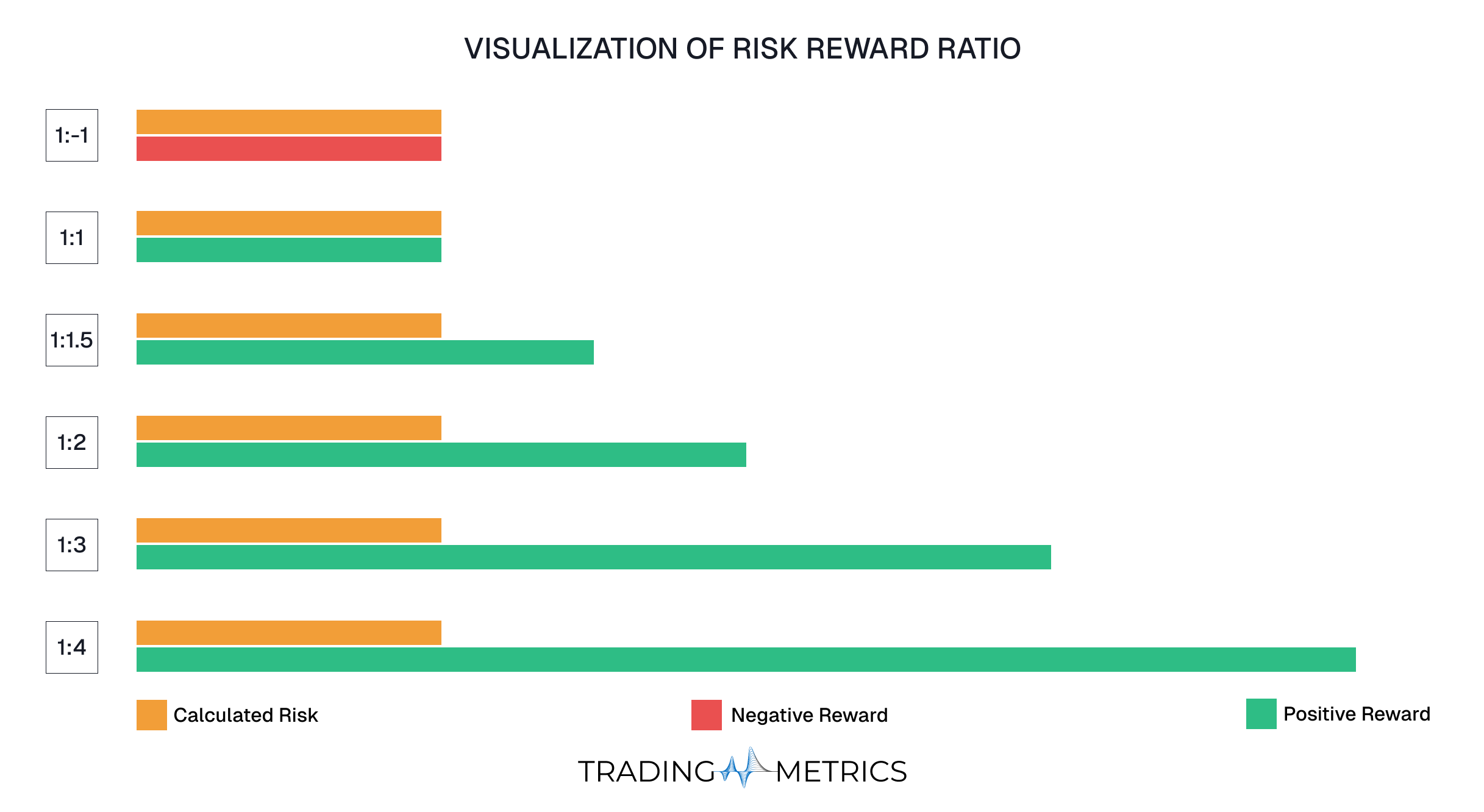

Choosing the Right RRR

Understanding and applying the right risk-reward ratio (RRR) is crucial for long-term trading success. By selecting an appropriate RRR, traders can balance potential profits against losses, align strategies with their win rates, and improve overall profitability.

1:1 (Neutral Approach)

A balanced approach for quick trades or scalping where risk and reward are equal. Best suited for traders with high-confidence setups.

- Commonly used for high-probability trades or scalping strategies with tight stop-loss levels.

- Requires a win rate above 50% to be profitable.

Example: Risking $100 to gain $100 means your trade must succeed more than half the time to yield a profit.

1:1.5 (Aggressive Approach)

This approach targets moderate profits while maintaining frequent trading opportunities. It’s ideal for traders with precise strategies and a higher win rate.

- Balances frequent trades with a moderate profit margin.

- Suitable for confident traders with win rates above 50%.

Example: Risking $100 to gain $150 requires a win rate of approximately 50-55% to be consistently profitable.

1:2 (Standard Practice)

A commonly recommended ratio that ensures long-term profitability even with a moderate win rate. This is a go-to choice for many traders.

- A widely accepted ratio ensuring profitability even with a 40% win rate.

- Effective for risk management across various market conditions.

Example: Risking $100 to gain $200 allows traders to lose more trades than they win and still generate profit over time.

1:3 (Conservative Approach)

This ratio offers more cushion and is suitable for volatile markets or long-term strategies. It prioritizes higher potential returns over frequency.

- Ideal for volatile markets or trend-following strategies with lower win rates.

- Profitable even with a 25% win rate, offering a strong profit buffer.

Example: Risking $100 to gain $300 requires trades to succeed only 25% of the time to break even.

1:4 or Higher (Trend Capturing)

Designed for capturing significant market movements, this ratio is used by traders aiming for high returns on select trades.

- Used in swing or position trading to capture significant market moves.

- Suitable for traders seeking to maximize returns on selective, high-conviction trades.

Example: Risking $100 to gain $400 ensures profitability with a win rate as low as 20%.

Protect Your Edge: Consistently applying a favorable Risk-Reward Ratio amplifies your trading edge. Small advantages compound into significant long-term success.

Combining RRR with Other Tools

-

Technical Analysis: Use indicators like Moving Averages, RSI, and MACD to validate potential trades.

-

Fundamental Analysis: Consider news, economic indicators, and blockchain developments.

-

Volume Analysis: Ensure there is sufficient market activity to support the trade.

-

Sentiment Analysis: Gauge market sentiment to understand potential price movements.

Use in Conjunction with Other Tools: Don’t rely solely on RRR. Use it along with technical and fundamental analysis to improve your trading strategy.

Key Points

- Profitability Measure: The risk-reward ratio evaluates the potential profit of a trade relative to the risk, helping traders determine if a trade is worth taking.

- Ideal Ratio: A risk-reward ratio of 1:2 or higher is commonly recommended, meaning the potential reward is at least twice the risk.

- Strategy Alignment: Different trading strategies may require varying ratios; scalping might use lower ratios, while swing trading favors higher ratios.

- Key to Consistency: Maintaining a favorable risk-reward ratio across trades increases the likelihood of long-term profitability, even with a lower win rate.

- Balance with Win Rate: A higher risk-reward ratio can offset a low win rate, while a lower ratio requires a higher win rate to remain profitable.

- Improves Discipline: Setting a predefined risk-reward ratio enforces discipline and reduces emotional decision-making during trades.

- Dynamic Adjustment: The ratio can change based on market conditions, trade setups, and volatility; regularly reassess to ensure relevance.

- Supports Risk Management: Calculating the ratio before entering a trade ensures risks are properly defined and mitigated.

- Complement to stop-loss: Combine the risk-reward ratio with precise stop-loss and take-profit levels to optimize trade execution.

- Backtesting Relevance: Include the risk-reward ratio in backtesting to evaluate the feasibility of a strategy under historical conditions.

Balance the Odds: A high win rate can’t save a strategy with a poor Risk-Reward Ratio. Focus on setups where potential rewards justify the risks you’re taking.

Conclusion

The Risk-Reward Ratio is important tool for any trader looking to achieve long-term success. It helps you make better decisions by quantifying potential gains against potential losses. Choosing the right RRR is essential for long-term trading success. Higher RRRs (1:2 or higher) are generally recommended for most traders, as they provide a better balance between risk and reward, enhancing profitability and managing losses effectively.