R-Multiple

The Risk multiple is a important metric in trading that compares the potential profit of a trade to its potential loss. It helps traders evaluate whether a trade offers a favorable return relative to the risk taken. By consistently aiming for a high risk multiple, traders can enhance their profitability, even with lower win rates.

How to Calculate R-Multiple?

To effectively evaluate and analyze trade performance, traders use R-Multiple) to measure the relationship between potential or actual reward and the predefined risk. A consistent R-Multiple approach helps improve decision-making and long-term profitability.

Potential R-Multiple

To evaluate a trade’s potential R-Multiple, calculate it using this formula:

- For long trades:

- For short trades:

Understanding the potential R-Multiple helps traders assess the reward multiple relative to their predefined risk. Let’s consider a long trade example:

| Metric | Value |

|---|---|

Entry Price | $100 |

Target Price | $115 |

Stop-Loss Price | $95 |

Potential Reward | 115 - 100 = 15 |

Risk | 100 - 95 = 5 |

Potential R-Multiple |

The potential R-Multiple is 3, meaning the reward is three times the risk.

Actual R-Multiple

To evaluate a trade’s Actual R-Multiple after the trade closes, use this formula:

- For long trades:

- For short trades:

Positive Trade: The Actual R-Multiple allows traders to analyze the actual performance of a trade. Let’s consider a long trade example that has been closed:

| Metric | Value |

|---|---|

Entry Price | $100 |

Stop-Loss Price | $95 |

Exit Price | $110 |

Actual Reward | 110 - 100 = 10 |

Risk | 100 - 95 = 5 |

Actual R-Multiple |

The actual R-Multiple is 2, meaning the achieved reward is twice the predefined risk.

Negative Trade:

| Metric | Value |

|---|---|

Entry Price | $100 |

Stop-Loss Price | $95 |

Exit Price | $94 |

Actual Reward | 94 - 100 = -6 |

Risk | 100 - 95 = 5 |

Actual R-Multiple |

The actual R-Multiple is -1.2, indicating a loss of 1.2 times the predefined risk. This highlights the importance of sticking to stop-losses and risk management principles.

Consistency Beats Luck: A consistent R-Multiple strategy is more profitable long-term than chasing random high-reward trades.

Importance of R-Multiple in Trading

Risk-Reward Management (R-Multiple) is important in trading because it ensures that potential rewards outweigh the risks, allowing traders to grow their accounts sustainably. By maintaining a favorable R-Multiple, traders can remain profitable even with a lower win rate. It protects capital by limiting losses and helps avoid emotional decision-making. Ultimately, strong R-Multiple is the foundation of long-term success in the markets.

Limitations of R-Multiple in Trading

Risk-Reward Management (R-Multiple) has limitations, as it relies on assumptions about potential outcomes that may not materialize. Market conditions can shift unpredictably, making predefined reward targets or stop-losses less effective. R-Multiple alone cannot guarantee profitability without solid analysis and execution. Additionally, overemphasizing R-Multiple may lead to missed opportunities if trades are cut short prematurely.

Protect Your Capital: Never risk more than you can afford to lose. Even a 5R reward multiple won’t save you from reckless position sizing.

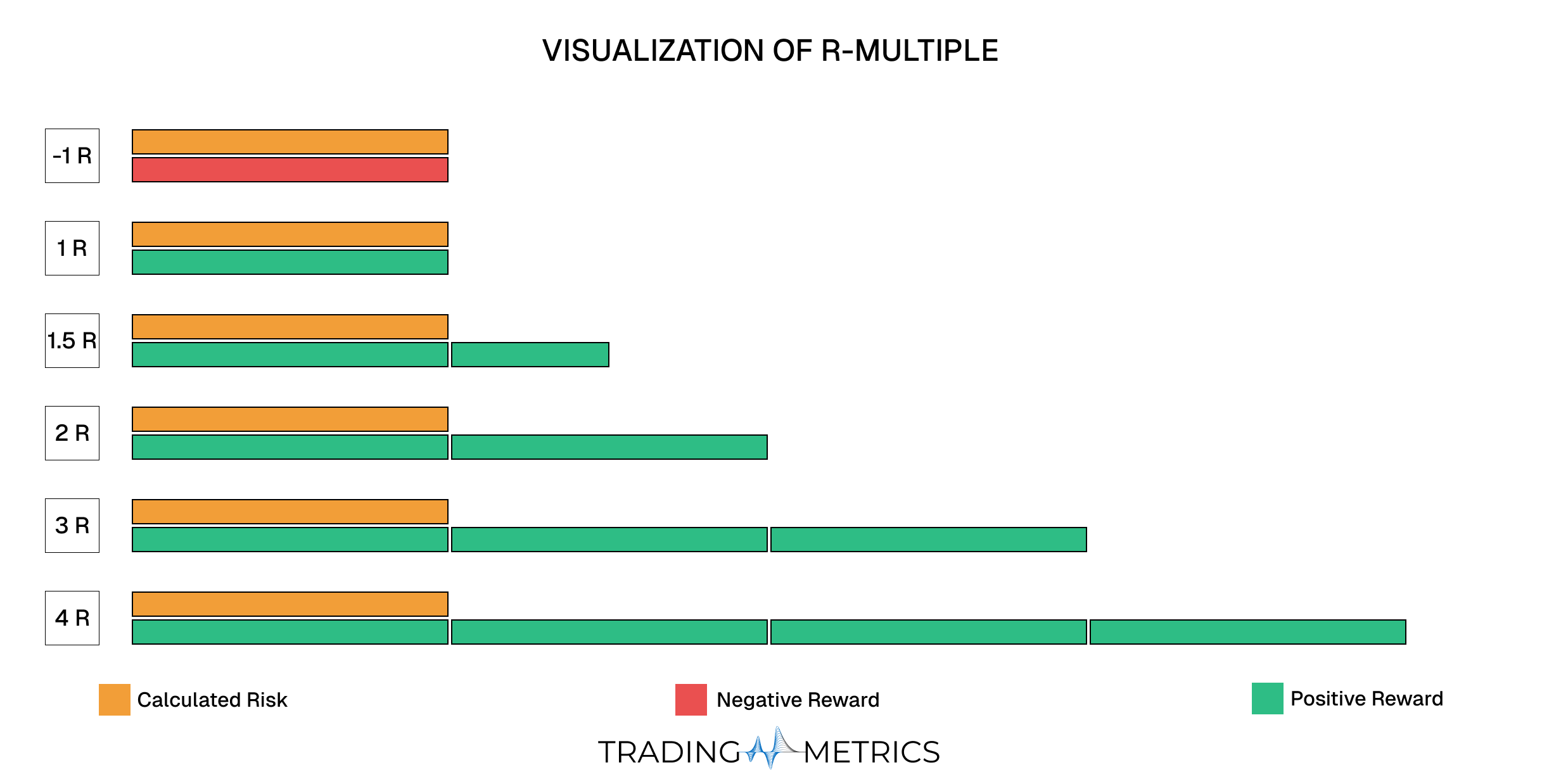

Choosing the Right R-Multiple

R-Multiple strategies are essential for managing profitability and aligning with your trading style. By choosing the right R-Multiple, traders can balance potential returns against losses, optimize risk management, and enhance overall trading consistency.

1x R-Multiple (Break-Even Focus)

This approach focuses on achieving breakeven profitability while maintaining disciplined execution. Best suited for traders prioritizing high-frequency, quick trades.

- Effective for high-probability trades or short-term scalping strategies.

- Profitable only with a win rate exceeding 50%.

Example: A 1x R-Multiple implies risking $100 to gain $100, requiring success on more than half of your trades to achieve profits.

1.5x R-Multiple (Moderate Profitability)

A slightly aggressive approach aimed at balancing risk with consistent rewards. Suitable for traders with precise setups and higher win rates.

- Balances frequent trading opportunities with moderate profit targets.

- Requires a win rate of approximately 50-55% for profitability.

Example: A 1.5x R-Multiple means risking $100 to achieve $150, ensuring moderate gains with disciplined risk management.

2x R-Multiple (Standard Target)

A popular and versatile approach providing a safety margin for traders. Widely adopted for long-term success across various strategies.

- Ensures profitability even with a win rate of 40% or higher.

- Works well in trending markets or range-bound setups with clear exits.

Example: Risking $100 to earn $200 ensures profitability even if less than half of your trades are successful.

3x R-Multiple (High Return Buffer)

A conservative strategy targeting high potential returns while tolerating fewer winning trades. Suitable for volatile markets or swing trading.

- Profitable with a win rate as low as 25-30%.

- Ideal for capturing significant price movements with reduced trade frequency.

Example: A 3x R-Multiple, risking $100 for $300, allows traders to lose three out of four trades and still break even.

4x+ R-Multiple (Maximum Gain Focus)

Geared towards capturing large market moves with minimal risk. Best for selective traders focused on swing or position trading.

- Requires patience and high conviction in setups.

- Profitable even with a win rate of 20-25% or lower.

Example: Risking $100 to achieve $400 or more ensures profitability with only a fraction of winning trades.

Adaptive R-Multiple

An adaptive method where the R-Multiple is adjusted based on market conditions or strategy goals. This approach provides flexibility but requires robust analysis.

- Suitable for traders balancing risk and reward dynamically.

- Demands a strong understanding of market trends and trading strategies.

Example: Switching between 2x and 4x R-Multiple depending on volatility and confidence in trade direction enhances adaptability.

By choosing the right R-Multiple approach, traders can align their strategies with their risk tolerance, market conditions, and trading objectives to achieve consistent results.

R-Multiple Filters Opportunities: Avoid trades with an R-Multiple lower than 2R as it rarely justifies the risk.

Trade Outcomes

Understanding trade outcomes is good because trades can evaluate performance and improve decision-making in the market. This section explores three key scenarios: winning trades, losing trades, and early exits while emphasizing the importance of R-Multiples in each case.

Riding the Trend

This trade example highlights a scenario where a trader successfully capitalized on a bullish trend.

| Metric | Value |

|---|---|

Entry Price | $1,600 |

Target Price | $1,700 |

Stop Loss | $1,550 |

Exit Price | $1,700 |

Potential R-Multiple | |

Actual R-Multiple |

Key Takeaway: This trade showcases a disciplined approach with a clear R-Multiple of 2R, achieving the target price without deviation.

Managing the Risk

This trade demonstrates how a stop-loss mechanism limits losses during an unfavorable market move.

| Metric | Value |

|---|---|

Entry Price | $1,600 |

Target Price | $1,700 |

Stop Loss | $1,550 |

Exit Price | $1,550 |

Potential R-Multiple | |

Actual R-Multiple |

Key Takeaway: Even though the trade resulted in a loss, adhering to the stop-loss prevented further damage, demonstrating proper risk management.

Adapting to Market Conditions

In this scenario, the trader exited before hitting the target, opting to secure partial profits due to changing market dynamics.

| Metric | Value |

|---|---|

Entry Price | $1,600 |

Target Price | $1,700 |

Stop Loss | $1,550 |

Exit Price | $1,650 |

Potential R-Multiple | |

Actual R-Multiple |

Key Takeaway: By exiting early, the trader reduced potential risk at the expense of achieving the full reward, resulting in an R-Multiple of 1R.

Time Affects Risk: Be mindful of time decay and volatility - an attractive R-Multiple can deteriorate quickly.

Combining R-Multiple with Other Tools

Below are key tools and strategies to combine with R-Multiples for deeper insights and better trading decisions:

- Win rate: Use R-Multiple alongside the probability of success to assess a trade’s overall expectancy.

- Technical Indicators: Combine with tools like RSI or Moving Averages to refine entry and exit points.

- Position sizing: Align R-Multiple with position sizing to manage risk effectively.

- Trade Journals: Track R-Multiple outcomes to identify patterns in your trading performance.

Reward Ratios Are Not Guarantees: A high R-Multiple doesn’t ensure profit. It’s a tool, not a promise - so execute it with discipline.

Key Points

- Trade Efficiency Measure: The R-Multiple calculates the actual profit or loss of a trade relative to the initial risk taken, offering insights into trade efficiency.

- Benchmark for Success: A positive R-Multiple (greater than 1) indicates a successful trade, while values below 1 reflect inefficiency.

- Cumulative Analysis: Over multiple trades, maintaining a high average R-Multiple is crucial for long-term profitability, especially with lower win rates.

- Risk Management Insight: Monitoring the R-Multiple helps identify whether trades consistently align with predefined Risk-Reward Ratio.

- Trade Evaluation Tool: Use the multiple to assess the quality of individual trades and refine entry and exit strategies for better outcomes.

- Adjust for Market Dynamics: The R-Multiple may vary based on volatility, trade duration, and market conditions; adapt strategies accordingly.

- Psychological Reinforcement: Positive multiples reinforce disciplined trading, while frequent negative multiples highlight the need for adjustments in strategy or risk management.

- Portfolio-Level Insights: Analyzing R-Multiple across trades or strategies provides a holistic view of overall trading efficiency.

- Backtesting and Optimization: Include the R-Multiple in backtesting to evaluate historical strategy performance and optimize future trades.

Conclusion

R-Multiples are invaluable for pre-trade planning and post-trade analysis. While they help enforce discipline, traders must balance them with probability and adapt to changing market conditions.